- India

- /

- Oil and Gas

- /

- NSEI:HINDOILEXP

Does Hindustan Oil Exploration (NSE:HINDOILEXP) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Hindustan Oil Exploration (NSE:HINDOILEXP). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Hindustan Oil Exploration

How Quickly Is Hindustan Oil Exploration Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Hindustan Oil Exploration has achieved impressive annual EPS growth of 42%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

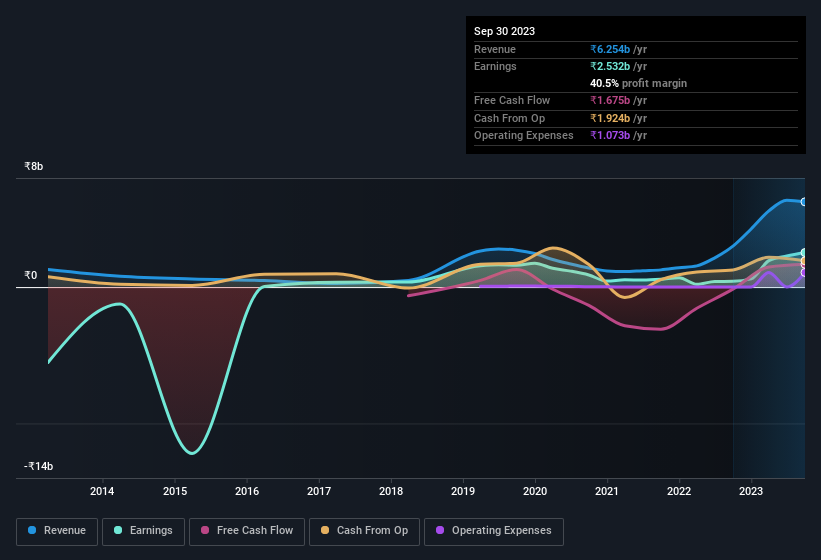

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Hindustan Oil Exploration shareholders can take confidence from the fact that EBIT margins are up from 30% to 50%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Hindustan Oil Exploration isn't a huge company, given its market capitalisation of ₹23b. That makes it extra important to check on its balance sheet strength.

Are Hindustan Oil Exploration Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Hindustan Oil Exploration followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Given insiders own a significant chunk of shares, currently valued at ₹6.3b, they have plenty of motivation to push the business to succeed. Amounting to 28% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Hindustan Oil Exploration with market caps between ₹8.3b and ₹33b is about ₹16m.

Hindustan Oil Exploration's CEO took home a total compensation package worth ₹14m in the year leading up to March 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Hindustan Oil Exploration To Your Watchlist?

Hindustan Oil Exploration's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Hindustan Oil Exploration certainly ticks a few boxes, so we think it's probably well worth further consideration. What about risks? Every company has them, and we've spotted 1 warning sign for Hindustan Oil Exploration you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Oil Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HINDOILEXP

Hindustan Oil Exploration

Engages in the exploration, development, and production of onshore and offshore crude oil and natural gas in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives