- India

- /

- Diversified Financial

- /

- NSEI:IREDA

Earnings Not Telling The Story For Indian Renewable Energy Development Agency Limited (NSE:IREDA) After Shares Rise 26%

Indian Renewable Energy Development Agency Limited (NSE:IREDA) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

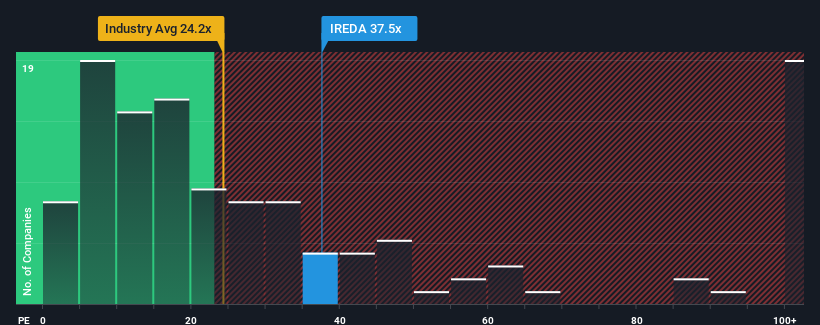

Since its price has surged higher, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 30x, you may consider Indian Renewable Energy Development Agency as a stock to potentially avoid with its 37.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Indian Renewable Energy Development Agency recently, which is pleasing to see. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Indian Renewable Energy Development Agency

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Indian Renewable Energy Development Agency would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 15%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 1.5% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 24% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Indian Renewable Energy Development Agency's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Indian Renewable Energy Development Agency shares have received a push in the right direction, but its P/E is elevated too. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Indian Renewable Energy Development Agency revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Indian Renewable Energy Development Agency (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Indian Renewable Energy Development Agency, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IREDA

Indian Renewable Energy Development Agency

A non-banking financial company, provides financial products and services in the renewable energy and energy efficiency sectors in India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives