- India

- /

- Consumer Finance

- /

- NSEI:SATIN

Did Changing Sentiment Drive Satin Creditcare Network's (NSE:SATIN) Share Price Down By 31%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Satin Creditcare Network Limited (NSE:SATIN) shareholders, since the share price is down 31% in the last three years, falling well short of the market return of around 40%. There was little comfort for shareholders in the last week as the price declined a further 3.5%.

See our latest analysis for Satin Creditcare Network

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Satin Creditcare Network actually saw its earnings per share (EPS) improve by 27% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past. It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

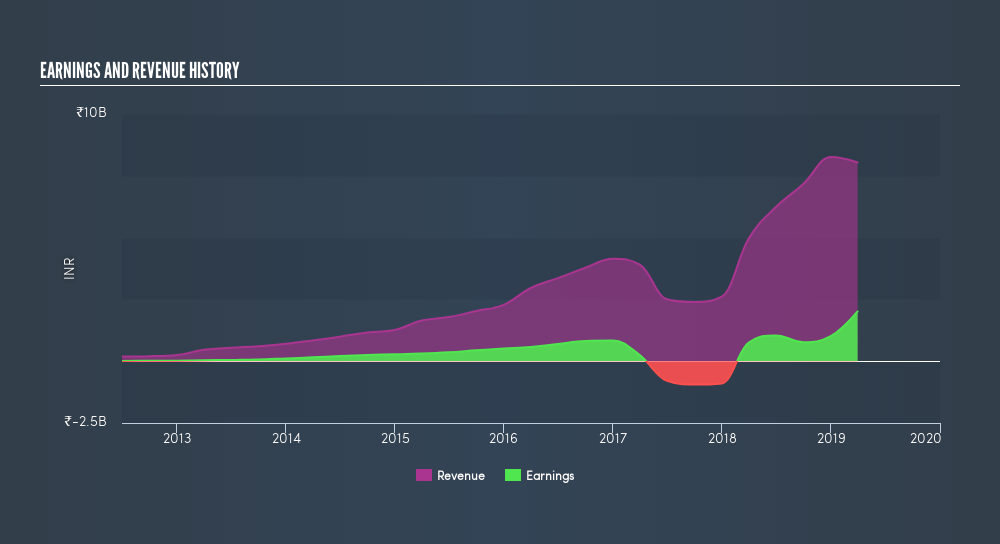

Revenue is actually up 36% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Satin Creditcare Network more closely, as sometimes stocks fall unfairly. This could present an opportunity.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We know that Satin Creditcare Network has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Satin Creditcare Network

A Different Perspective

Satin Creditcare Network shareholders are down 19% for the year, but the broader market is up 0.3%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 11% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Satin Creditcare Network may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SATIN

Satin Creditcare Network

A non-banking finance company, provides micro finance services in India.

High growth potential and fair value.

Market Insights

Community Narratives