- India

- /

- Capital Markets

- /

- NSEI:MOTILALOFS

Here's Why We Think Motilal Oswal Financial Services (NSE:MOTILALOFS) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Motilal Oswal Financial Services (NSE:MOTILALOFS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Motilal Oswal Financial Services

How Fast Is Motilal Oswal Financial Services Growing Its Earnings Per Share?

Over the last three years, Motilal Oswal Financial Services has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Motilal Oswal Financial Services' EPS skyrocketed from ₹76.18 to ₹96.48, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 27%.

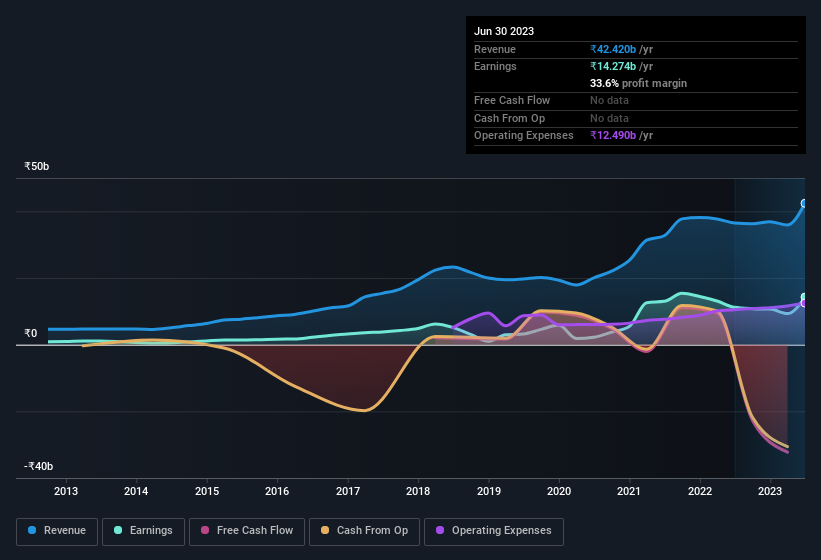

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Motilal Oswal Financial Services' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Motilal Oswal Financial Services remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 16% to ₹42b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Motilal Oswal Financial Services' future profits.

Are Motilal Oswal Financial Services Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold ₹83m worth of shares. But that's far less than the ₹205m insiders spent purchasing stock. This bodes well for Motilal Oswal Financial Services as it highlights the fact that those who are important to the company having a lot of faith in its future. We also note that it was the Co-Founder, Motilal Oswal, who made the biggest single acquisition, paying ₹73m for shares at about ₹562 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Motilal Oswal Financial Services insiders own more than a third of the company. In fact, they own 77% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. ₹93b That level of investment from insiders is nothing to sneeze at.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Motilal Oswal is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Motilal Oswal Financial Services, with market caps between ₹82b and ₹263b, is around ₹43m.

Motilal Oswal Financial Services offered total compensation worth ₹24m to its CEO in the year to March 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Motilal Oswal Financial Services To Your Watchlist?

You can't deny that Motilal Oswal Financial Services has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. However, before you get too excited we've discovered 4 warning signs for Motilal Oswal Financial Services (2 are a bit unpleasant!) that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Motilal Oswal Financial Services isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MOTILALOFS

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives