- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

IIFL Securities Limited (NSE:IIFLSEC) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

IIFL Securities Limited (NSE:IIFLSEC) shares have had a horrible month, losing 29% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 115% in the last twelve months.

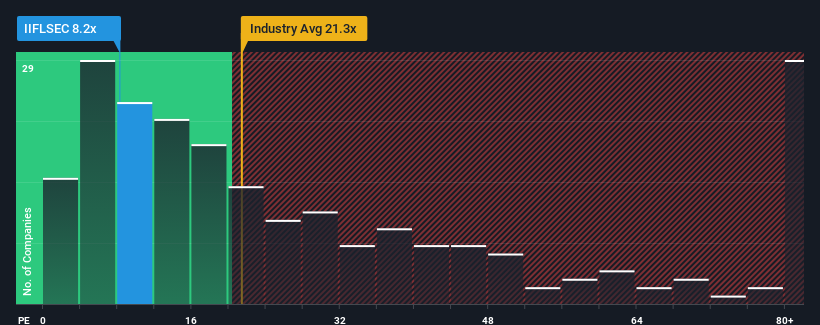

Since its price has dipped substantially, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 29x, you may consider IIFL Securities as a highly attractive investment with its 8.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, IIFL Securities has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for IIFL Securities

How Is IIFL Securities' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as IIFL Securities' is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 71% last year. The latest three year period has also seen an excellent 141% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 24% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that IIFL Securities' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

IIFL Securities' P/E looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that IIFL Securities currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for IIFL Securities that you need to take into consideration.

If you're unsure about the strength of IIFL Securities' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives