With EPS Growth And More, Bombay Super Hybrid Seeds (NSE:BSHSL) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Bombay Super Hybrid Seeds (NSE:BSHSL), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Bombay Super Hybrid Seeds with the means to add long-term value to shareholders.

See our latest analysis for Bombay Super Hybrid Seeds

How Fast Is Bombay Super Hybrid Seeds Growing Its Earnings Per Share?

Bombay Super Hybrid Seeds has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Bombay Super Hybrid Seeds' EPS soared from ₹0.99 to ₹1.60, over the last year. That's a impressive gain of 61%.

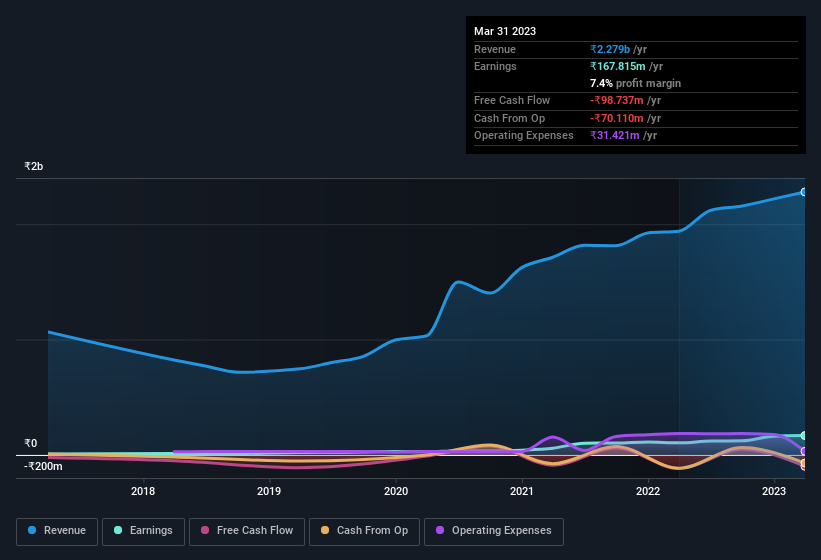

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Bombay Super Hybrid Seeds shareholders is that EBIT margins have grown from 6.5% to 8.9% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Bombay Super Hybrid Seeds Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Bombay Super Hybrid Seeds insiders walking the walk, by spending ₹20m on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was Chairman & MD Arvindkumar Kakadia who made the biggest single purchase, worth ₹2.9m, paying ₹140 per share.

On top of the insider buying, we can also see that Bombay Super Hybrid Seeds insiders own a large chunk of the company. To be exact, company insiders hold 87% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. At the current share price, that insider holding is worth a staggering ₹28b. That level of investment from insiders is nothing to sneeze at.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Arvindkumar Kakadia is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Bombay Super Hybrid Seeds with market caps between ₹17b and ₹66b is about ₹26m.

Bombay Super Hybrid Seeds' CEO only received compensation totalling ₹1.2m in the year to March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Bombay Super Hybrid Seeds Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Bombay Super Hybrid Seeds' strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Bombay Super Hybrid Seeds that you should be aware of.

The good news is that Bombay Super Hybrid Seeds is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bombay Super Hybrid Seeds might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BSHSL

Bombay Super Hybrid Seeds

Engages in the research, production, processing, and marketing of hybrid and GM seeds in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives