- India

- /

- Energy Services

- /

- NSEI:UNIDT

These 4 Measures Indicate That United Drilling Tools (NSE:UNIDT) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that United Drilling Tools Limited (NSE:UNIDT) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for United Drilling Tools

What Is United Drilling Tools's Debt?

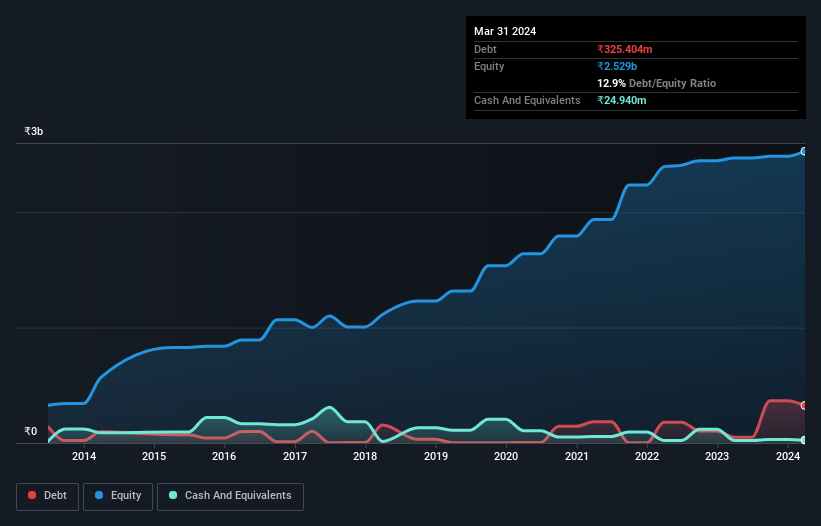

The image below, which you can click on for greater detail, shows that at March 2024 United Drilling Tools had debt of ₹325.4m, up from ₹50.1m in one year. On the flip side, it has ₹24.9m in cash leading to net debt of about ₹300.5m.

How Strong Is United Drilling Tools' Balance Sheet?

The latest balance sheet data shows that United Drilling Tools had liabilities of ₹965.6m due within a year, and liabilities of ₹74.5m falling due after that. On the other hand, it had cash of ₹24.9m and ₹573.0m worth of receivables due within a year. So its liabilities total ₹442.2m more than the combination of its cash and short-term receivables.

Of course, United Drilling Tools has a market capitalization of ₹4.18b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While United Drilling Tools's low debt to EBITDA ratio of 1.4 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.6 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. We saw United Drilling Tools grow its EBIT by 8.8% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since United Drilling Tools will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, United Drilling Tools actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

United Drilling Tools's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that it has an adequate capacity handle its debt, based on its EBITDA,. Looking at all this data makes us feel a little cautious about United Drilling Tools's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that United Drilling Tools is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UNIDT

United Drilling Tools

Together with its subsidiary, P Mittal Manufacturing Private Limited, manufactures and sells wire line and well service equipment, gas lift gear, downhole tools, and OD casing pipes and connectors under the UDT brand in India and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives