- India

- /

- Oil and Gas

- /

- NSEI:CHENNPETRO

Insufficient Growth At Chennai Petroleum Corporation Limited (NSE:CHENNPETRO) Hampers Share Price

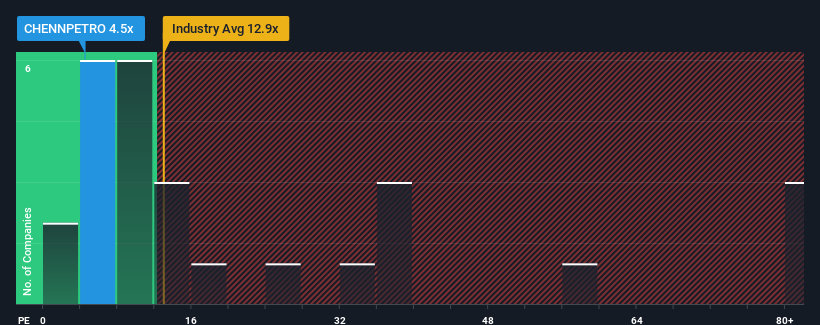

Chennai Petroleum Corporation Limited's (NSE:CHENNPETRO) price-to-earnings (or "P/E") ratio of 4.5x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 31x and even P/E's above 58x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Chennai Petroleum hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Chennai Petroleum

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Chennai Petroleum's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 46% during the coming year according to the lone analyst following the company. That's not great when the rest of the market is expected to grow by 24%.

With this information, we are not surprised that Chennai Petroleum is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Chennai Petroleum maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Chennai Petroleum (including 1 which is a bit unpleasant).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CHENNPETRO

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives