- India

- /

- Capital Markets

- /

- NSEI:MONARCH

Is Now The Time To Put Monarch Networth Capital (NSE:MONARCH) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Monarch Networth Capital (NSE:MONARCH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Monarch Networth Capital

Monarch Networth Capital's Improving Profits

Monarch Networth Capital has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Monarch Networth Capital's EPS grew from ₹15.39 to ₹28.67, over the previous 12 months. It's a rarity to see 86% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

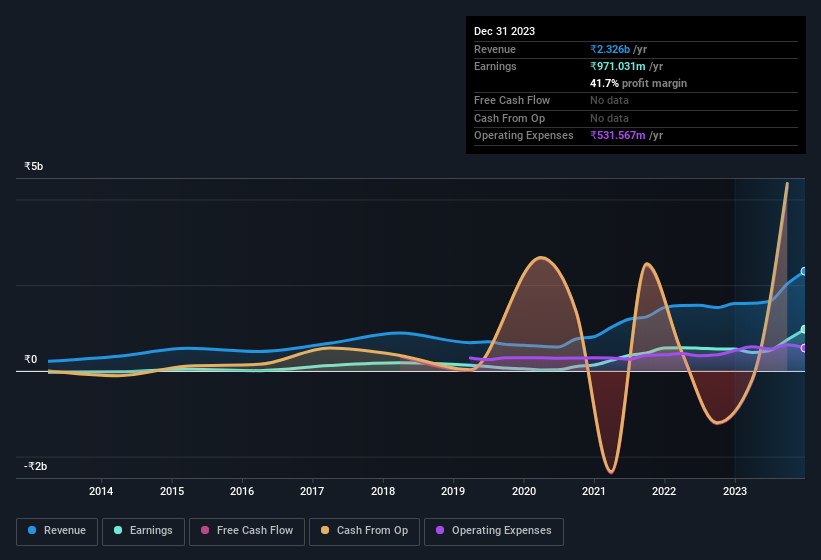

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Monarch Networth Capital's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Monarch Networth Capital achieved similar EBIT margins to last year, revenue grew by a solid 48% to ₹2.3b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Monarch Networth Capital is no giant, with a market capitalisation of ₹17b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Monarch Networth Capital Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's pleasing to note that insiders spent ₹116m buying Monarch Networth Capital shares, over the last year, without reporting any share sales whatsoever. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. Zooming in, we can see that the biggest insider purchase was by MD & Non-Independent Executive Director Vaibhav Shah for ₹68m worth of shares, at about ₹228 per share.

On top of the insider buying, we can also see that Monarch Networth Capital insiders own a large chunk of the company. In fact, they own 60% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹10b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Monarch Networth Capital Worth Keeping An Eye On?

Monarch Networth Capital's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Monarch Networth Capital deserves timely attention. Now, you could try to make up your mind on Monarch Networth Capital by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Keen growth investors love to see insider buying. Thankfully, Monarch Networth Capital isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MONARCH

Monarch Networth Capital

Provides financial services to high net worth individuals, institutional and foreign investors, financial institutions, and corporate clients in India.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives