Do CCL Products (India)'s (NSE:CCL) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like CCL Products (India) (NSE:CCL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for CCL Products (India)

How Fast Is CCL Products (India) Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years CCL Products (India) grew its EPS by 6.5% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

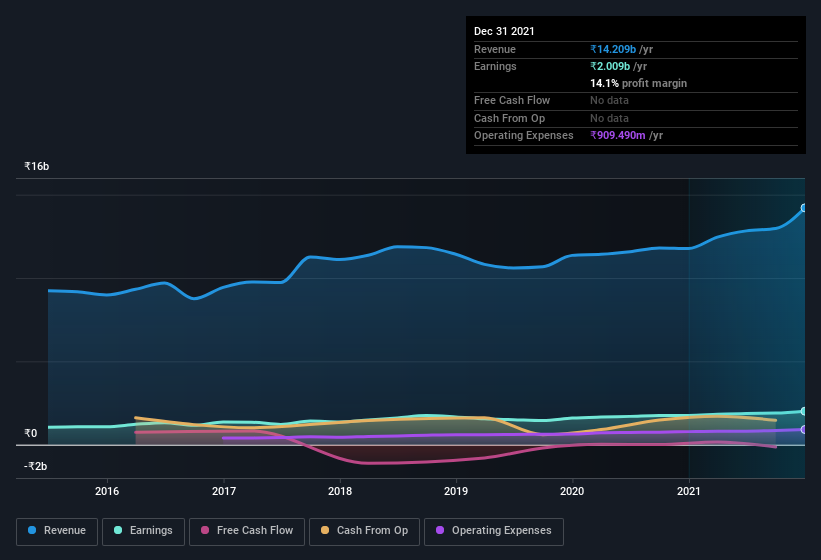

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note CCL Products (India)'s EBIT margins were flat over the last year, revenue grew by a solid 21% to ₹14b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of CCL Products (India)'s future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are CCL Products (India) Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it CCL Products (India) shareholders can gain quiet confidence from the fact that insiders shelled out ₹41m to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Executive Chairman, Challa Prasad, who made the biggest single acquisition, paying ₹10.0m for shares at about ₹403 each.

On top of the insider buying, we can also see that CCL Products (India) insiders own a large chunk of the company. Actually, with 38% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. And their holding is extremely valuable at the current share price, totalling ₹19b. That means they have plenty of their own capital riding on the performance of the business!

Is CCL Products (India) Worth Keeping An Eye On?

As I already mentioned, CCL Products (India) is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. We should say that we've discovered 2 warning signs for CCL Products (India) that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But CCL Products (India) isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CCL

CCL Products (India)

Manufactures and sells instant coffee and coffee related products in India.

High growth potential with proven track record and pays a dividend.

Market Insights

Community Narratives