3 Undiscovered Gems In India With Strong Financial Foundations

Reviewed by Simply Wall St

The market is up 2.6% in the last 7 days, with all sectors gaining ground. Over the past 12 months, the market is up 44%, and earnings are forecast to grow by 17% annually. In this thriving environment, identifying stocks with strong financial foundations can be crucial for long-term success.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.04% | 60.31% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Kalyani Investment | NA | 21.42% | 6.35% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers a range of capital market services in India's primary and secondary markets with a market cap of ₹68.43 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities (₹20.25 billion) and also earns significant income from insurance broking and ancillary services (₹2.77 billion).

IIFL Securities, a notable player in India's financial sector, has shown impressive earnings growth of 120.4% over the past year, outpacing the Capital Markets industry's 64%. The company's price-to-earnings ratio stands at a favorable 12.4x compared to the Indian market's 32.9x. Over five years, its debt to equity ratio improved from 117.6% to 67.2%, reflecting prudent financial management. Recent regulatory issues include a INR300K penalty by SEBI for incorrect client data entries but seem manageable given their overall performance trajectory and high-quality earnings.

- Click here and access our complete health analysis report to understand the dynamics of IIFL Securities.

Explore historical data to track IIFL Securities' performance over time in our Past section.

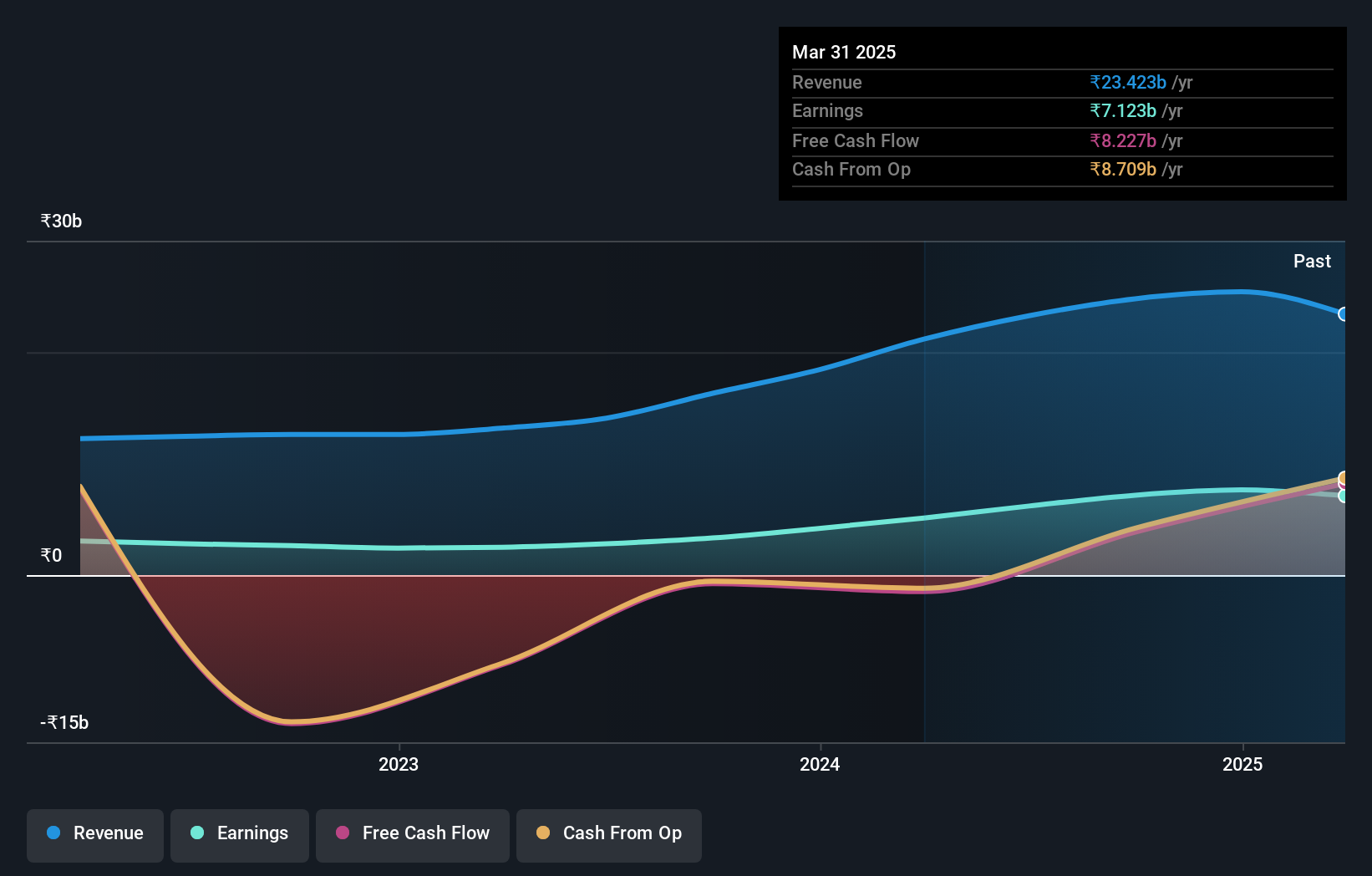

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research and development, manufacturing, marketing, and sale of generic pharmaceutical formulations globally and has a market cap of ₹99.76 billion.

Operations: Marksans Pharma Limited generates revenue primarily from its pharmaceuticals segment, which reported ₹22.68 billion. The company focuses on the research and development, manufacturing, marketing, and sale of generic pharmaceutical formulations globally.

Marksans Pharma, a small-cap pharmaceutical company, has shown robust financial performance with earnings growing 21.7% last year, outpacing the industry average of 19.3%. The company's debt to equity ratio improved from 19.9% to 11.7% over five years, indicating better financial health. Recent news includes a successful USFDA inspection and plans for M&A to expand in Europe. First-quarter sales reached ₹5,906 million compared to ₹5,000 million last year, reflecting solid growth prospects.

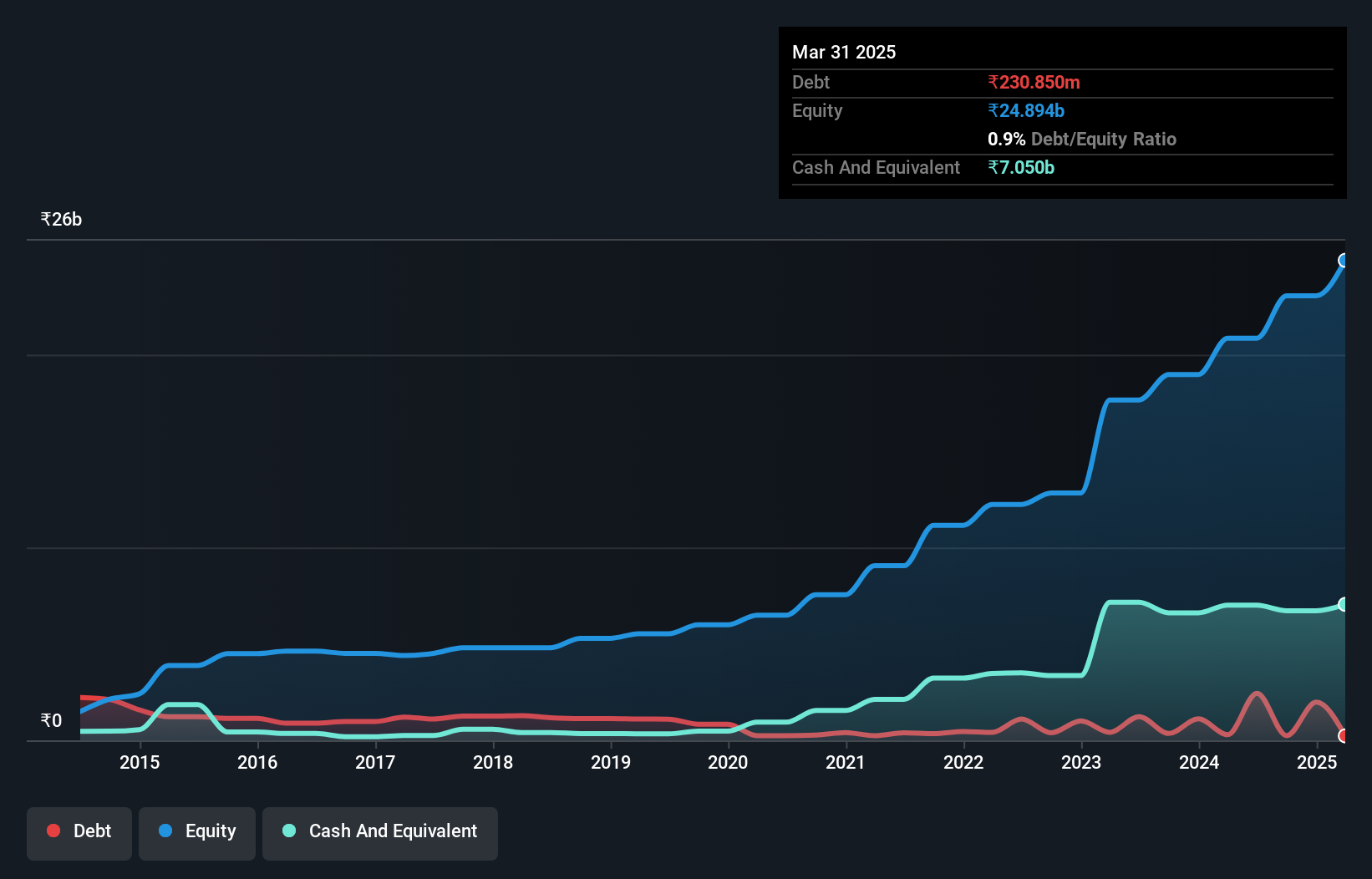

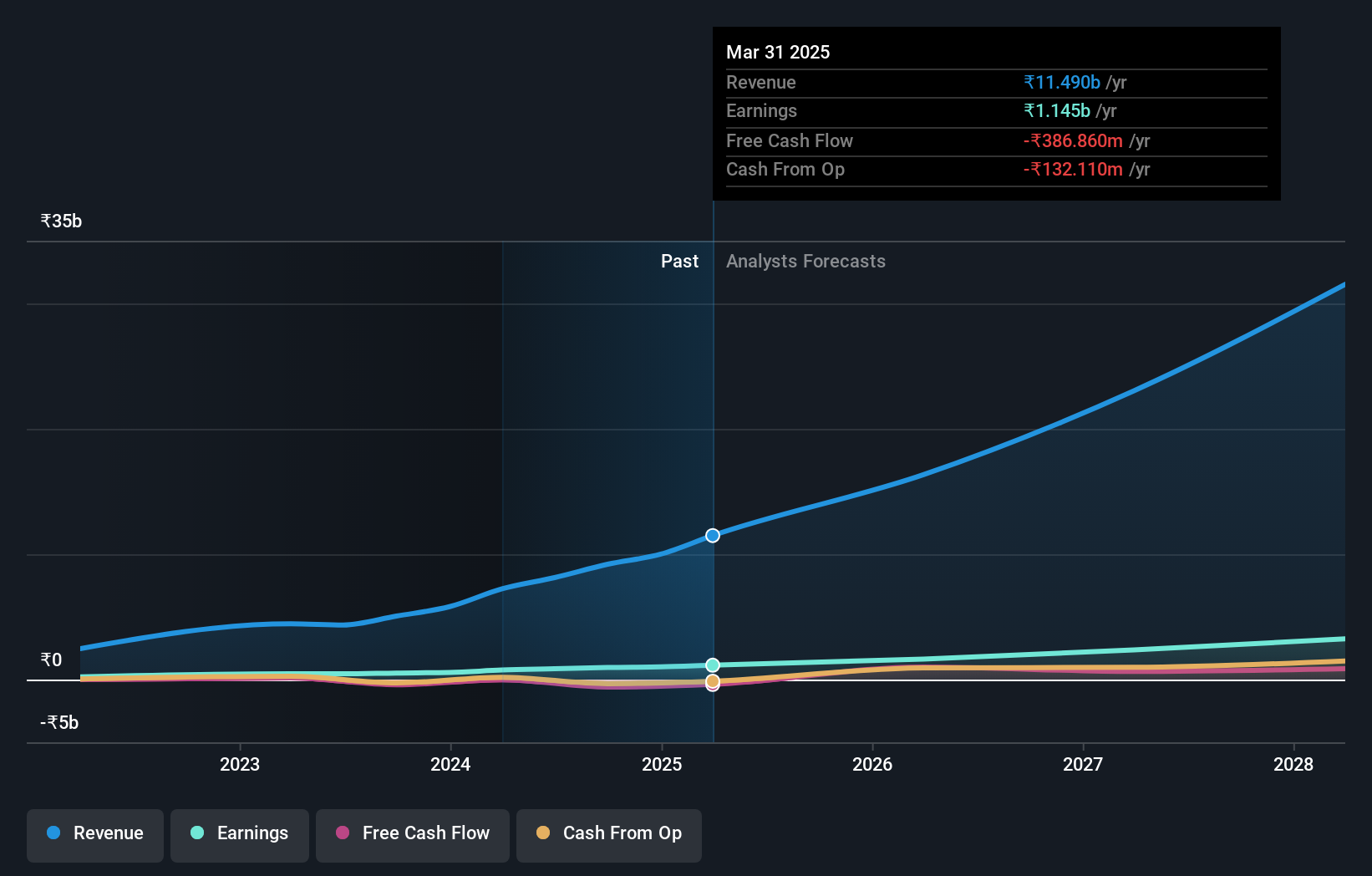

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹143.31 billion.

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion. The company's net profit margin stands at 17.33%.

Netweb Technologies India has been making waves with its impressive financial performance and innovative product launches. Over the past year, earnings surged by 85.8%, significantly outpacing the tech industry's 10.2% growth rate. The company's debt to equity ratio has impressively reduced from 108% to just 2.3% over five years, showcasing strong financial management. Recent Q1 results highlighted a net income of INR154 million compared to INR51 million last year, reflecting robust operational efficiency and profitability improvements.

- Dive into the specifics of Netweb Technologies India here with our thorough health report.

Gain insights into Netweb Technologies India's past trends and performance with our Past report.

Seize The Opportunity

- Click here to access our complete index of 460 Indian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives