Is Now The Time To Put Continental Seeds and Chemicals (NSE:CONTI) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Continental Seeds and Chemicals (NSE:CONTI), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Continental Seeds and Chemicals' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Continental Seeds and Chemicals grew its EPS from ₹0.0009 to ₹1.71, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

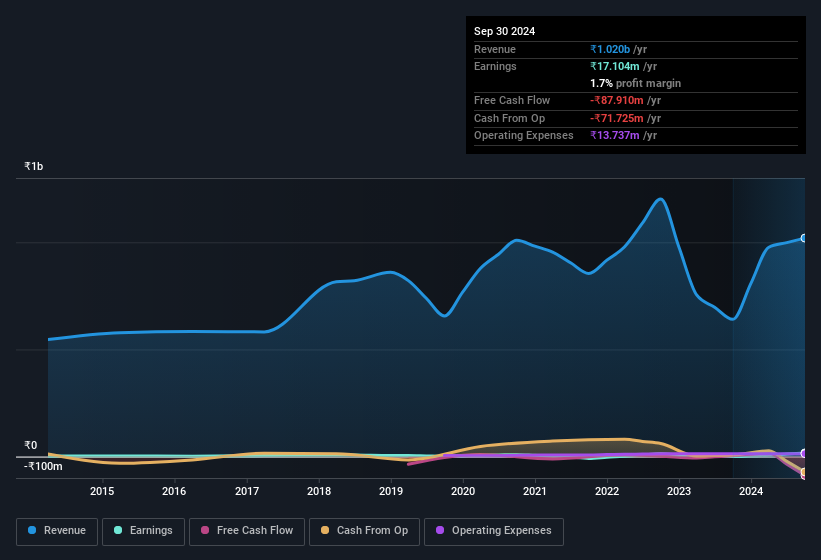

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the revenue front, Continental Seeds and Chemicals has done well over the past year, growing revenue by 59% to ₹1.0b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for Continental Seeds and Chemicals

Since Continental Seeds and Chemicals is no giant, with a market capitalisation of ₹299m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Continental Seeds and Chemicals Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Continental Seeds and Chemicals will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 63% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Valued at only ₹299m Continental Seeds and Chemicals is really small for a listed company. So this large proportion of shares owned by insiders only amounts to ₹188m. That might not be a huge sum but it should be enough to keep insiders motivated!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Continental Seeds and Chemicals, with market caps under ₹17b is around ₹3.7m.

The Continental Seeds and Chemicals CEO received total compensation of only ₹1.5m in the year to March 2024. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Continental Seeds and Chemicals Worth Keeping An Eye On?

Continental Seeds and Chemicals' earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Continental Seeds and Chemicals certainly ticks a few boxes, so we think it's probably well worth further consideration. You should always think about risks though. Case in point, we've spotted 3 warning signs for Continental Seeds and Chemicals you should be aware of, and 2 of them don't sit too well with us.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CONTI

Continental Seeds and Chemicals

Engages in developing, processing, grading, and supplying agricultural foundation and certified seeds in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives