- India

- /

- Capital Markets

- /

- NSEI:HDFCAMC

Revenue Beat: HDFC Asset Management Company Limited Beat Analyst Estimates By 22%

HDFC Asset Management Company Limited (NSE:HDFCAMC) investors will be delighted, with the company turning in some strong numbers with its latest results. Statutory earnings beat expectations, with revenues of ₹12b coming in a massive 22% ahead of forecasts, while earnings per share (eps) of ₹34.82 beat expectations by 7.3%. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on HDFC Asset Management after the latest results.

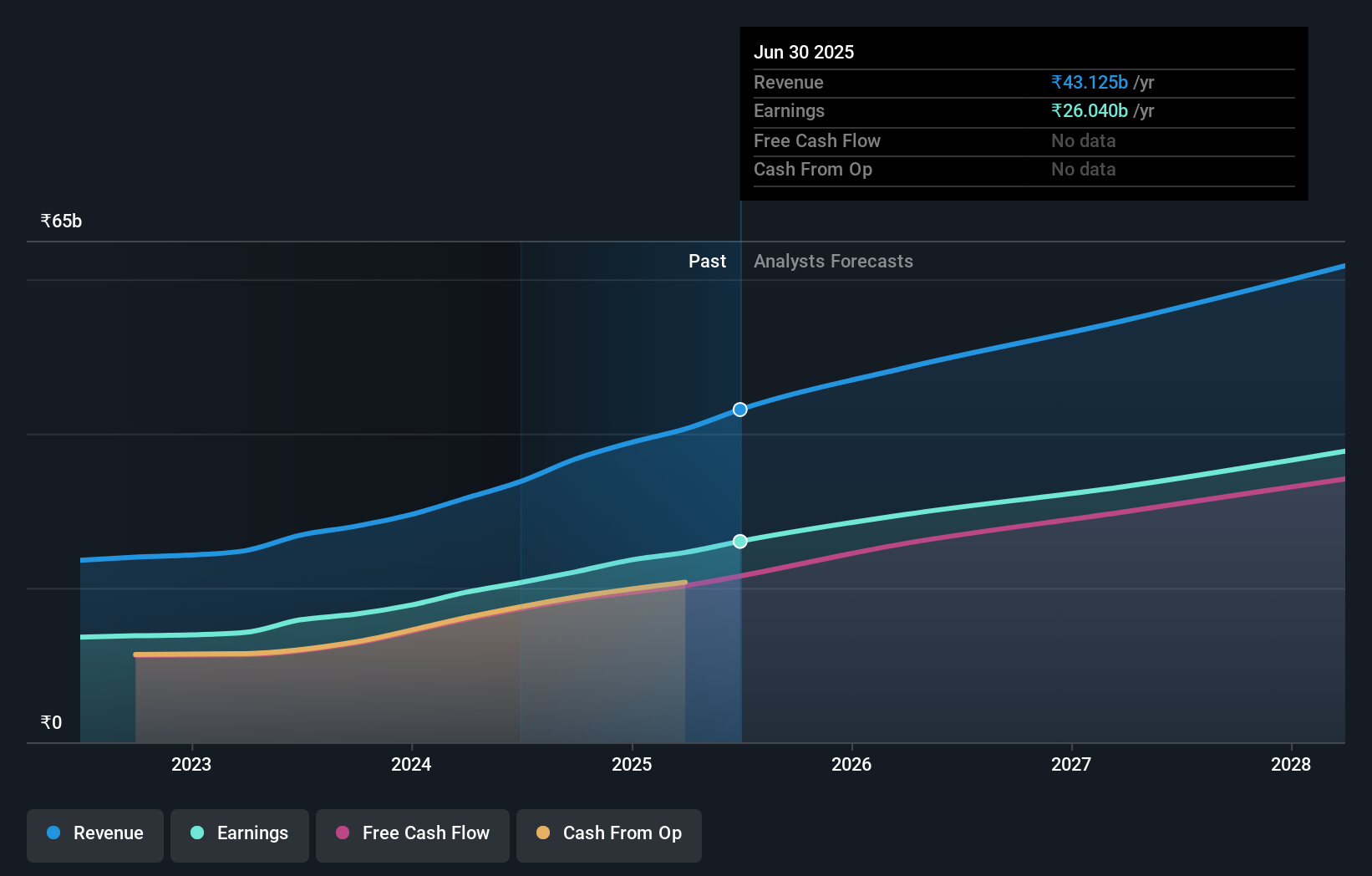

After the latest results, the 19 analysts covering HDFC Asset Management are now predicting revenues of ₹48.5b in 2026. If met, this would reflect a decent 13% improvement in revenue compared to the last 12 months. Per-share earnings are expected to grow 13% to ₹138. In the lead-up to this report, the analysts had been modelling revenues of ₹45.2b and earnings per share (EPS) of ₹129 in 2026. It looks like there's been a modest increase in sentiment following the latest results, withthe analysts becoming a bit more optimistic in their predictions for both revenues and earnings.

See our latest analysis for HDFC Asset Management

With these upgrades, we're not surprised to see that the analysts have lifted their price target 12% to ₹5,538per share. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic HDFC Asset Management analyst has a price target of ₹6,530 per share, while the most pessimistic values it at ₹4,521. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await HDFC Asset Management shareholders.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The period to the end of 2026 brings more of the same, according to the analysts, with revenue forecast to display 17% growth on an annualised basis. That is in line with its 15% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 13% per year. So although HDFC Asset Management is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards HDFC Asset Management following these results. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple HDFC Asset Management analysts - going out to 2028, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for HDFC Asset Management that you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if HDFC Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HDFCAMC

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026