- India

- /

- Capital Markets

- /

- NSEI:PRIMESECU

Prime Securities Limited's (NSE:PRIMESECU) Risks Elevated At These Prices

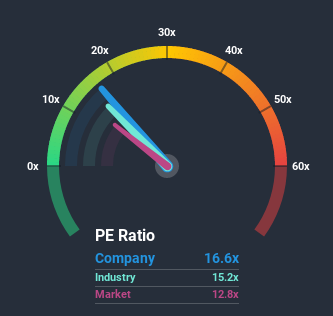

Prime Securities Limited's (NSE:PRIMESECU) price-to-earnings (or "P/E") ratio of 16.6x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Prime Securities' financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Prime Securities

How Does Prime Securities' P/E Ratio Compare To Its Industry Peers?

An inspection of average P/E's throughout Prime Securities' industry may help to explain its high P/E ratio. You'll notice in the figure below that P/E ratios in the Capital Markets industry are also higher than the market. So this certainly goes a fair way towards explaining the company's ratio right now. In the context of the Capital Markets industry's current setting, most of its constituents' P/E's would be expected to be raised up. We'd highlight though, the spotlight should be on the anticipated direction of the company's earnings.

What Are Growth Metrics Telling Us About The High P/E?

Prime Securities' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 53%. The last three years don't look nice either as the company has shrunk EPS by 41% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 4.8% shows the market is more attractive on an annualised basis regardless.

In light of this, it's odd that Prime Securities' P/E sits above the majority of other companies. In general, when earnings shrink rapidly the P/E premium often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Prime Securities revealed its sharp three-year contraction in earnings isn't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to shrink less severely. When we see below average earnings, we suspect the share price is at risk of declining, sending the high P/E lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader market turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Prime Securities that you need to be mindful of.

Of course, you might also be able to find a better stock than Prime Securities. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade Prime Securities, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:PRIMESECU

Prime Securities

Provides corporate advisory and investment banking services in India, the United Kingdom, the United Arab Emirates, and internationally.

Outstanding track record with flawless balance sheet.