- India

- /

- Professional Services

- /

- NSEI:BLS

Undiscovered Gems in India to Watch This August 2024

Reviewed by Simply Wall St

The Indian market has gained 2.6% recently and is up an impressive 48% over the last 12 months, with earnings forecasted to grow by 17% annually. In this robust environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pearl Global Industries | 54.72% | 19.34% | 38.59% | ★★★★★★ |

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Kokuyo Camlin | 21.96% | 11.97% | 59.14% | ★★★★★★ |

| Macpower CNC Machines | NA | 20.01% | 23.61% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Abans Holdings | 91.73% | -25.26% | 17.68% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Innovana Thinklabs | 4.53% | 12.52% | 19.93% | ★★★★☆☆ |

We'll examine a selection from our screener results.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹149.88 billion.

Operations: BLS International Services Limited generates revenue primarily from Visa and Consular Services (₹13.62 billion) and Digital Services (₹3.34 billion).

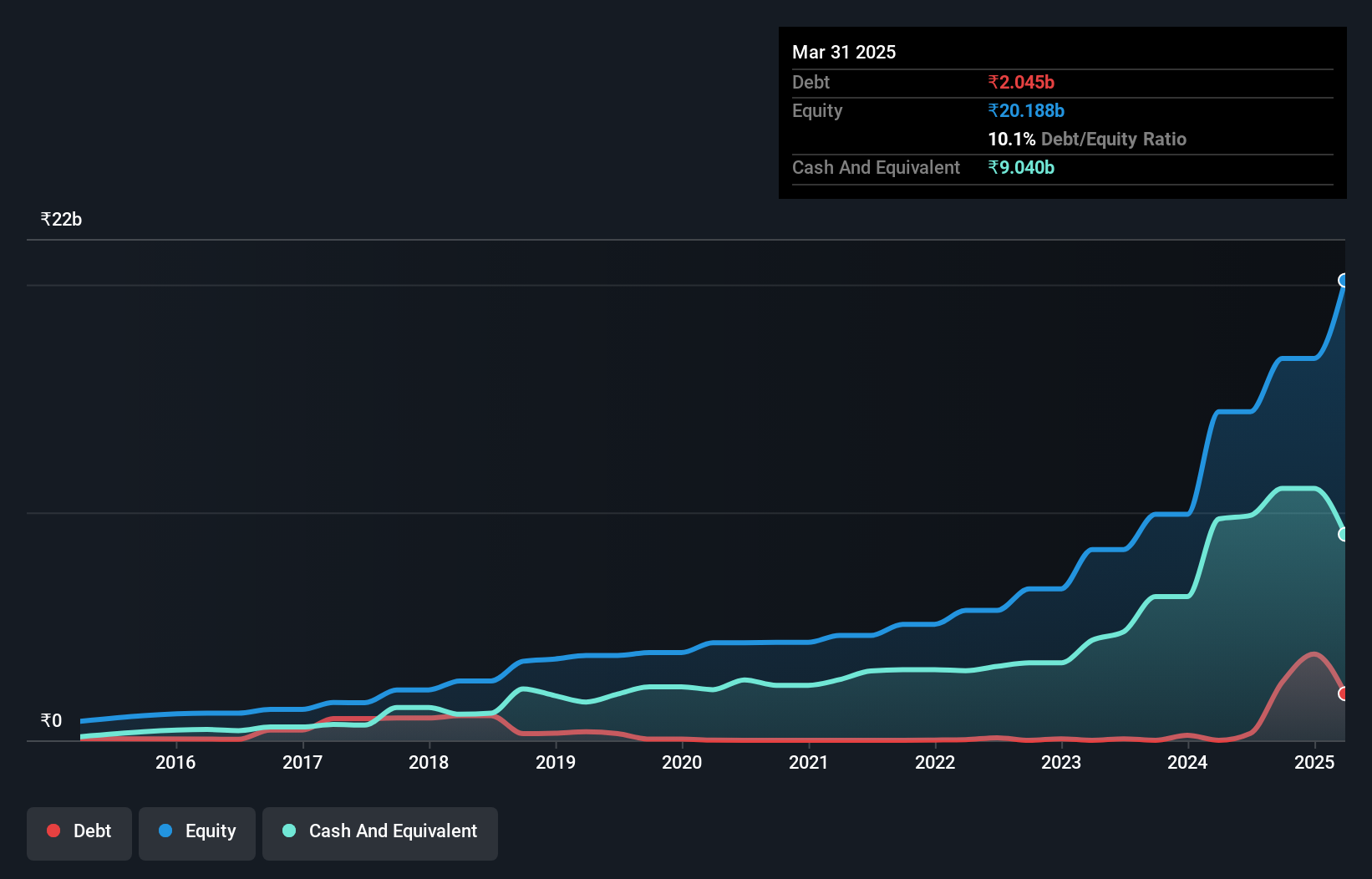

BLS International Services, a promising player in the professional services sector, has shown robust earnings growth of 55.9% over the past year, significantly outpacing the industry's 9.4%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 10.1%. Recent strategic moves include establishing BLS International Holding Anonim Sirketi in Turkey with a share capital of TRY700M and proposing a final dividend of INR0.50 per equity share for FY2023-24.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, operates in the mining of iron ores in India and has a market cap of ₹145.19 billion.

Operations: GPIL generates revenue primarily from mining iron ores, with a significant portion attributed to this segment. The company reported a net profit margin of 12.50% in the most recent fiscal year.

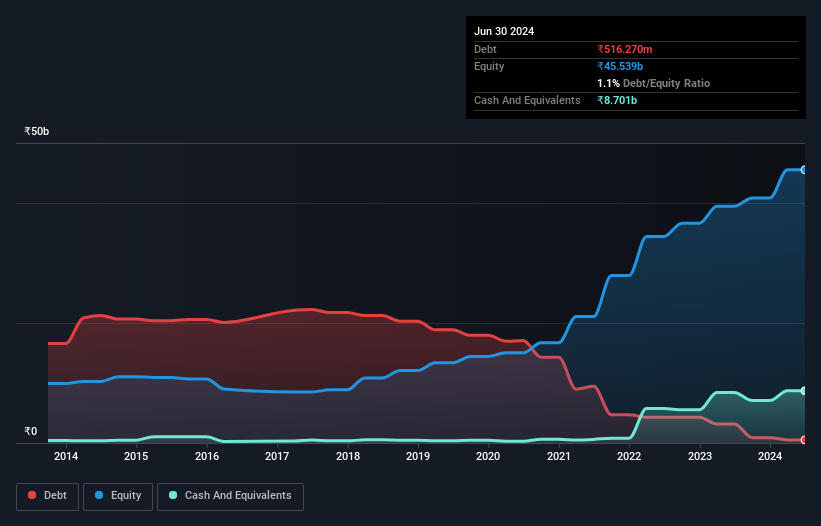

Godawari Power & Ispat (GPIL) showcases a compelling profile with its debt to equity ratio dropping from 141.1% to 1.1% over five years, indicating financial prudence. The company’s EBIT covers interest payments 19.9 times, reflecting strong operational efficiency. Recent expansions include a new 2 million ton pellet plant and a share buyback of INR 3,010 million for 2,150,000 shares. GPIL’s earnings growth of 18%, surpassing industry averages, underscores its robust performance in the metals sector.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market cap of ₹65.52 billion.

Operations: IIFL Securities Limited generates revenue through its capital market services in India's primary and secondary markets. The company has a market cap of ₹65.52 billion.

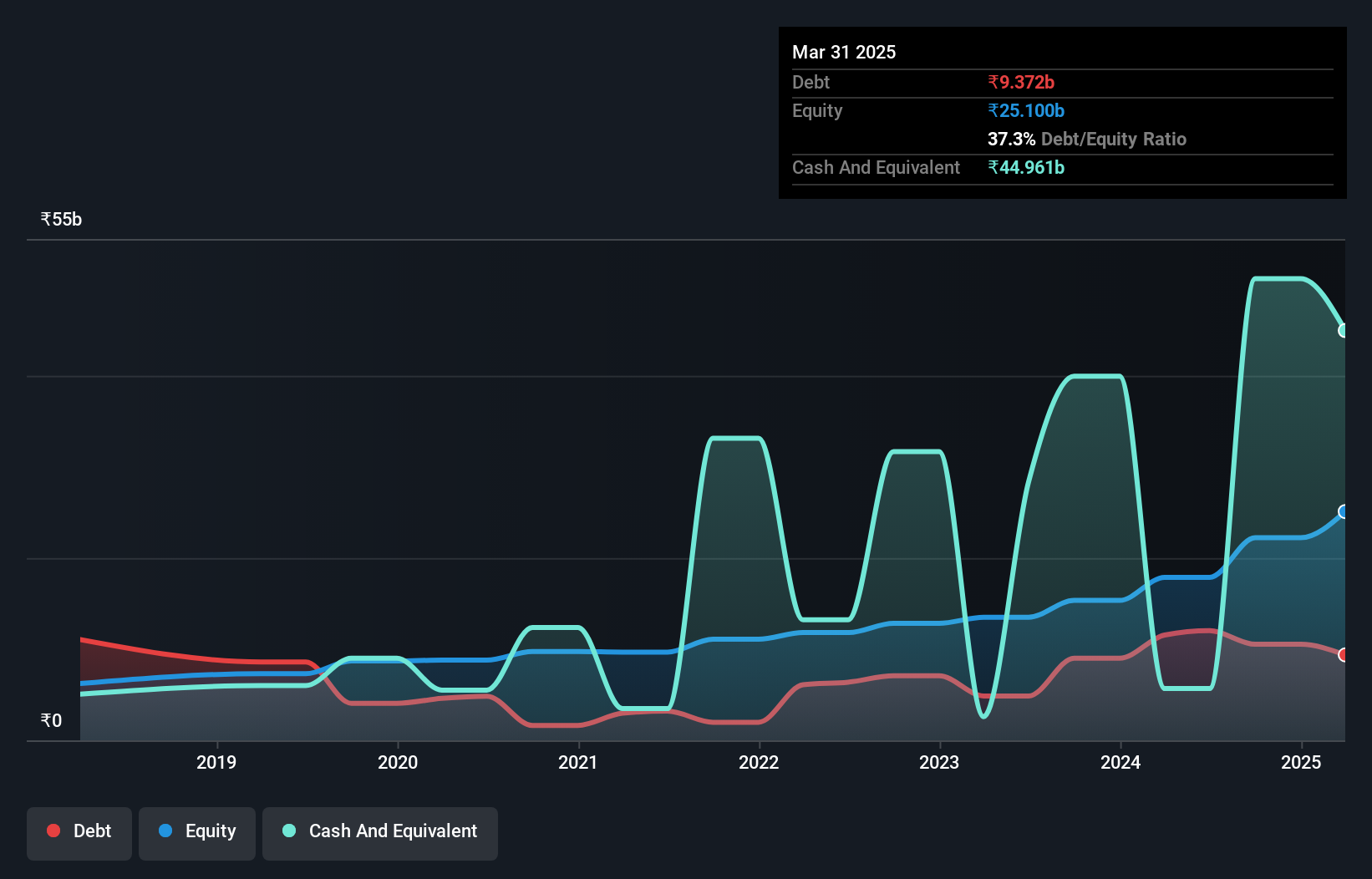

IIFL Securities, a promising small-cap stock in India's financial sector, has shown robust performance with earnings growing by 120.4% over the past year, outpacing the Capital Markets industry’s 58.9%. The net debt to equity ratio stands at a satisfactory 32.8%, down from 117.6% five years ago. Recent earnings for Q1 FY2025 reported revenue of INR 6.44 billion and net income of INR 1.82 billion, reflecting strong operational efficiency and high-quality earnings amidst market volatility.

- Click here to discover the nuances of IIFL Securities with our detailed analytical health report.

Gain insights into IIFL Securities' past trends and performance with our Past report.

Turning Ideas Into Actions

- Gain an insight into the universe of 456 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BLS International Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLS

BLS International Services

Provides outsourcing and administrative task of visa, passport, and consular services to various diplomatic missions in India.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives