Here's Why We Think CCL Products (India) (NSE:CCL) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in CCL Products (India) (NSE:CCL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide CCL Products (India) with the means to add long-term value to shareholders.

Check out our latest analysis for CCL Products (India)

CCL Products (India)'s Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. CCL Products (India) managed to grow EPS by 15% per year, over three years. That's a good rate of growth, if it can be sustained.

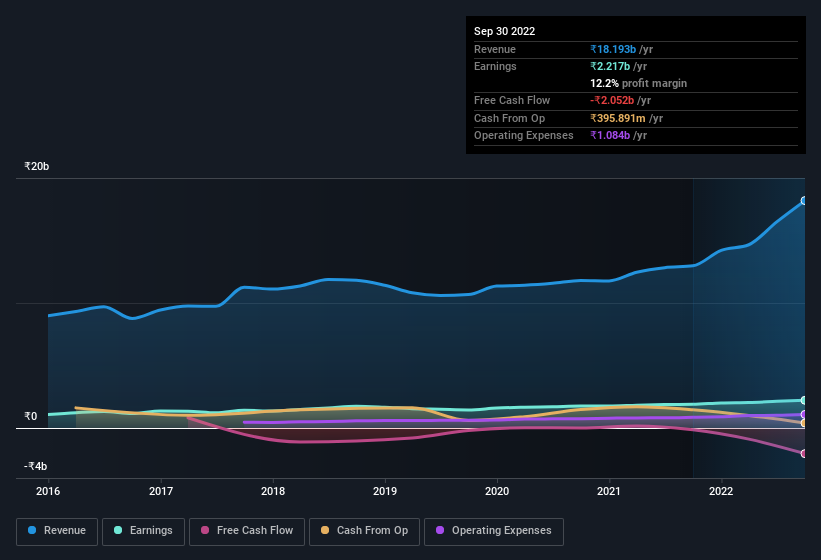

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, CCL Products (India)'s EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for CCL Products (India)?

Are CCL Products (India) Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in CCL Products (India) will be more than happy to see insiders committing themselves to the company, spending ₹36m on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Executive Chairman Challa Prasad for ₹10.0m worth of shares, at about ₹403 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since CCL Products (India) insiders own more than a third of the company. Owning 48% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. That means they have plenty of their own capital riding on the performance of the business!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Praveen Jaipuriar is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to CCL Products (India), with market caps between ₹33b and ₹133b, is around ₹37m.

CCL Products (India)'s CEO took home a total compensation package of ₹8.0m in the year prior to March 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is CCL Products (India) Worth Keeping An Eye On?

One positive for CCL Products (India) is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Still, you should learn about the 3 warning signs we've spotted with CCL Products (India) (including 2 which are a bit concerning).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of CCL Products (India), you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CCL

CCL Products (India)

Manufactures and sells instant coffee and coffee related products in India.

High growth potential with proven track record and pays a dividend.

Market Insights

Community Narratives