- India

- /

- Oil and Gas

- /

- NSEI:AEGISLOG

Should Weakness in Aegis Logistics Limited's (NSE:AEGISLOG) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

With its stock down 4.2% over the past month, it is easy to disregard Aegis Logistics (NSE:AEGISLOG). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study Aegis Logistics' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Aegis Logistics is:

10% = ₹9.0b ÷ ₹86b (Based on the trailing twelve months to September 2025).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each ₹1 of shareholders' capital it has, the company made ₹0.10 in profit.

Check out our latest analysis for Aegis Logistics

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Aegis Logistics' Earnings Growth And 10% ROE

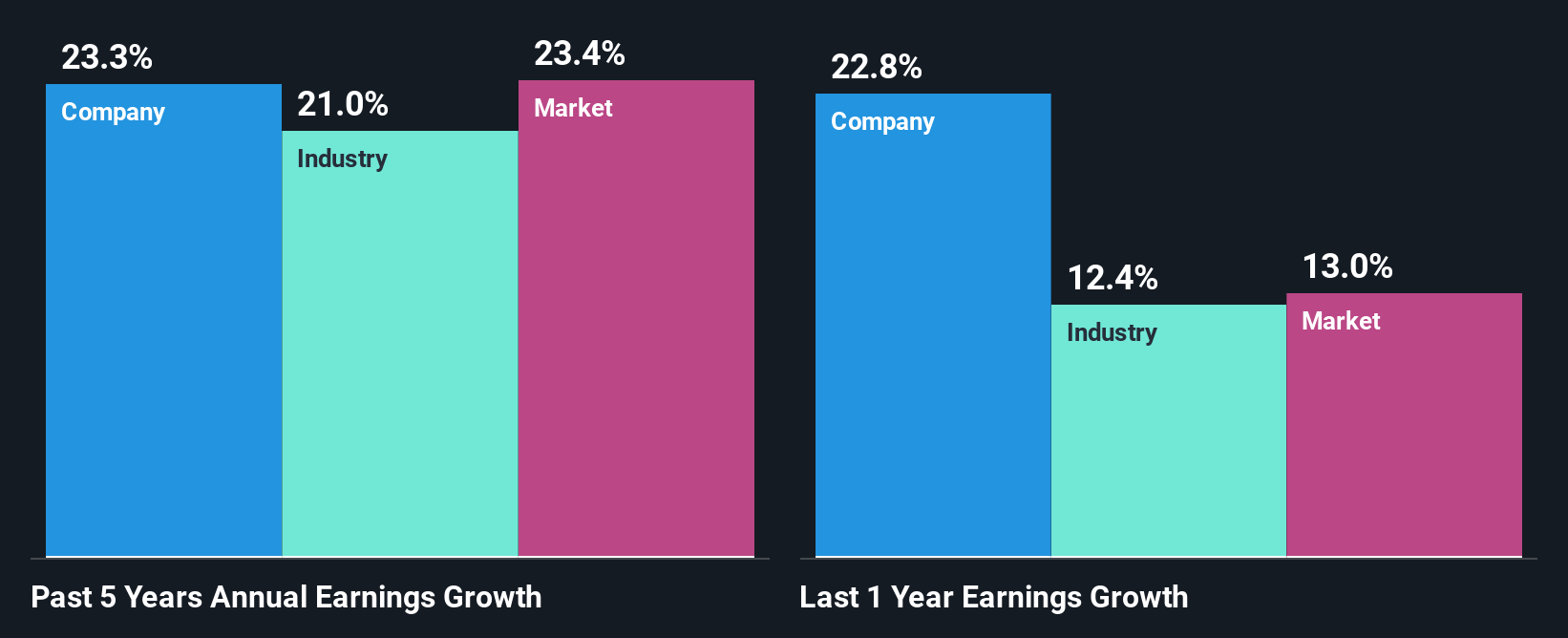

At first glance, Aegis Logistics' ROE doesn't look very promising. However, given that the company's ROE is similar to the average industry ROE of 11%, we may spare it some thought. Looking at Aegis Logistics' exceptional 23% five-year net income growth in particular, we are definitely impressed. Given the slightly low ROE, it is likely that there could be some other aspects that are driving this growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then performed a comparison between Aegis Logistics' net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 21% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Aegis Logistics fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Aegis Logistics Efficiently Re-investing Its Profits?

Aegis Logistics' three-year median payout ratio is a pretty moderate 42%, meaning the company retains 58% of its income. By the looks of it, the dividend is well covered and Aegis Logistics is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Additionally, Aegis Logistics has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 30% over the next three years. As a result, the expected drop in Aegis Logistics' payout ratio explains the anticipated rise in the company's future ROE to 19%, over the same period.

Summary

On the whole, we do feel that Aegis Logistics has some positive attributes. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AEGISLOG

Aegis Logistics

Operates as an oil, gas, and chemical logistics company primarily in India.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026