Announcing: Bombay Burmah Trading Corporation (NSE:BBTC) Stock Increased An Energizing 156% In The Last Five Years

The Bombay Burmah Trading Corporation, Limited (NSE:BBTC) shareholders might be concerned after seeing the share price drop 16% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 156% higher today. We think it's more important to dwell on the long term returns than the short term returns. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for Bombay Burmah Trading Corporation

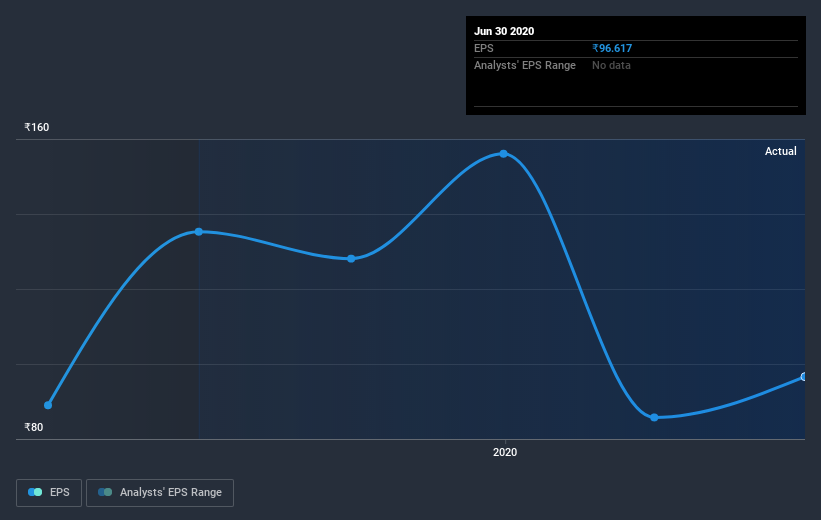

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Bombay Burmah Trading Corporation achieved compound earnings per share (EPS) growth of 14% per year. This EPS growth is lower than the 21% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Bombay Burmah Trading Corporation's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Bombay Burmah Trading Corporation shareholders gained a total return of 3.2% during the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 21% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Bombay Burmah Trading Corporation better, we need to consider many other factors. Take risks, for example - Bombay Burmah Trading Corporation has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Bombay Burmah Trading Corporation or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bombay Burmah Trading Corporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:BBTC

Bombay Burmah Trading Corporation

Engages in the tea and coffee plantations, auto electric components, healthcare, and real estate businesses in India and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives