Do Mrs. Bectors Food Specialities' (NSE:BECTORFOOD) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Mrs. Bectors Food Specialities (NSE:BECTORFOOD). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Mrs. Bectors Food Specialities

How Quickly Is Mrs. Bectors Food Specialities Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Mrs. Bectors Food Specialities has grown EPS by 24% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

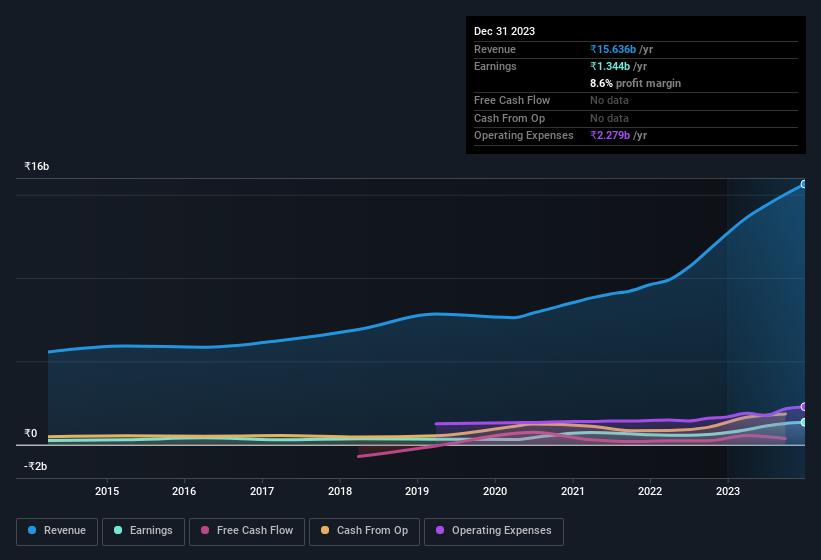

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Mrs. Bectors Food Specialities shareholders can take confidence from the fact that EBIT margins are up from 7.9% to 11%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Mrs. Bectors Food Specialities' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Mrs. Bectors Food Specialities Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

For the sake of balance, it should be noted that Mrs. Bectors Food Specialities insiders sold ₹5.0m worth of shares last year. But that doesn't beat the large ₹9.2m share acquisition by MD & Director Anoop Bector. So, on balance, that's positive.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Mrs. Bectors Food Specialities will reveal that insiders own a significant piece of the pie. Owning 36% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. This insider holding amounts to That level of investment from insiders is nothing to sneeze at.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Mrs. Bectors Food Specialities' CEO, Manu Talwar, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Mrs. Bectors Food Specialities with market caps between ₹33b and ₹134b is about ₹32m.

The Mrs. Bectors Food Specialities CEO received total compensation of just ₹11m in the year to March 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Mrs. Bectors Food Specialities To Your Watchlist?

You can't deny that Mrs. Bectors Food Specialities has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. However, before you get too excited we've discovered 1 warning sign for Mrs. Bectors Food Specialities that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Mrs. Bectors Food Specialities isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BECTORFOOD

Mrs. Bectors Food Specialities

Manufactures and distributes various food products in India.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives