- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Undiscovered Gems E.I.D.- Parry (India) And 2 Promising Small Caps

Reviewed by Simply Wall St

In the last week, the Indian market has been flat, but it is up 44% over the past year with earnings forecast to grow by 17% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; E.I.D.- Parry (India) and two other promising small caps exemplify such opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| S J Logistics (India) | 11.71% | 90.19% | 60.29% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

E.I.D.- Parry (India) (NSEI:EIDPARRY)

Simply Wall St Value Rating: ★★★★★★

Overview: E.I.D.- Parry (India) Limited, together with its subsidiaries, engages in the manufacture and sale of sugar, nutraceuticals, and distillery products in India, North America, Europe, and internationally. Market Cap: ₹154.13 billion.

Operations: The company's revenue streams include distillery (₹8.54 billion), co-generation (₹1.83 billion), nutraceuticals (₹2.34 billion), nutrient and allied business (₹187.88 billion), and crop protection including bio-pesticides (₹24.61 billion).

E.I.D.- Parry (India) showcases a compelling profile with a price-to-earnings ratio of 17.5x, well below the Indian market's 34.3x, suggesting potential undervaluation. Over the past five years, its debt-to-equity ratio has significantly reduced from 132.9% to 15.6%. Despite earnings forecasted to decline by an average of 43.7% annually over the next three years, last year's earnings grew by 13.1%, outpacing the chemicals industry at 10.7%. Recent management changes include Mr. Suresh's early retirement and Mr. Murugappan stepping in as CEO from September 2024 onwards, which may influence future strategic directions.

- Take a closer look at E.I.D.- Parry (India)'s potential here in our health report.

Understand E.I.D.- Parry (India)'s track record by examining our Past report.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets and has a market cap of ₹117.03 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion) and also earns from facilities and ancillary services (₹375.25 million) as well as insurance broking and ancillary services (₹2.77 billion).

IIFL Securities has seen significant growth, with earnings surging 120.4% over the past year, outpacing the Capital Markets industry. The company's debt to equity ratio improved from 117.6% to 67.2% in five years, reflecting prudent financial management. With a price-to-earnings ratio of 18.9x, it appears undervalued compared to the Indian market average of 34.3x. Recent developments include a proposed name change and a penalty from SEBI for technical errors in client data mapping.

- Get an in-depth perspective on IIFL Securities' performance by reading our health report here.

Gain insights into IIFL Securities' historical performance by reviewing our past performance report.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in power generation and cement grinding businesses both in India and internationally, with a market cap of ₹131.24 billion.

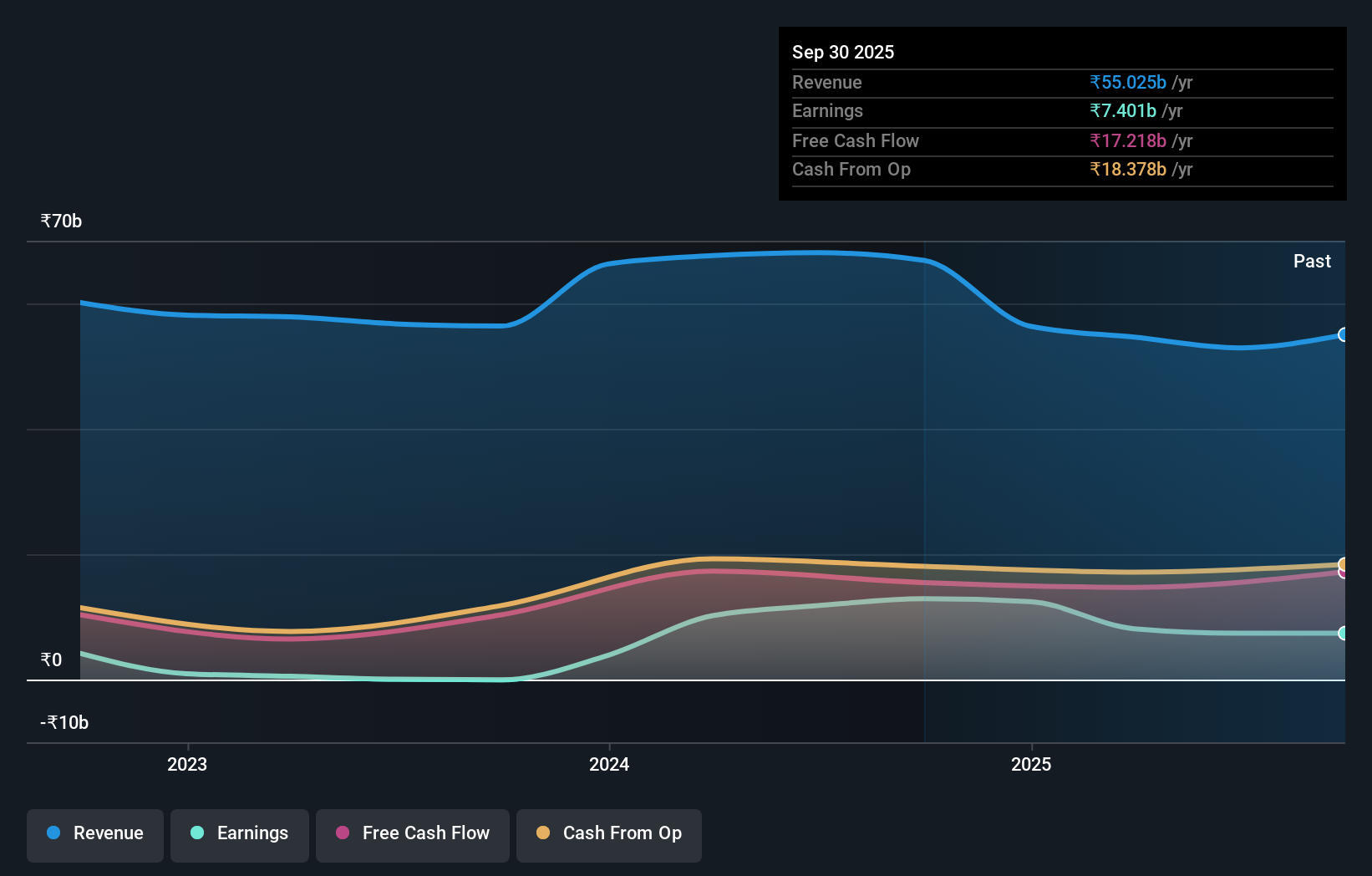

Operations: Jaiprakash Power Ventures generates revenue primarily from its power segment, which contributed ₹61.68 billion, and coal segment, which added ₹6.59 billion.

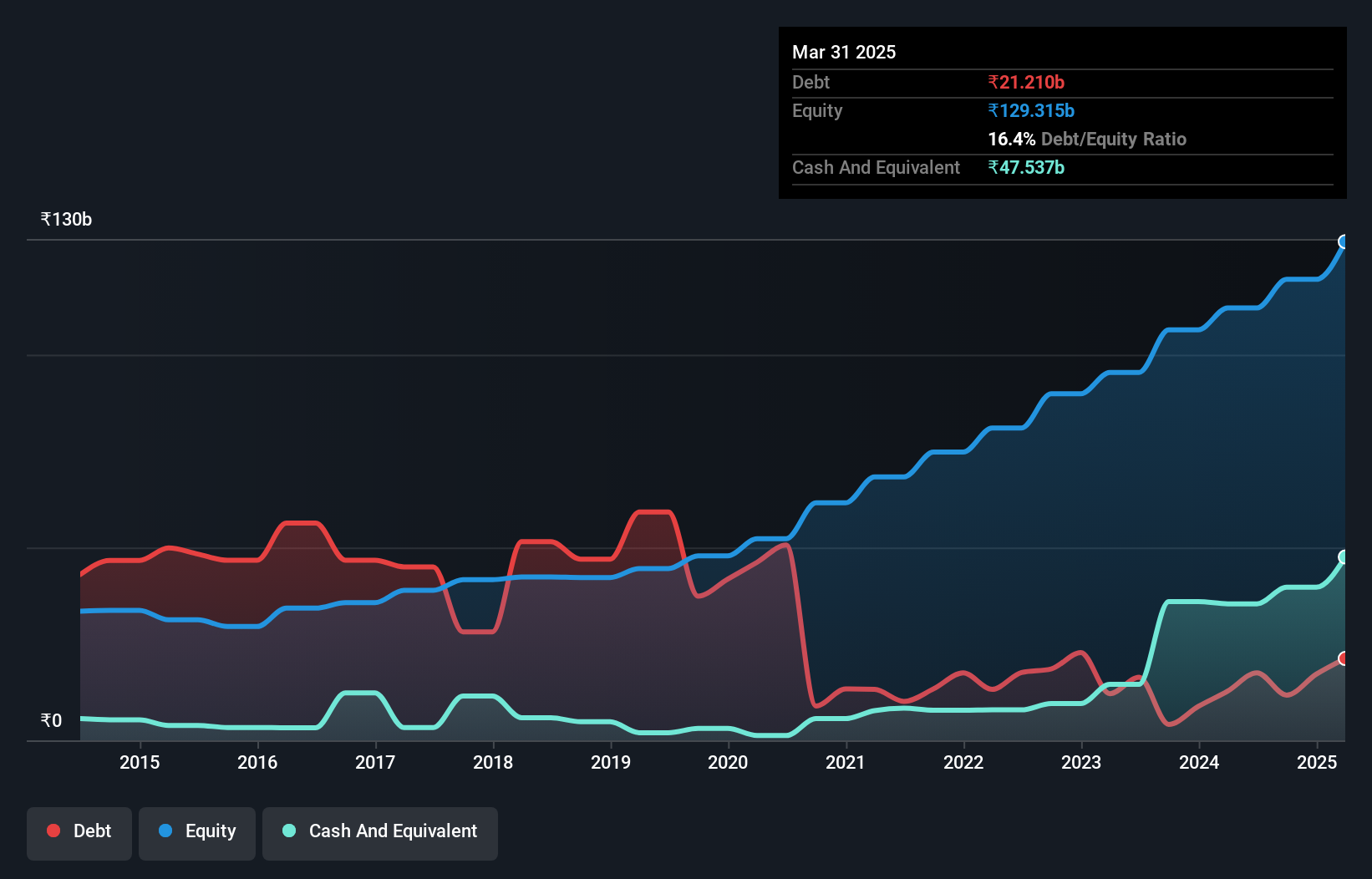

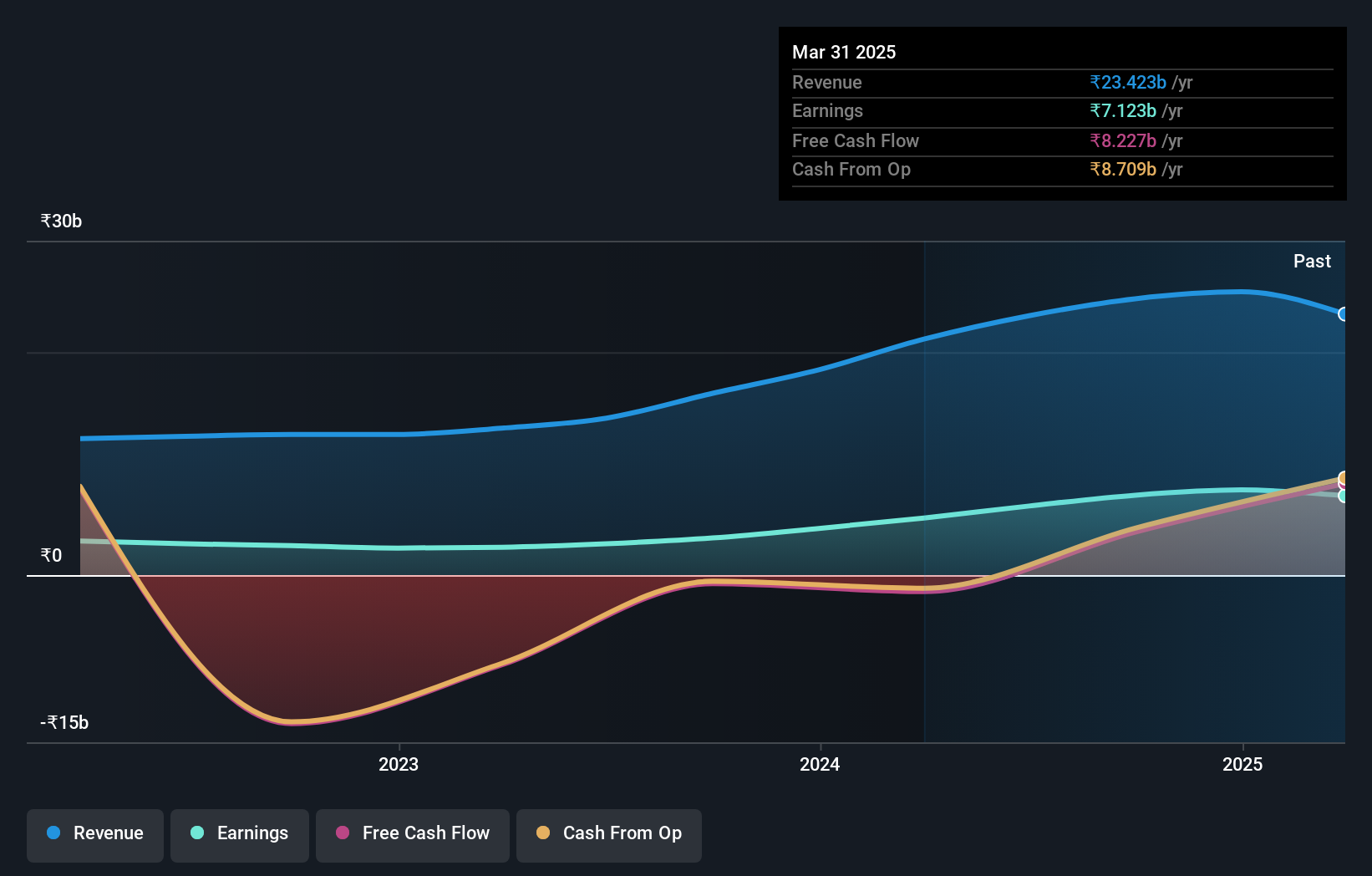

Jaiprakash Power Ventures has shown impressive earnings growth of 22969% over the past year, far outpacing the Renewable Energy industry’s 12%. Despite a significant one-off loss of ₹6.9B impacting recent financial results, its interest payments are well covered by EBIT at 5.2x. The company’s net debt to equity ratio stands at a satisfactory 28.7%, having reduced from 254% over five years, and it trades at 68% below estimated fair value.

Next Steps

- Navigate through the entire inventory of 473 Indian Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives