- India

- /

- Capital Markets

- /

- NSEI:ISEC

Head of Institutional Equities Jaideep Goswami Just Sold A Bunch Of Shares In ICICI Securities Limited (NSE:ISEC)

Investors may wish to note that the Head of Institutional Equities of ICICI Securities Limited, Jaideep Goswami, recently netted ₹3.4m from selling stock, receiving an average price of ₹457. While that isn't a lot of money, it was a substantial 100% of their holding, so certainly isn't a good sign.

See our latest analysis for ICICI Securities

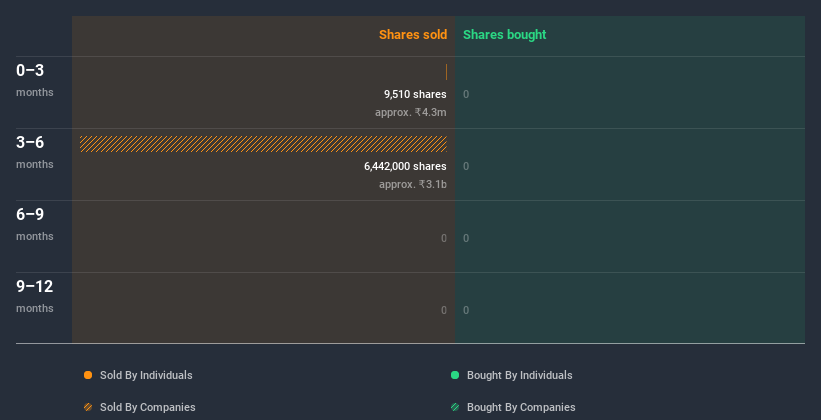

ICICI Securities Insider Transactions Over The Last Year

In fact, the recent sale by Jaideep Goswami was the biggest sale of ICICI Securities shares made by an insider individual in the last twelve months, according to our records. That means that an insider was selling shares at around the current price of ₹453. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

Jaideep Goswami sold a total of 9.51k shares over the year at an average price of ₹457. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. From what we can see in our data, insiders own only about ₹28m worth of ICICI Securities shares. We might be missing something but that seems like very low insider ownership.

What Might The Insider Transactions At ICICI Securities Tell Us?

An insider sold stock recently, but they haven't been buying. And there weren't any purchases to give us comfort, over the last year. But since ICICI Securities is profitable and growing, we're not too worried by this. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. So we'd only buy after careful consideration. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Our analysis shows 3 warning signs for ICICI Securities (1 can't be ignored!) and we strongly recommend you look at these before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade ICICI Securities, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ISEC

ICICI Securities

Engages in the institutional and retail broking, financial products distribution, merchant banking, private wealth management, and issuer and advisory services in India and internationally.

Second-rate dividend payer low.

Similar Companies

Market Insights

Community Narratives