If You Like EPS Growth Then Check Out Ajooni Biotech (NSE:AJOONI) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Ajooni Biotech (NSE:AJOONI), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Ajooni Biotech

Ajooni Biotech's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Ajooni Biotech has managed to grow EPS by 21% per year over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

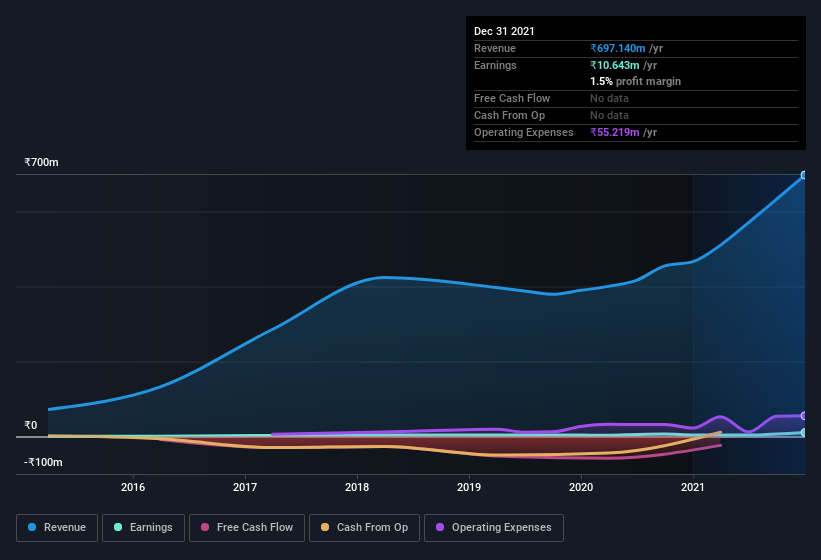

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Ajooni Biotech's EBIT margins were flat over the last year, revenue grew by a solid 49% to ₹697m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Ajooni Biotech isn't a huge company, given its market capitalization of ₹688m. That makes it extra important to check on its balance sheet strength.

Are Ajooni Biotech Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx Ajooni Biotech insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Chairman, Jasjot Singh, paid ₹5.0m to buy shares at an average price of ₹51.00.

On top of the insider buying, we can also see that Ajooni Biotech insiders own a large chunk of the company. In fact, they own 47% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only ₹688m Ajooni Biotech is really small for a listed company. So despite a large proportional holding, insiders only have ₹324m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Gursimran Singh, is paid less than the median for similar sized companies. For companies with market capitalizations under ₹15b, like Ajooni Biotech, the median CEO pay is around ₹2.9m.

The CEO of Ajooni Biotech was paid just ₹540k in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Ajooni Biotech Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Ajooni Biotech's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Ajooni Biotech that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Ajooni Biotech, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AJOONI

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026