- India

- /

- Consumer Finance

- /

- NSEI:FUSION

3 Indian Stocks Possibly Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

In the last week, the Indian market is up 1.7%, and over the past year, it has climbed 41%, with earnings forecast to grow by 17% annually. In this thriving environment, identifying stocks that are potentially trading below their estimated intrinsic value could offer significant opportunities for investors.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹200.73 | ₹306.54 | 34.5% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹815.85 | ₹1509.79 | 46% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2331.80 | ₹4408.26 | 47.1% |

| Apollo Pipes (BSE:531761) | ₹624.05 | ₹1143.97 | 45.4% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1348.05 | ₹2174.27 | 38% |

| Patel Engineering (BSE:531120) | ₹59.80 | ₹94.10 | 36.4% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹288.65 | ₹445.15 | 35.2% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹61.44 | ₹93.60 | 34.4% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹295.90 | ₹585.71 | 49.5% |

| Tarsons Products (NSEI:TARSONS) | ₹442.10 | ₹708.25 | 37.6% |

Let's uncover some gems from our specialized screener.

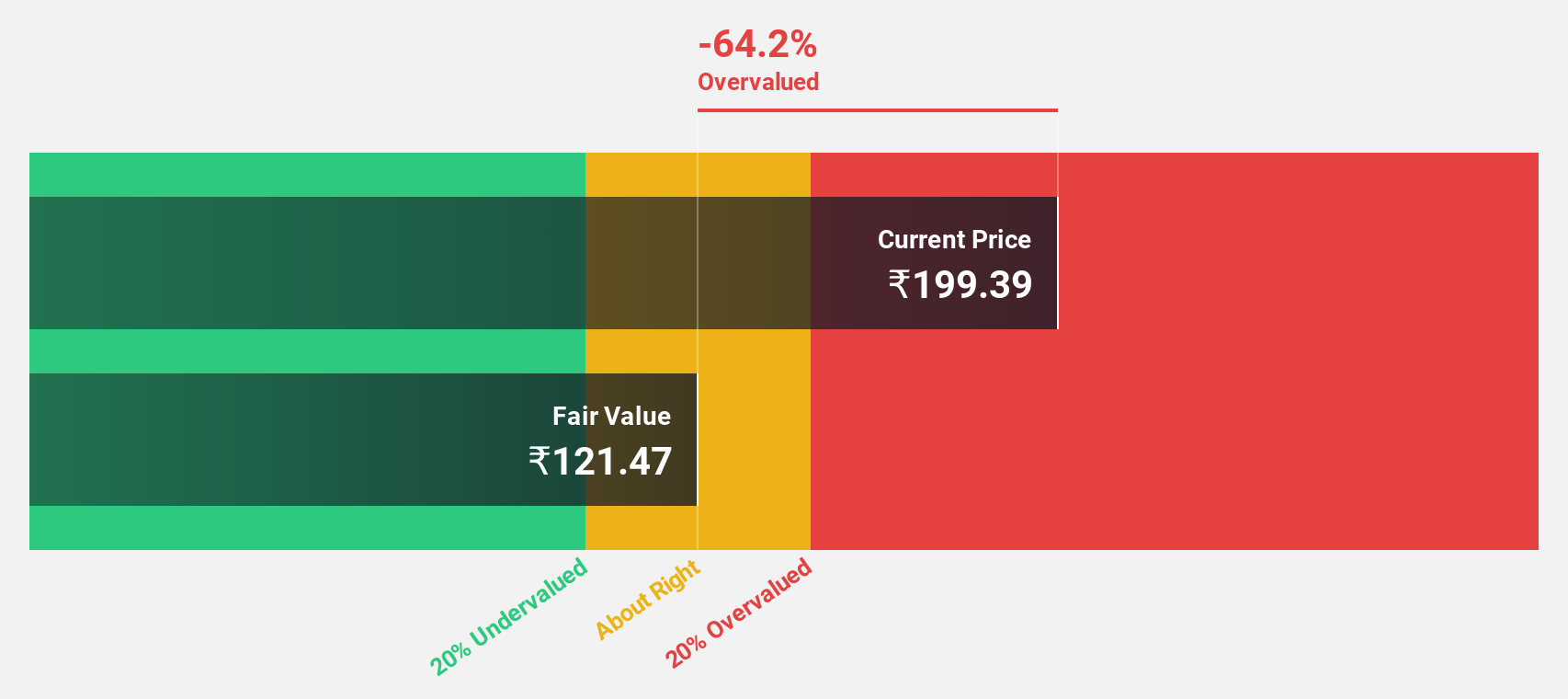

Artemis Medicare Services (NSEI:ARTEMISMED)

Overview: Artemis Medicare Services Limited manages and operates multi-specialty hospitals in India and internationally, with a market cap of ₹39.72 billion.

Operations: Artemis Medicare Services generates revenue primarily through its healthcare services segment, amounting to ₹8.92 billion.

Estimated Discount To Fair Value: 35.2%

Artemis Medicare Services is trading at ₹288.65, significantly below its estimated fair value of ₹445.15, indicating potential undervaluation based on cash flows. Despite a high level of debt and forecasted low return on equity (16.5%), the company’s earnings are expected to grow substantially at 45.4% annually over the next three years, outpacing the Indian market's growth rate of 17.1%. Recent board changes include appointing experienced legal professionals as independent directors, potentially strengthening governance.

- According our earnings growth report, there's an indication that Artemis Medicare Services might be ready to expand.

- Get an in-depth perspective on Artemis Medicare Services' balance sheet by reading our health report here.

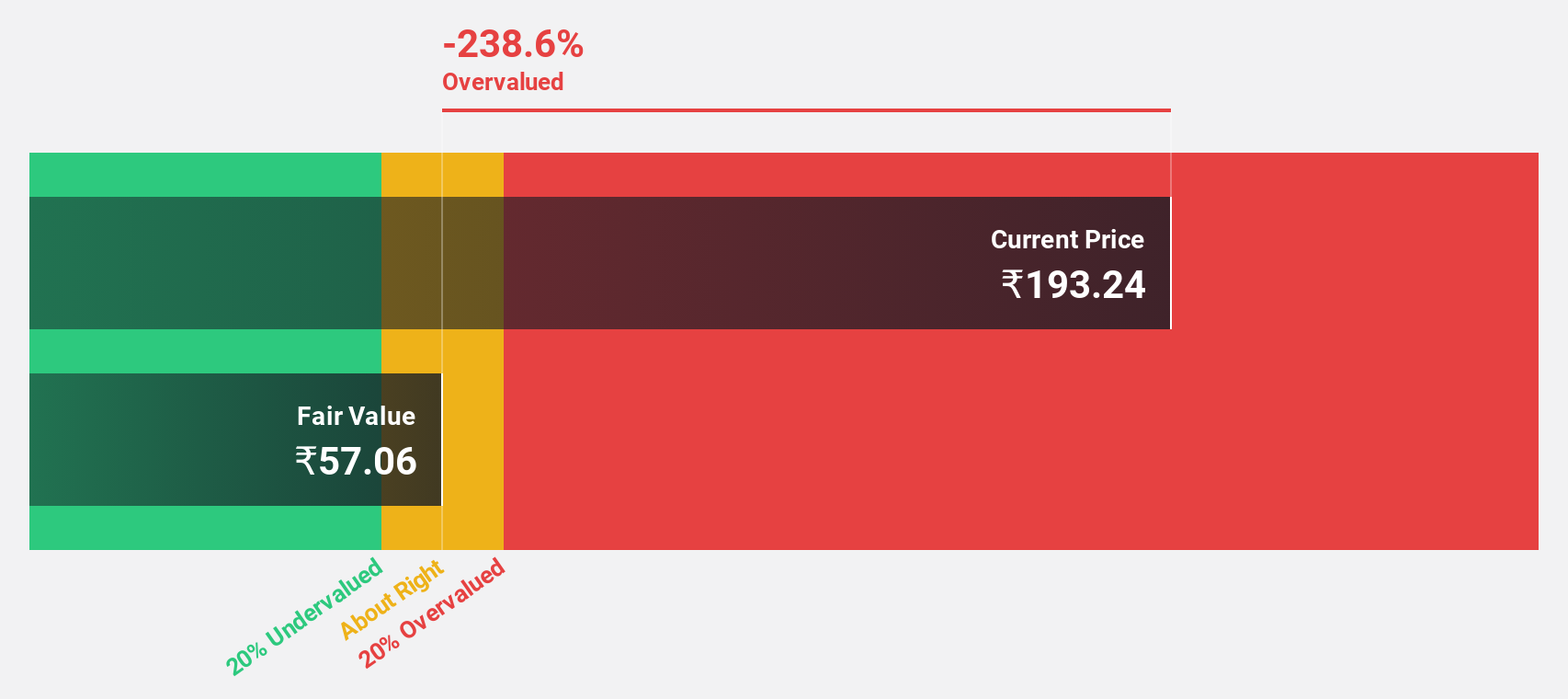

Fusion Finance (NSEI:FUSION)

Overview: Fusion Finance Limited, with a market cap of ₹31.08 billion, is a non-banking financial company that offers microfinance lending services to women entrepreneurs in rural and semi-urban areas in India.

Operations: Fusion Finance's revenue from micro financing activities is ₹10.98 billion.

Estimated Discount To Fair Value: 19.6%

Fusion Finance, trading at ₹308.8, is undervalued based on its estimated fair value of ₹383.88. The company's earnings and revenue are expected to grow significantly at 24.7% and 29.4% annually, respectively, outpacing the Indian market's growth rates. However, Fusion faces challenges with regulatory actions and a recent net loss of ₹356.2 million for Q1 2024 compared to a net income of ₹1.20 billion a year ago, impacting its financial stability despite strong growth forecasts.

- In light of our recent growth report, it seems possible that Fusion Finance's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Fusion Finance's balance sheet health report.

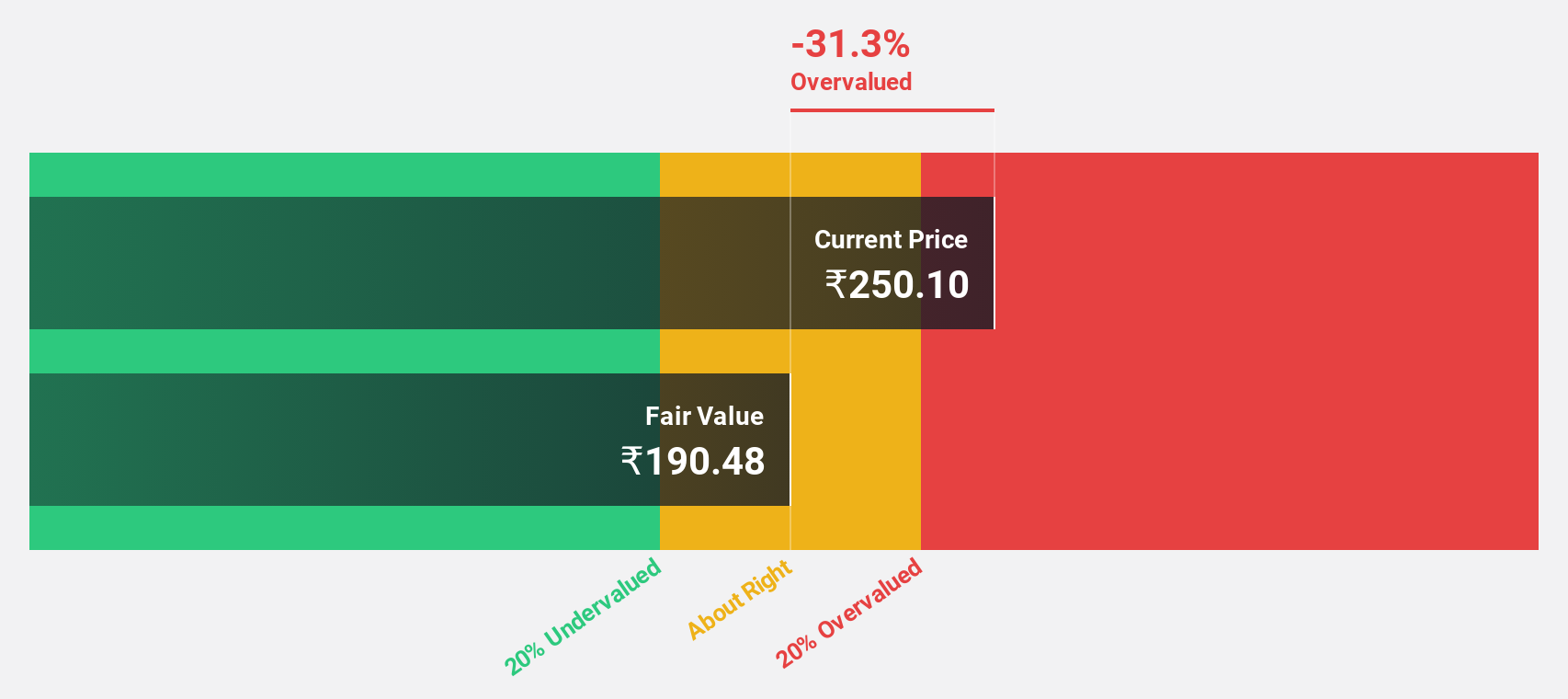

Rajesh Exports (NSEI:RAJESHEXPO)

Overview: Rajesh Exports Limited, a gold refiner with a market cap of ₹87.37 billion, manufactures, wholesales, and retails gold and diamond jewelry as well as various gold products in India.

Operations: The company's revenue from gold products amounts to ₹2.56 billion.

Estimated Discount To Fair Value: 49.5%

Rajesh Exports, trading at ₹295.9, is significantly undervalued with an estimated fair value of ₹585.71. Despite a sharp decline in Q1 net income to ₹118.58 million from ₹3.09 billion last year, the company is expected to see annual earnings growth of 40.1%, outpacing the Indian market's 17.1%. However, profit margins have decreased and Return on Equity is forecasted to be low at 8.4% in three years.

- Our expertly prepared growth report on Rajesh Exports implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Rajesh Exports here with our thorough financial health report.

Make It Happen

- Navigate through the entire inventory of 28 Undervalued Indian Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:FUSION

Fusion Finance

A non-banking financial company, provides micro finance lending services to women entrepreneurs in rural and semi-urban areas in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives