- India

- /

- Oil and Gas

- /

- NSEI:MRPL

Mangalore Refinery and Petrochemicals (NSE:MRPL) shareholders have earned a 29% CAGR over the last five years

Mangalore Refinery and Petrochemicals Limited (NSE:MRPL) shareholders might be concerned after seeing the share price drop 27% in the last quarter. But that doesn't change the fact that the returns over the last five years have been very strong. It's fair to say most would be happy with 257% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Mangalore Refinery and Petrochemicals

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Mangalore Refinery and Petrochemicals became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

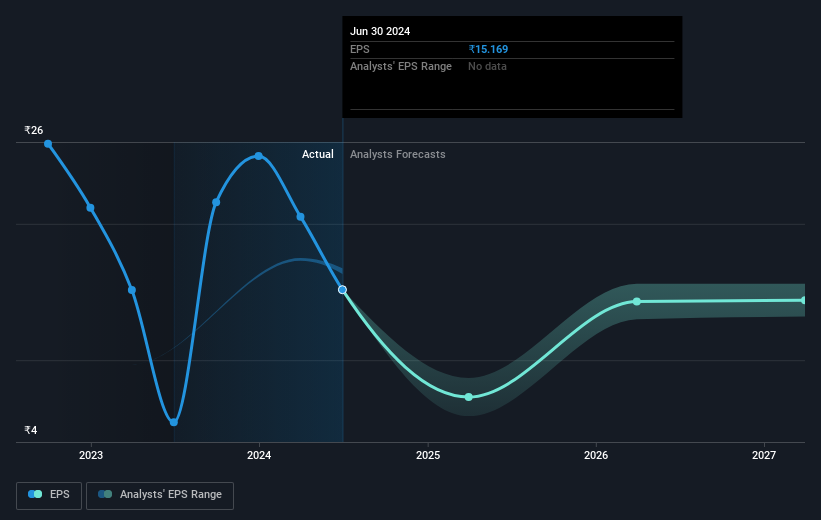

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Mangalore Refinery and Petrochemicals' earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Mangalore Refinery and Petrochemicals the TSR over the last 5 years was 262%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Mangalore Refinery and Petrochemicals shareholders have received a total shareholder return of 76% over the last year. Of course, that includes the dividend. That's better than the annualised return of 29% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Mangalore Refinery and Petrochemicals (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

Of course Mangalore Refinery and Petrochemicals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MRPL

Mangalore Refinery and Petrochemicals

Engages in the manufacture and sale of refined petroleum products in India and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives