- India

- /

- Auto Components

- /

- NSEI:TSFINV

Undiscovered Gems In India Including IIFL Securities And 2 Other Small Cap Picks

Reviewed by Simply Wall St

In the last week, the Indian market has been flat, but it is up 43% over the past year with earnings expected to grow by 17% per annum over the next few years. In this promising landscape, identifying stocks with strong fundamentals and growth potential is key; here we explore IIFL Securities and two other small-cap picks that could be undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers a range of capital market services in India's primary and secondary markets, with a market cap of ₹98.80 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities (₹20.25 billion), followed by insurance broking and ancillary services (₹2.77 billion), and facilities and ancillary services (₹375.25 million).

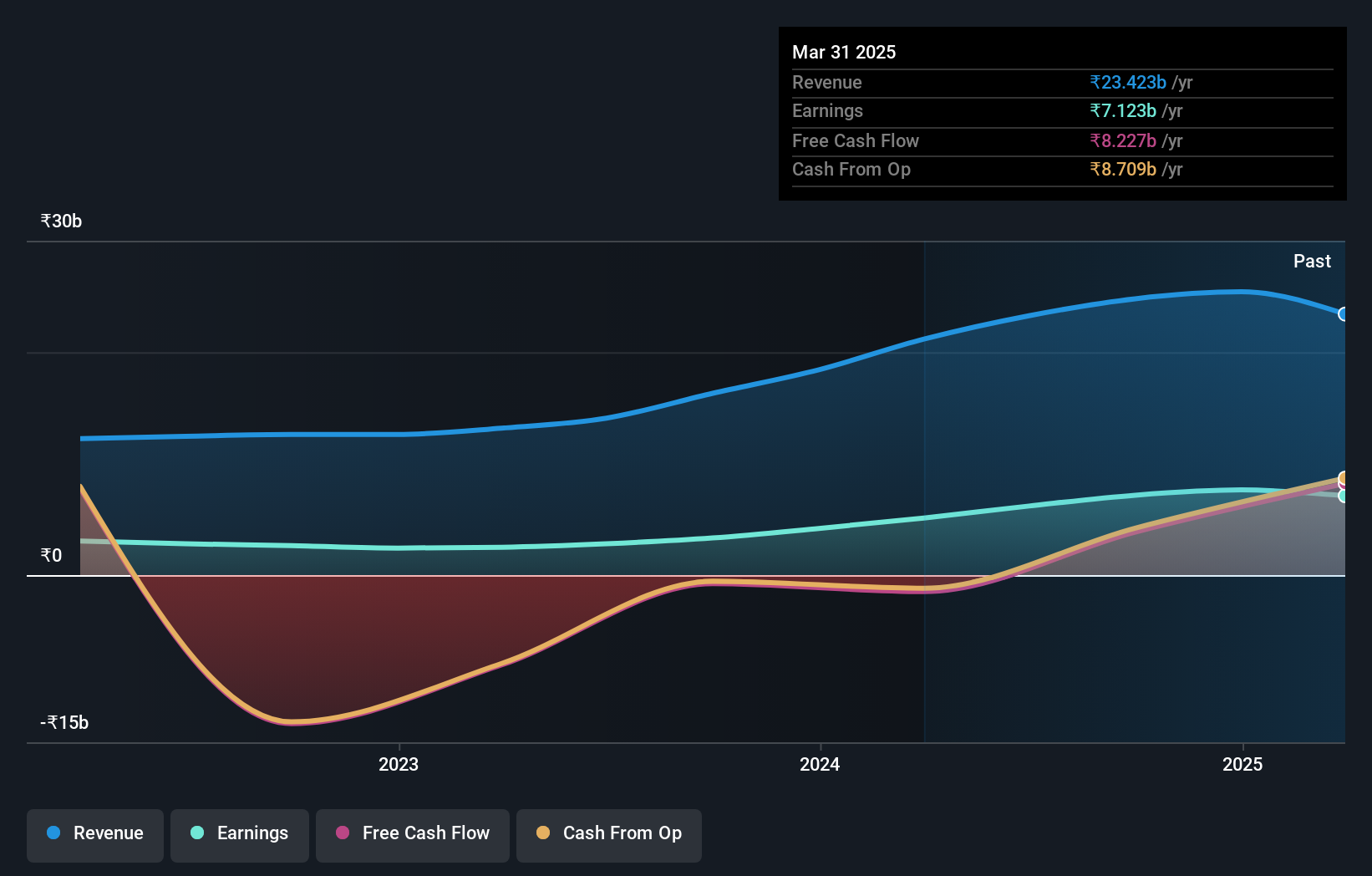

IIFL Securities has shown impressive earnings growth of 120.4% over the past year, outpacing the Capital Markets industry at 64%. The company’s price-to-earnings ratio stands at 15.9x, significantly lower than the Indian market's 34.3x, indicating good value. Additionally, IIFL's net debt to equity ratio has improved from 117.6% to a satisfactory 67.2% over five years. Despite recent volatility and a SEBI penalty of INR 300K, its strong earnings performance and strategic appointments like Hardik Sanghavi as CTO bolster confidence in its future prospects.

- Delve into the full analysis health report here for a deeper understanding of IIFL Securities.

Examine IIFL Securities' past performance report to understand how it has performed in the past.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand; it has a market cap of ₹118.41 billion.

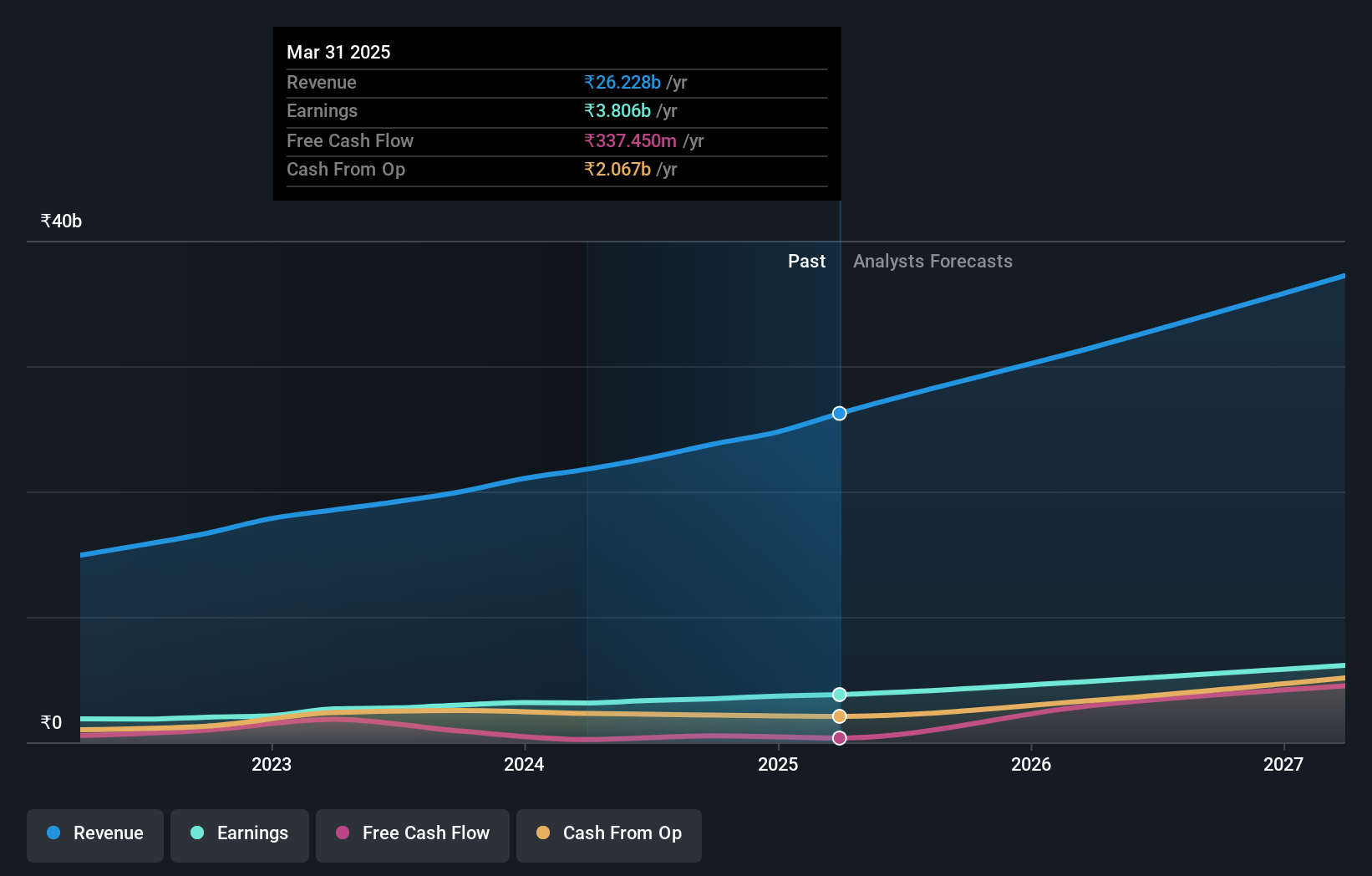

Operations: Marksans Pharma Limited generates revenue primarily from its pharmaceutical formulations segment, amounting to ₹22.68 billion.

Marksans Pharma, a notable player in the pharmaceutical sector, has shown strong financial health with cash exceeding total debt and a reduced debt-to-equity ratio from 19.9% to 11.7% over five years. The company reported earnings growth of 21.7% last year, surpassing the industry average of 19.3%. Recent Q1 results revealed net income at INR 887.52 million, up from INR 686.58 million year-on-year, reflecting robust performance and potential for future growth through M&A activities in Europe.

Sundaram Finance Holdings (NSEI:SUNDARMHLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited engages in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹92.14 billion.

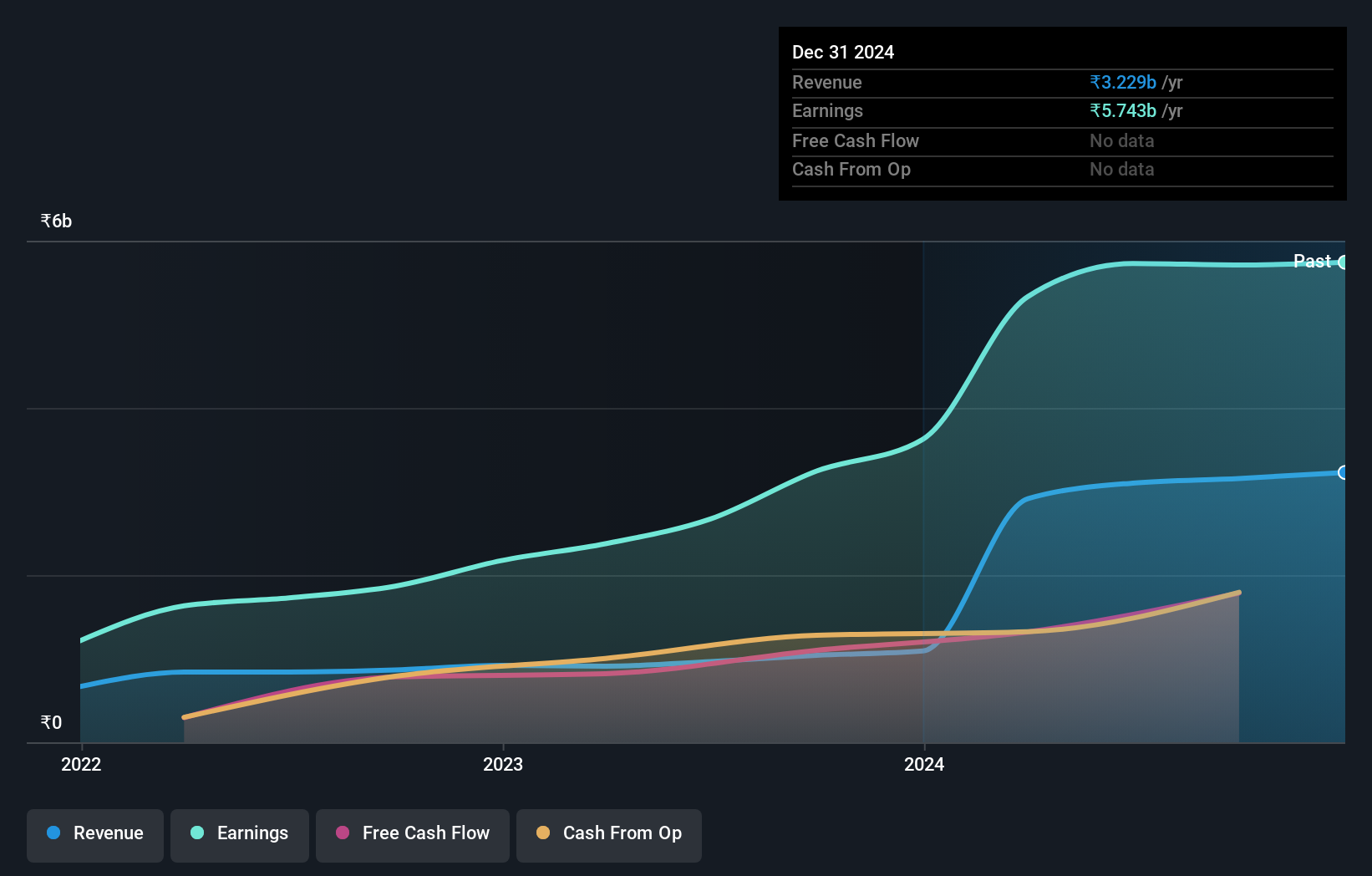

Operations: The company generates revenue primarily from investments (₹2.51 billion), domestic shared services (₹105.51 million), and overseas shared services (₹489.78 million).

Sundaram Finance Holdings (SFHL) has demonstrated impressive growth, with earnings surging by 114.5% over the past year, outpacing the Auto Components industry’s 20.1%. The company has a price-to-earnings ratio of 16.1x, well below the Indian market average of 34.3x, indicating potential value. Recent earnings for Q1 FY2024 showed revenue at INR 442.78 million and net income at INR 1,103.35 million compared to INR 706.72 million last year; basic EPS rose to INR 4.97 from INR 3.18.

- Click to explore a detailed breakdown of our findings in Sundaram Finance Holdings' health report.

Assess Sundaram Finance Holdings' past performance with our detailed historical performance reports.

Seize The Opportunity

- Click through to start exploring the rest of the 470 Indian Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSF Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TSFINV

TSF Investments

Engages in the business of investments, and business processing and support services in India and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives