- India

- /

- Capital Markets

- /

- NSEI:MAHSCOOTER

Undiscovered Gems In India Featuring 3 Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

The Indian market has climbed 1.1% over the last week and is up 41% over the past 12 months, with earnings expected to grow by 17% per annum in the coming years. In this thriving environment, identifying small-cap stocks with strong fundamentals can provide promising opportunities for investors seeking growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.10% | -6.06% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Action Construction Equipment (NSEI:ACE)

Simply Wall St Value Rating: ★★★★★★

Overview: Action Construction Equipment Limited manufactures and sells material handling and construction equipment primarily in India, with a market cap of ₹160.43 billion.

Operations: ACE generates revenue primarily from its material handling and construction equipment segments, with additional income from agriculture equipment amounting to ₹2.05 billion.

Action Construction Equipment (ACE) has demonstrated impressive financial health, with earnings growing by 76.2% over the past year, significantly outpacing the Machinery industry's 24.8%. The company's debt-to-equity ratio has improved from 18.5% to just 0.4% over five years, indicating strong financial management. Recent news highlights include a substantial order from the Ministry of Defence and an approved final dividend of INR 2 per share for FY2024, showcasing ACE's robust market presence and shareholder value focus.

- Take a closer look at Action Construction Equipment's potential here in our health report.

Learn about Action Construction Equipment's historical performance.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market cap of ₹102.22 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities (₹20.25 billion) and insurance broking and ancillary services (₹2.77 billion). Facilities and ancillary services contribute an additional ₹375.25 million to the revenue stream.

IIFL Securities, a notable entity in the Indian capital markets, has shown impressive earnings growth of 120.4% over the past year, outpacing the industry average of 63.2%. With a price-to-earnings ratio of 16.5x, it stands attractively valued against the broader market's 34.4x. The company’s net debt to equity ratio is at a satisfactory level of 35.5%, having reduced from 117.6% five years ago to its current position of 67.2%. Recent regulatory actions led to a penalty by SEBI for technical errors in client data mapping but did not significantly impact overall performance as evidenced by strong Q1 results with revenue climbing to INR 6,438 million and net income reaching INR 1,821 million compared to last year’s figures.

- Click to explore a detailed breakdown of our findings in IIFL Securities' health report.

Examine IIFL Securities' past performance report to understand how it has performed in the past.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. manufactures and sells pressure die casting dies, jigs, fixtures, and die casting components primarily for the two and three-wheeler industry in India with a market cap of ₹135.61 billion.

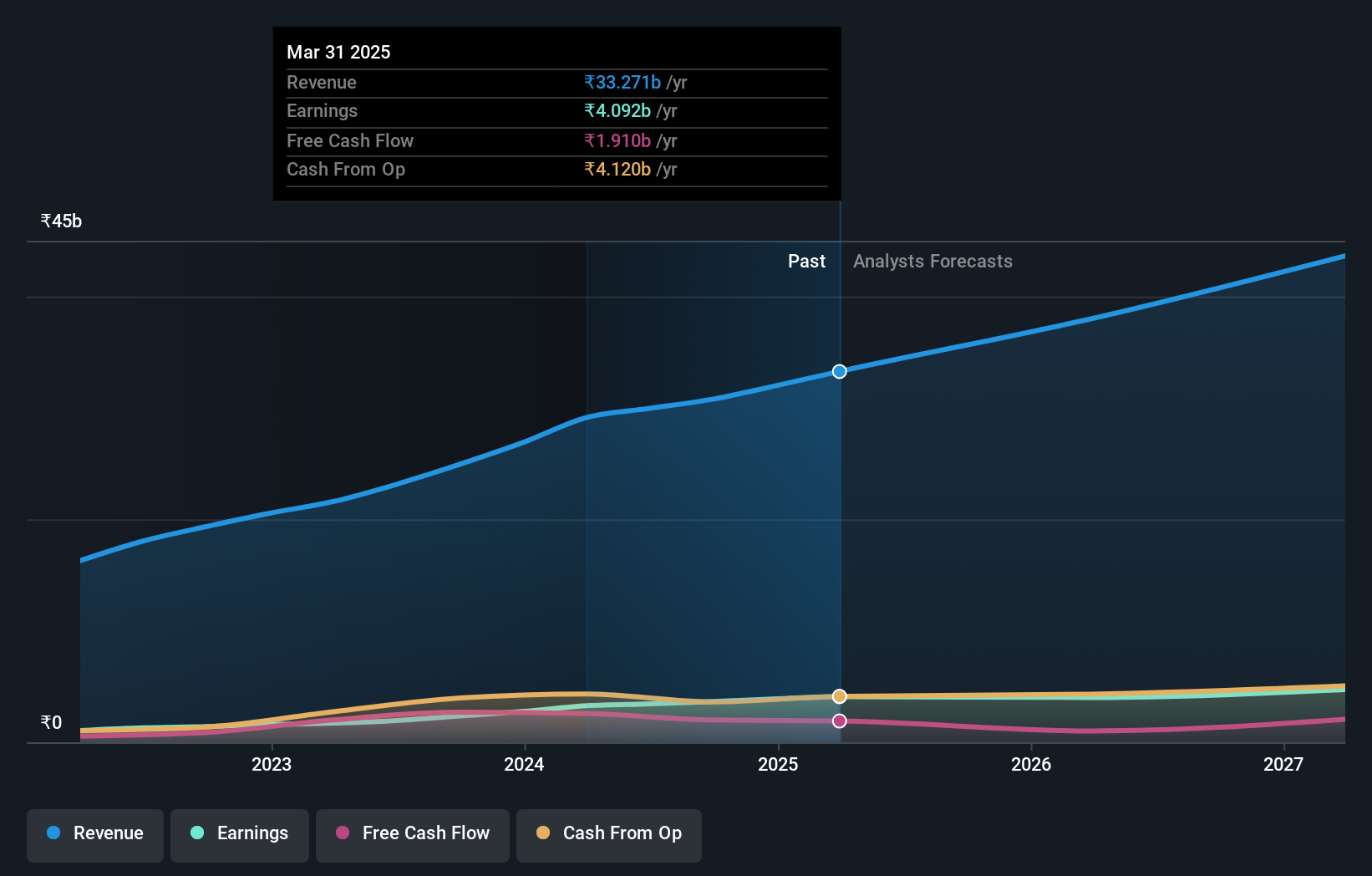

Operations: Maharashtra Scooters Ltd. generates revenue primarily through investments (₹2.14 billion) and manufacturing activities (₹108.10 million), with a minor segment adjustment of ₹15.50 million.

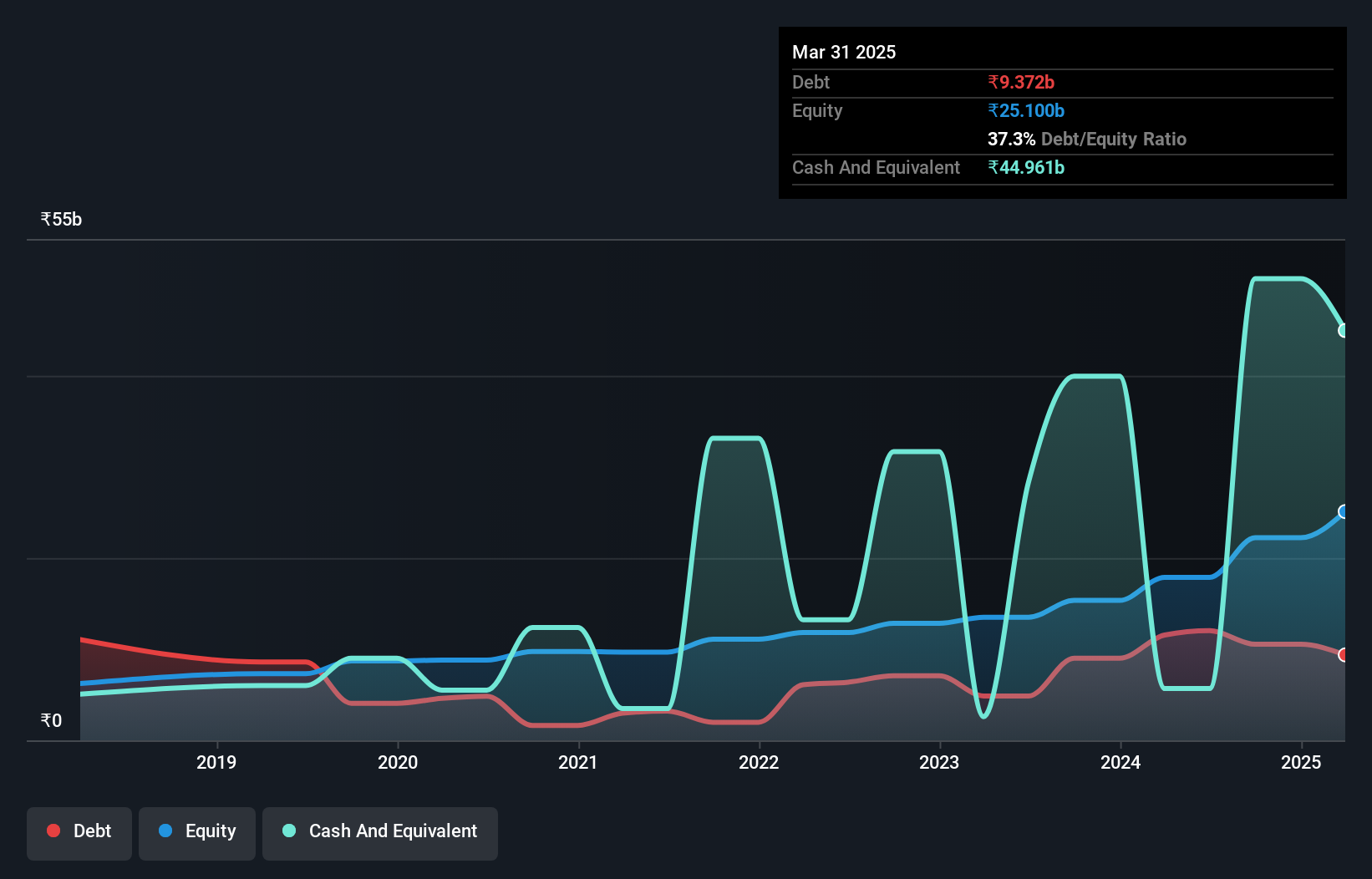

Earnings for Maharashtra Scooters have grown 19.3% annually over the past five years, showcasing high-quality earnings. The company is debt-free, eliminating concerns about interest payments and has remained so for the last five years. Recently, Maharashtra Scooters approved an interim dividend of ₹110 per share and reported a significant increase in net income to ₹82.6 million from ₹4.8 million year-over-year, with basic earnings per share rising to ₹7.2 from ₹0.4

Make It Happen

- Dive into all 473 of the Indian Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAHSCOOTER

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026