- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

Discovering India's Undiscovered Gems This October 2024

Reviewed by Simply Wall St

The Indian market has been flat in the last week, yet it has shown remarkable growth over the past 12 months with a 39% increase and earnings forecasted to grow by 17% annually. In this dynamic environment, identifying stocks that are poised for sustained growth amidst stable market conditions can uncover hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Goldiam International | 0.74% | 10.81% | 15.85% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Avantel | 5.92% | 33.97% | 37.33% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 19.96% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market capitalization of ₹125.04 billion.

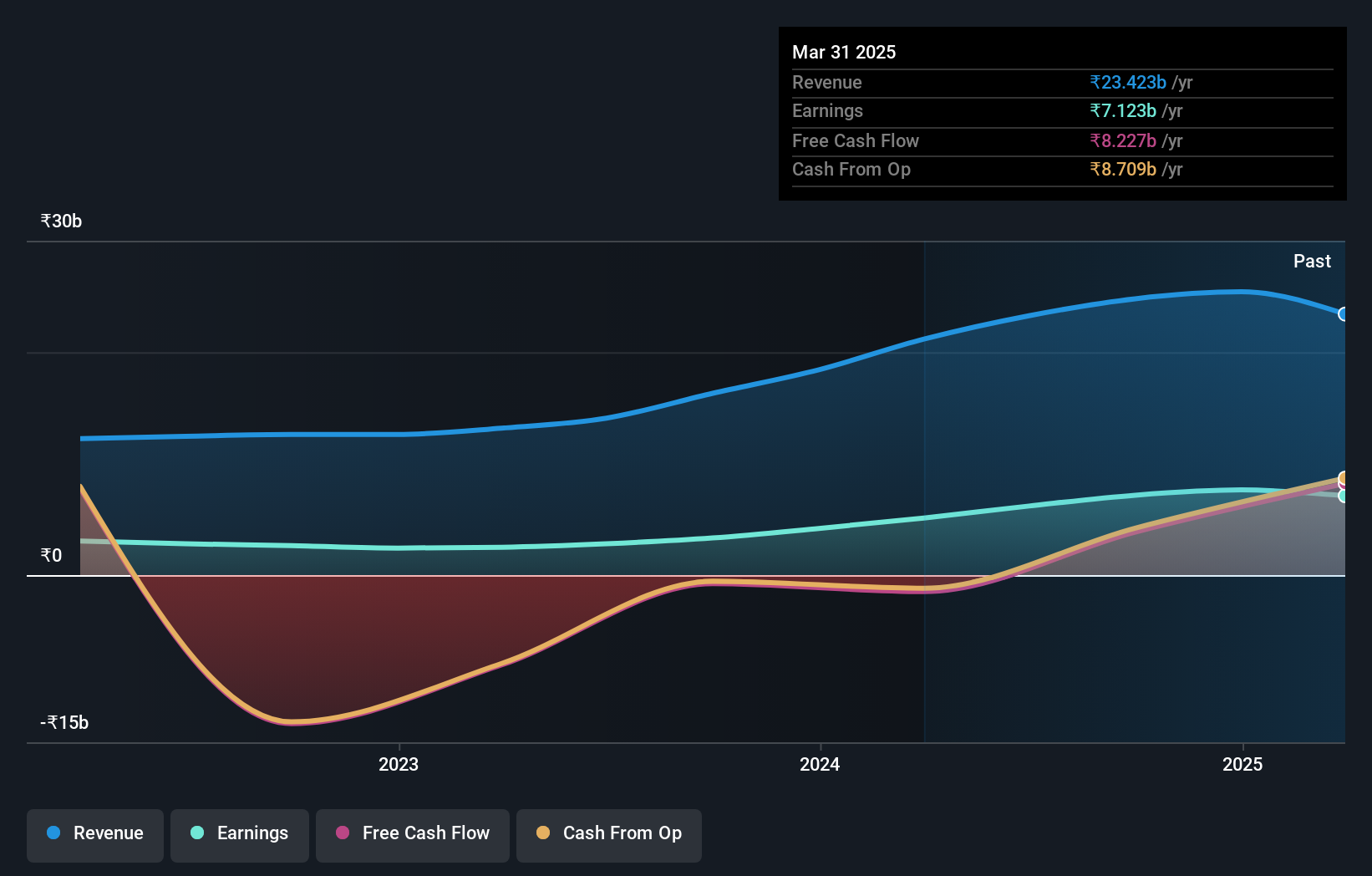

Operations: IIFL Securities Limited generates revenue primarily from capital market activities, amounting to ₹20.25 billion, supplemented by facilities and ancillary services at ₹375.25 million and insurance broking at ₹2.77 billion.

IIFL Securities, a noteworthy player in India's capital markets, has shown impressive earnings growth of 120.4% over the past year, outpacing industry growth of 64.3%. The company’s net debt to equity ratio stands at a satisfactory 35.5%, having reduced significantly from 117.6% five years ago. Despite recent share price volatility and a penalty from SEBI for technical errors, its P/E ratio of 20.2x suggests it offers good value compared to the broader Indian market's average of 33.5x.

- Navigate through the intricacies of IIFL Securities with our comprehensive health report here.

Review our historical performance report to gain insights into IIFL Securities''s past performance.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both in India and internationally, with a market capitalization of ₹156.81 billion.

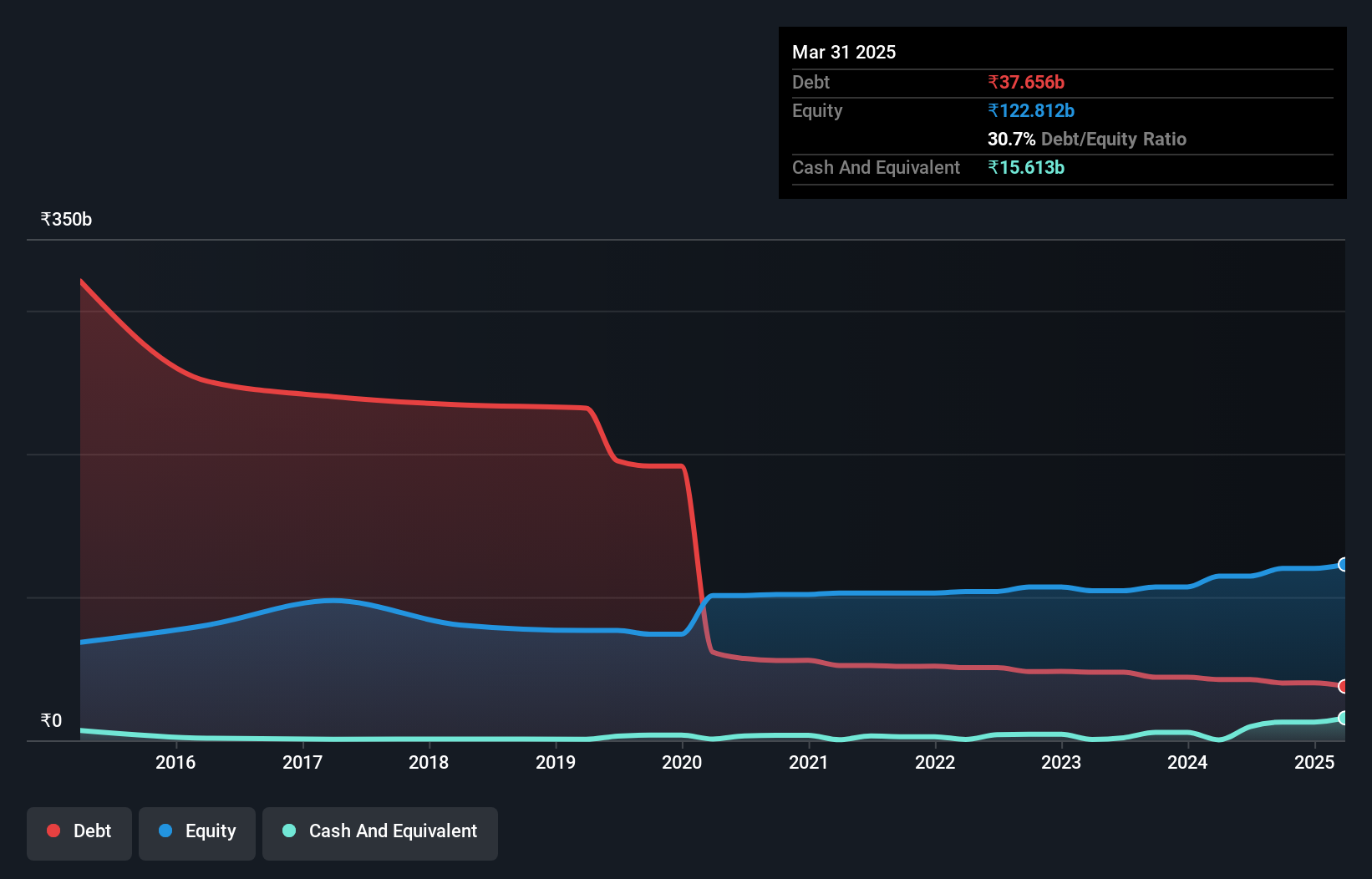

Operations: The company generates revenue primarily from its power segment, amounting to ₹61.68 billion, and coal segment contributing ₹6.59 billion. The net profit margin shows a notable trend at 2.5%.

Jaiprakash Power Ventures, a player in the renewable energy sector, has shown impressive earnings growth of 22,969% over the past year. The company's net debt to equity ratio stands at a satisfactory 28.7%, reflecting improved financial health from a previous high of 254.1%. Despite facing a ₹6.9 billion one-off loss recently, its interest payments are well covered with an EBIT coverage of 5.2x, suggesting solid operational performance amidst challenges.

- Delve into the full analysis health report here for a deeper understanding of Jaiprakash Power Ventures.

Gain insights into Jaiprakash Power Ventures' past trends and performance with our Past report.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited focuses on generating solar power in India, with a market capitalization of ₹84.41 billion.

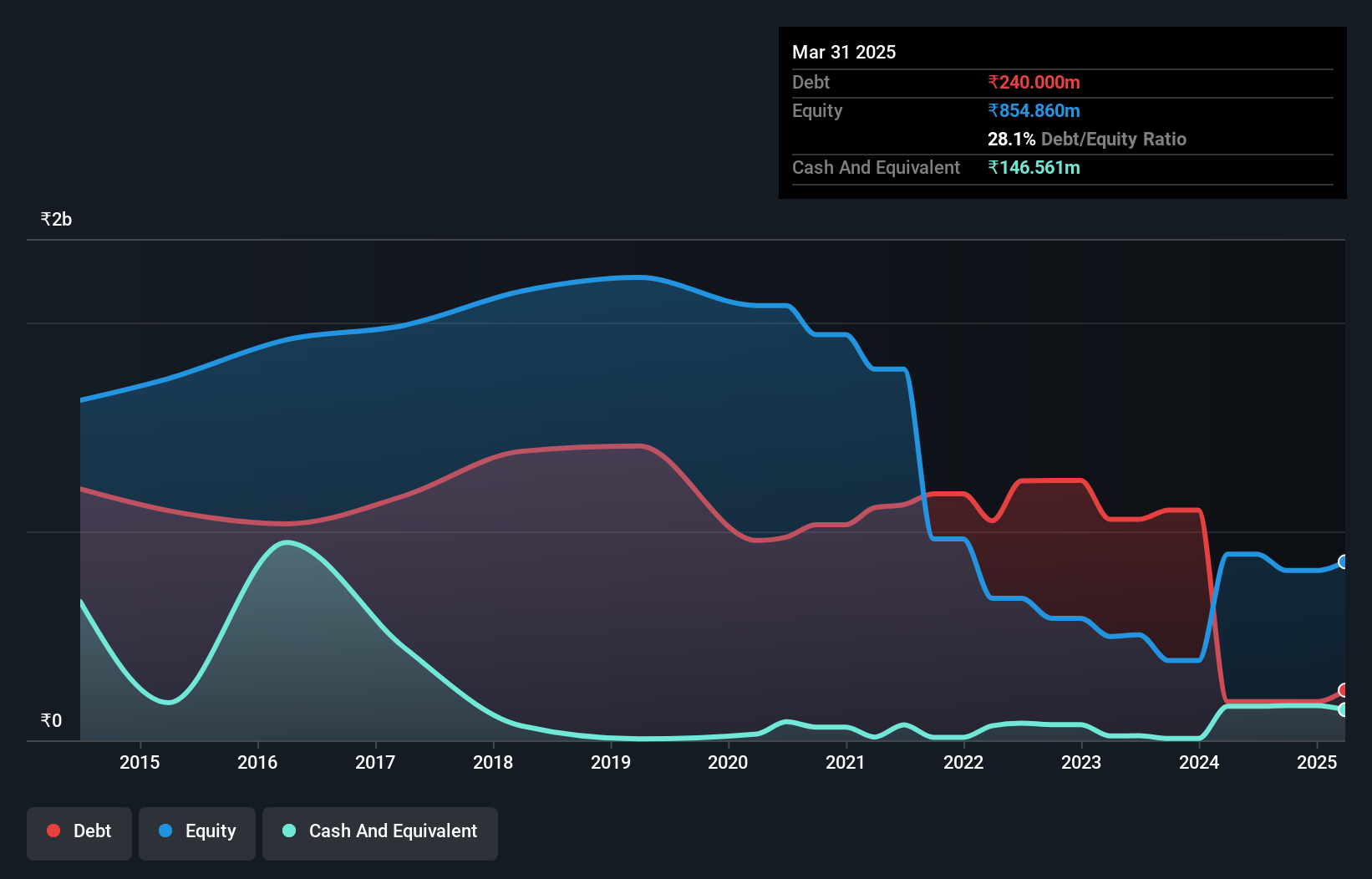

Operations: Ujaas Energy derives its revenue primarily from the operation of solar power plants, contributing ₹307.70 million to its total revenue. The electric vehicle segment also adds ₹41.00 million.

Ujaas Energy, a small player in India's renewable sector, has shown a turnaround by achieving profitability this year with net income of ₹38.15M compared to last year's loss of ₹58.57M. The company reported revenue growth to ₹107.16M from ₹74.83M the previous year, despite sales dropping to ₹62.89M from ₹71.84M. A satisfactory net debt-to-equity ratio of 2.5% reflects improved financial health, although substantial shareholder dilution occurred recently with illiquid shares remaining a concern.

- Unlock comprehensive insights into our analysis of Ujaas Energy stock in this health report.

Gain insights into Ujaas Energy's historical performance by reviewing our past performance report.

Taking Advantage

- Dive into all 468 of the Indian Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.