Here's Why We Think Bombay Super Hybrid Seeds (NSE:BSHSL) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bombay Super Hybrid Seeds (NSE:BSHSL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Bombay Super Hybrid Seeds

How Fast Is Bombay Super Hybrid Seeds Growing Its Earnings Per Share?

In the last three years Bombay Super Hybrid Seeds' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Bombay Super Hybrid Seeds' EPS has grown from ₹9.38 to ₹11.45 over twelve months. That's a 22% gain; respectable growth in the broader scheme of things.

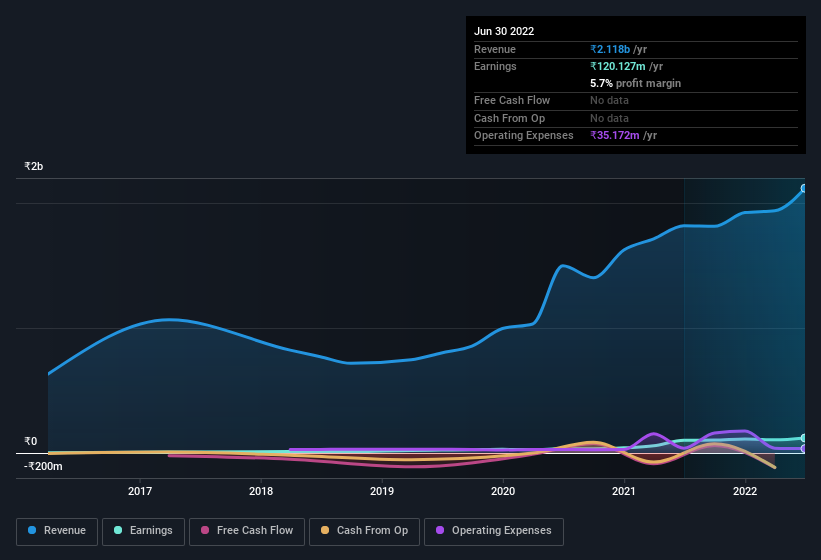

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Bombay Super Hybrid Seeds maintained stable EBIT margins over the last year, all while growing revenue 17% to ₹2.1b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Bombay Super Hybrid Seeds is no giant, with a market capitalisation of ₹5.3b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Bombay Super Hybrid Seeds Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Bombay Super Hybrid Seeds insiders spent ₹4.7m on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. We also note that it was the Chairman & MD, Arvindkumar Kakadia, who made the biggest single acquisition, paying ₹1.5m for shares at about ₹383 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Bombay Super Hybrid Seeds will reveal that insiders own a significant piece of the pie. In fact, they own 86% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about ₹4.5b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Arvindkumar Kakadia is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Bombay Super Hybrid Seeds with market caps under ₹16b is about ₹3.0m.

The CEO of Bombay Super Hybrid Seeds was paid just ₹1.2m in total compensation for the year ending March 2021. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Bombay Super Hybrid Seeds Worth Keeping An Eye On?

One important encouraging feature of Bombay Super Hybrid Seeds is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Bombay Super Hybrid Seeds (1 is significant) you should be aware of.

The good news is that Bombay Super Hybrid Seeds is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Bombay Super Hybrid Seeds, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bombay Super Hybrid Seeds might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BSHSL

Bombay Super Hybrid Seeds

Engages in the research, production, processing, and marketing of hybrid and GM seeds in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives