- India

- /

- Capital Markets

- /

- NSEI:IIFLSEC

Undiscovered Gems In India Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.0%, but it is up 39% over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying promising small-cap stocks can be a strategic move for investors seeking growth opportunities in lesser-known segments of the market.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Goldiam International | 0.74% | 10.79% | 15.85% | ★★★★★★ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| S J Logistics (India) | 11.71% | 90.19% | 60.29% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market cap of ₹98.09 billion.

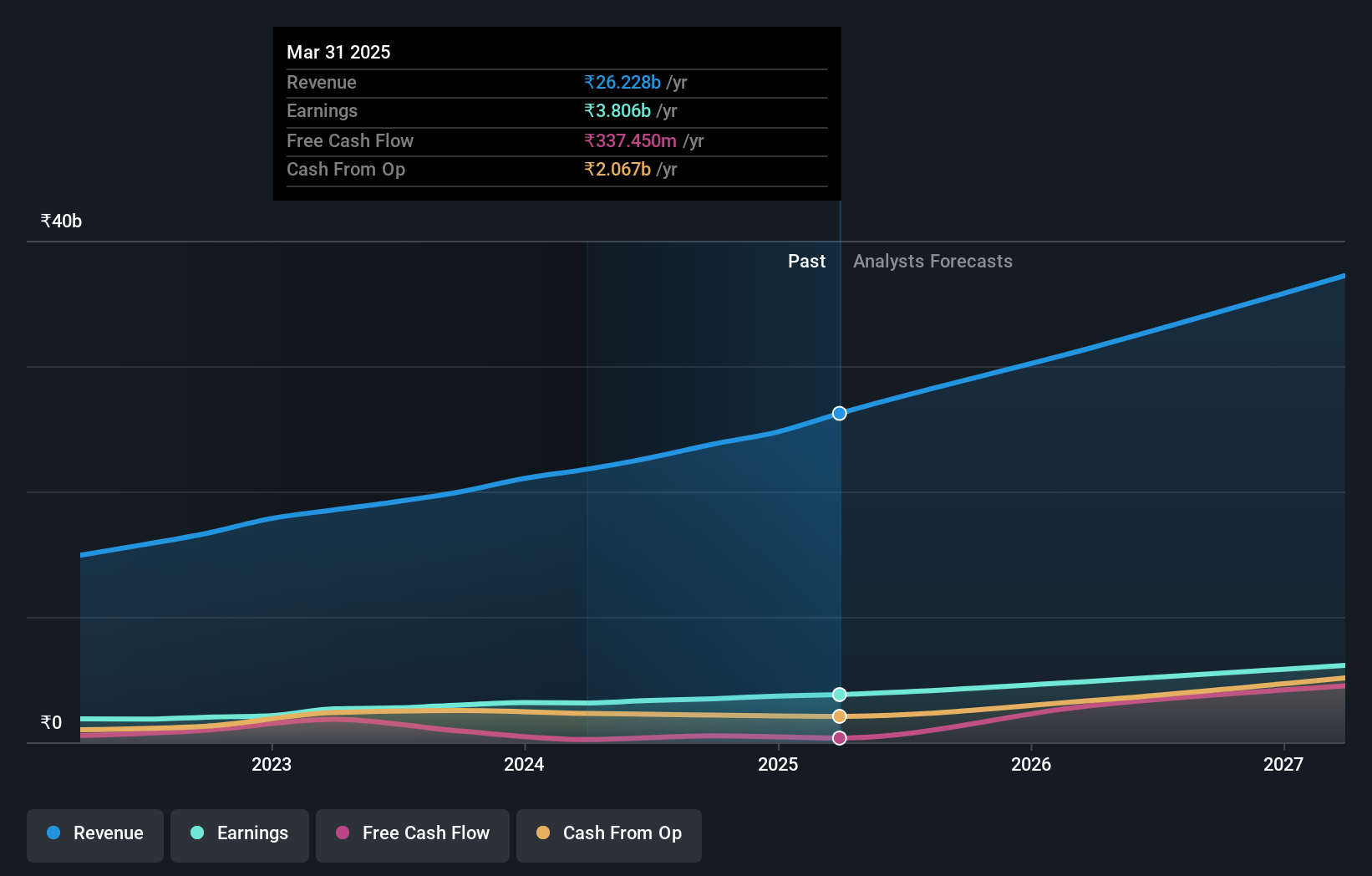

Operations: IIFL Securities generates revenue primarily from capital market activities (₹20.25 billion) and insurance broking and ancillary services (₹2.77 billion). Additional income comes from facilities and ancillary services, contributing ₹375.25 million.

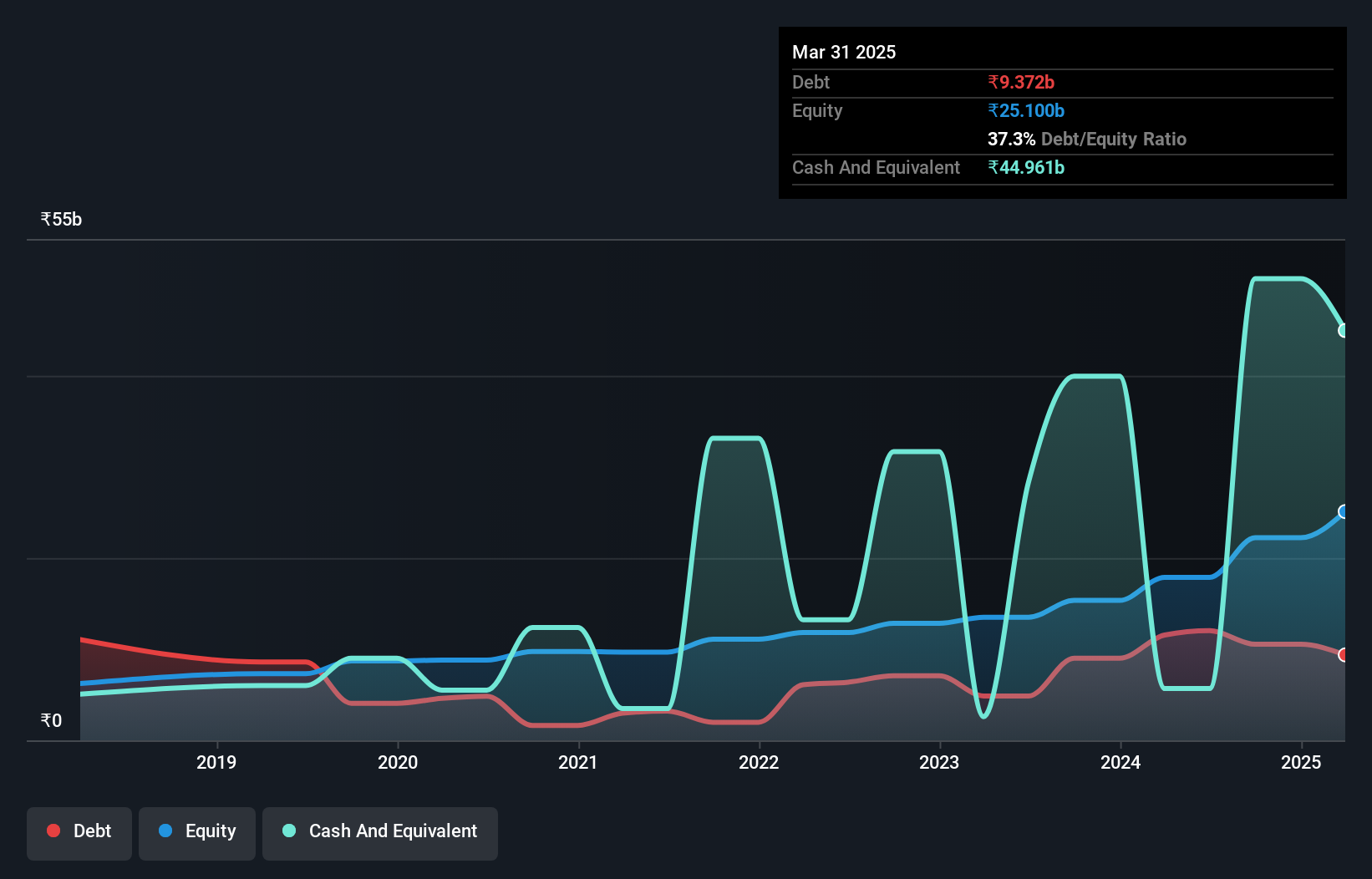

IIFL Securities, a notable player in India's capital markets, has seen its earnings grow by 120.4% over the past year, outpacing the industry average of 60.3%. With a price-to-earnings ratio of 15.8x, it is attractively valued compared to the broader Indian market at 34.4x. The company’s net debt to equity ratio stands at a satisfactory 35.5%, down from 117.6% five years ago, indicating improved financial health despite recent regulatory challenges and penalties totaling INR 300,000 (US$3K).

- Get an in-depth perspective on IIFL Securities' performance by reading our health report here.

Understand IIFL Securities' track record by examining our Past report.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand with a market cap of ₹119.22 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceutical formulations segment, which reported ₹22.68 billion in revenue. The company's net profit margin is %.

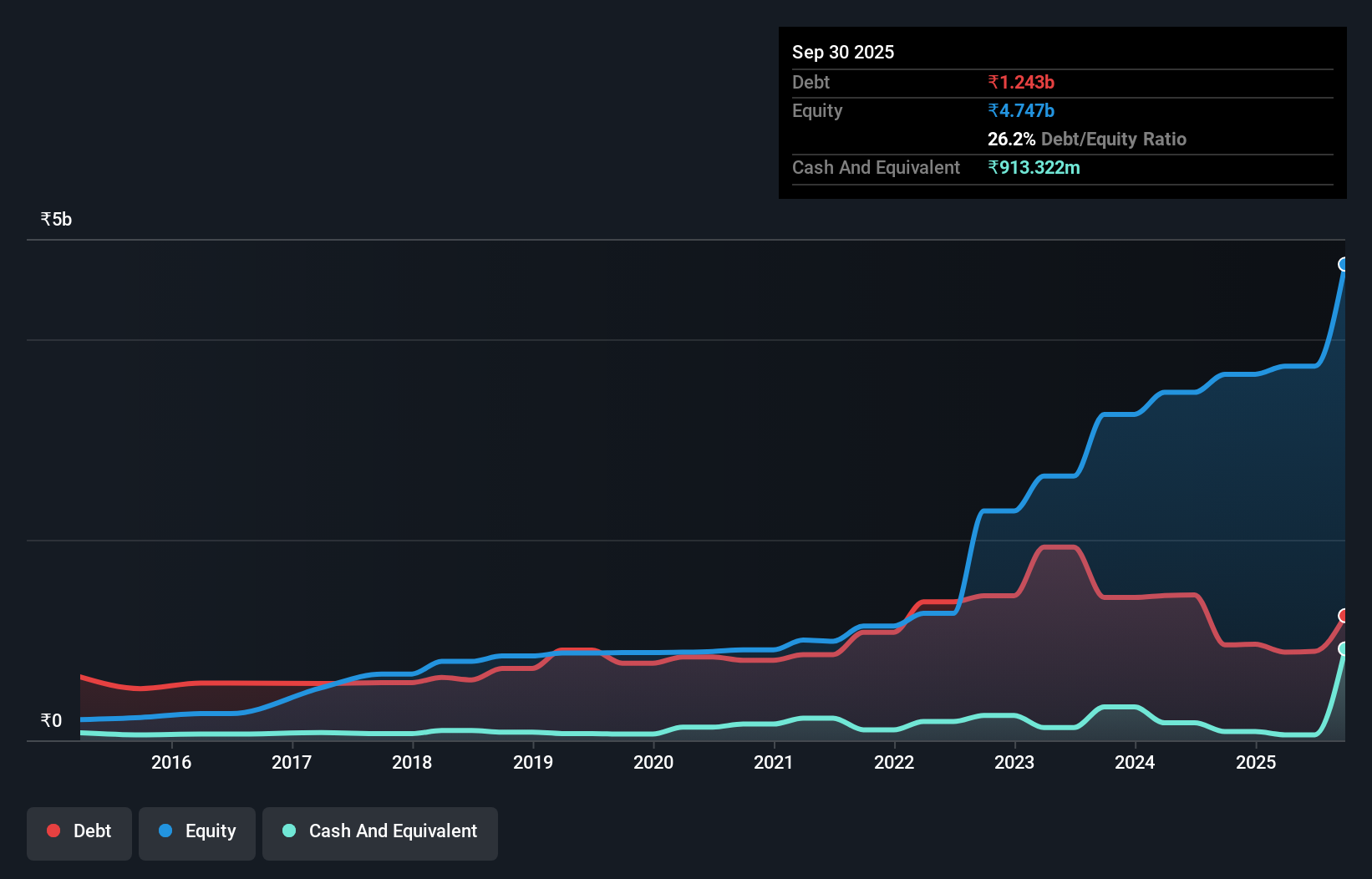

Marksans Pharma, a notable player in the pharmaceuticals sector, has seen its debt to equity ratio drop from 19.9% to 11.7% over five years. The company reported net income of ₹887.52 million for Q1 2025, up from ₹686.58 million a year prior, with earnings per share rising to ₹1.96 from ₹1.52. Trading at a P/E ratio of 35.7x against the industry average of 41.9x, Marksans also announced successful closure of a USFDA inspection in August 2024.

- Navigate through the intricacies of Marksans Pharma with our comprehensive health report here.

Examine Marksans Pharma's past performance report to understand how it has performed in the past.

Rama Steel Tubes (NSEI:RAMASTEEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rama Steel Tubes Limited manufactures and trades steel pipes, tubes, rigid poly vinyl chloride, and galvanized iron pipes in India and internationally with a market cap of ₹25.68 billion.

Operations: Rama Steel Tubes Limited generates revenue primarily from manufacturing steel pipes (₹7.16 billion) and trading building materials and steel products (₹2.34 billion).

Rama Steel Tubes has been making waves with its strategic moves, including a recent collaboration with Onix Renewable Ltd. to provide steel structures for solar projects. Despite reporting lower Q1 earnings (INR 63.57 million vs INR 70.72 million last year), the company's debt to equity ratio has improved significantly from 103.4% to 41.8% over five years, and its net debt to equity ratio stands at a satisfactory 36.8%. However, shareholders have faced dilution in the past year amidst significant insider selling over the last three months.

- Delve into the full analysis health report here for a deeper understanding of Rama Steel Tubes.

Assess Rama Steel Tubes' past performance with our detailed historical performance reports.

Where To Now?

- Navigate through the entire inventory of 479 Indian Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLSEC

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Outstanding track record with mediocre balance sheet.