3 Indian Growth Companies With High Insider Ownership Expecting Up To 33% Revenue Growth

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.7%, driven by a pullback of 2.3% in the Financials sector. However, over the longer term, the market has risen by 43% in the last year with earnings forecast to grow by 17% annually. In this context, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the business and potential for substantial revenue increases.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 35.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 31.9% | 20.7% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| JNK India (NSEI:JNKINDIA) | 21% | 31.8% |

| KEI Industries (BSE:517569) | 19.1% | 20.3% |

| Aether Industries (NSEI:AETHER) | 31.1% | 43.6% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Let's dive into some prime choices out of the screener.

Aether Industries (NSEI:AETHER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aether Industries Limited produces and sells advanced intermediates and specialty chemicals in India and internationally, with a market cap of ₹116.74 billion.

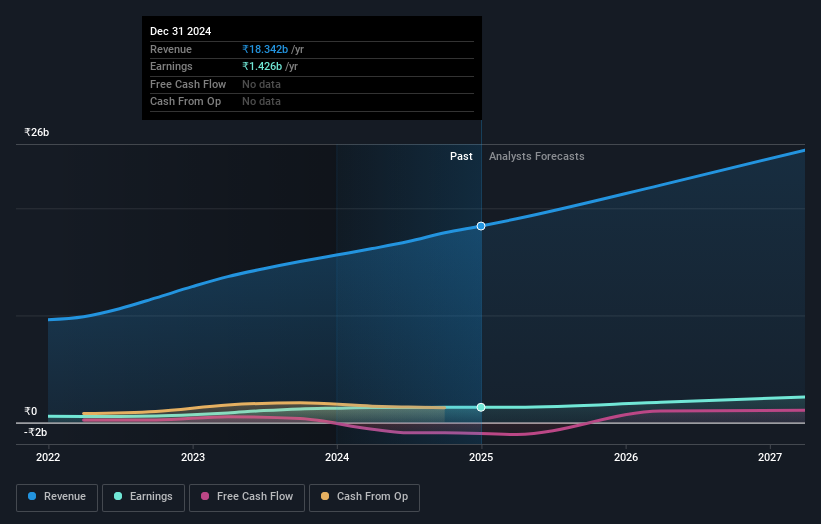

Operations: The company's revenue segments include Contract Manufacturing at ₹1.54 billion, Large Scale Manufacturing at ₹3.73 billion, and Contract Research and Manufacturing Services (CRAMS) at ₹832.89 million.

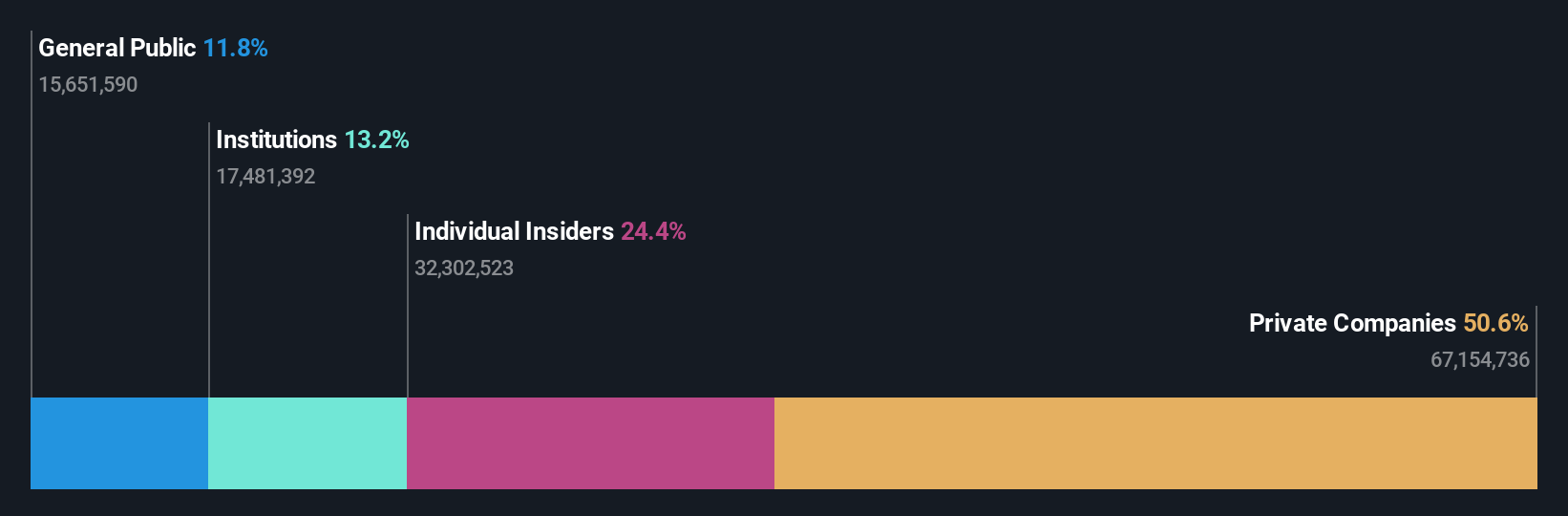

Insider Ownership: 31.1%

Revenue Growth Forecast: 33% p.a.

Aether Industries demonstrates strong growth potential with forecasted annual revenue and earnings growth rates of 33% and 43.63%, respectively, outpacing the Indian market averages. Despite a recent dip in profit margins from 19.8% to 13.4%, the company reported positive Q1 results with net income rising slightly to INR 299.32 million. Additionally, Aether's strategic supply agreement with Baker Hughes bolsters its position in contract manufacturing, enhancing its growth trajectory and market footprint.

- Click to explore a detailed breakdown of our findings in Aether Industries' earnings growth report.

- The analysis detailed in our Aether Industries valuation report hints at an inflated share price compared to its estimated value.

Mrs. Bectors Food Specialities (NSEI:BECTORFOOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mrs. Bectors Food Specialities Limited manufactures and distributes various food products in India, with a market cap of ₹85.82 billion.

Operations: The company's revenue from food products is ₹16.89 billion.

Insider Ownership: 36.2%

Revenue Growth Forecast: 14.7% p.a.

Mrs. Bectors Food Specialities exhibits promising growth with forecasted annual revenue and earnings growth of 14.7% and 19.4%, respectively, surpassing the Indian market averages. Recent Q1 results show a revenue increase to ₹4.44 billion from ₹3.79 billion year-over-year, alongside net income rising to ₹354.26 million from ₹348.5 million, indicating robust performance despite modest earnings growth projections compared to significant benchmarks for high-growth companies in India.

- Navigate through the intricacies of Mrs. Bectors Food Specialities with our comprehensive analyst estimates report here.

- Our valuation report here indicates Mrs. Bectors Food Specialities may be overvalued.

Pricol (NSEI:PRICOLLTD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pricol Limited, along with its subsidiaries, manufactures and sells instrument clusters and other allied automobile components to original equipment manufacturers and replacement markets in India and internationally, with a market cap of ₹62.54 billion.

Operations: The company's revenue primarily comes from its automotive components segment, which generated ₹23.55 billion.

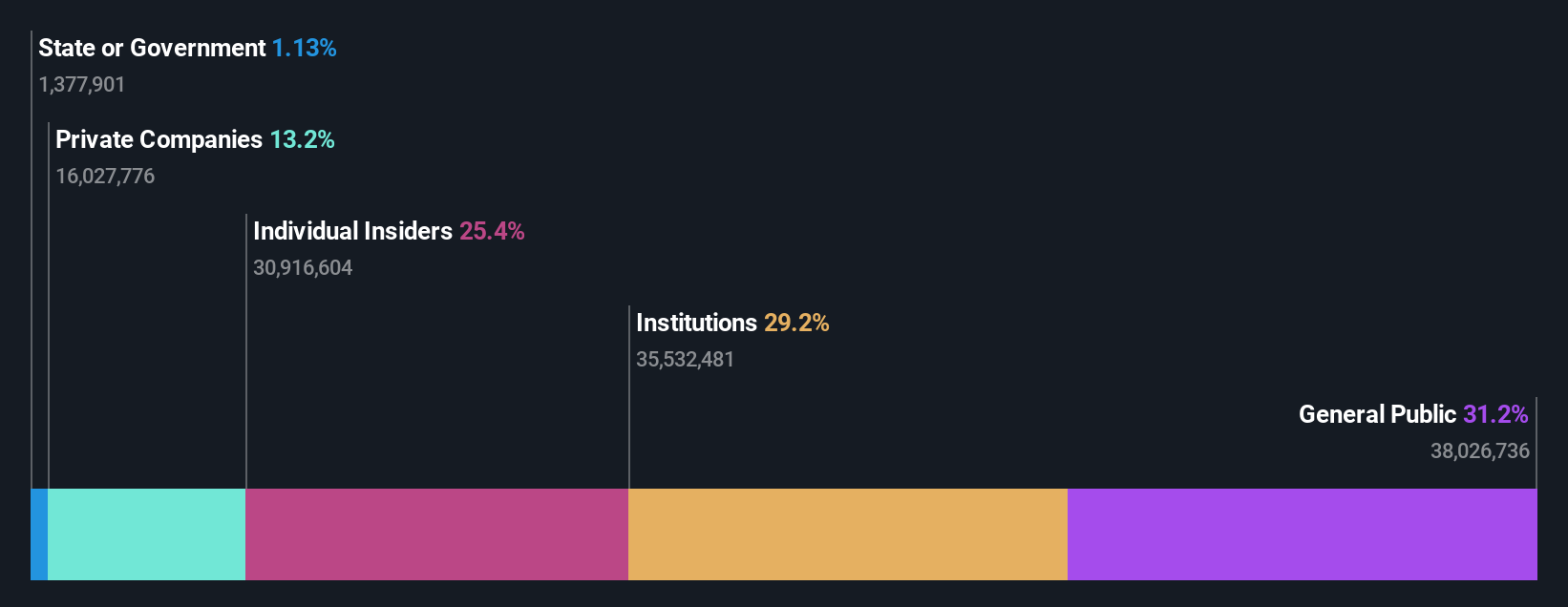

Insider Ownership: 25.5%

Revenue Growth Forecast: 16.5% p.a.

Pricol Limited demonstrates strong growth potential with forecasted annual earnings growth of 24%, outpacing the Indian market's 16.9%. Recent Q1 results show revenue rising to ₹6.22 billion from ₹5.40 billion year-over-year, and net income increasing to ₹455.61 million from ₹319.38 million, reflecting robust performance. Despite recent executive changes, high insider ownership aligns management interests with shareholders, supporting long-term value creation in a competitive market environment where Pricol's revenue is expected to grow at 16.5% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Pricol.

- Our comprehensive valuation report raises the possibility that Pricol is priced higher than what may be justified by its financials.

Taking Advantage

- Unlock our comprehensive list of 92 Fast Growing Indian Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AETHER

Aether Industries

Produces and sells advanced intermediates and specialty chemicals in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives