- India

- /

- Capital Markets

- /

- NSEI:DHUNINV

Benign Growth For Dhunseri Investments Limited (NSE:DHUNINV) Underpins Its Share Price

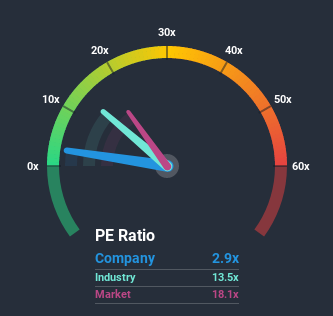

With a price-to-earnings (or "P/E") ratio of 2.9x Dhunseri Investments Limited (NSE:DHUNINV) may be sending very bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 19x and even P/E's higher than 41x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Dhunseri Investments' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Dhunseri Investments

Is There Any Growth For Dhunseri Investments?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Dhunseri Investments' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. This means it has also seen a slide in earnings over the longer-term as EPS is down 43% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 27% shows it's an unpleasant look.

With this information, we are not surprised that Dhunseri Investments is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Dhunseri Investments' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Dhunseri Investments revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Dhunseri Investments (of which 1 is a bit concerning!) you should know about.

You might be able to find a better investment than Dhunseri Investments. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you decide to trade Dhunseri Investments, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:DHUNINV

Dhunseri Investments

A non-banking finance company, invests in shares and securities in India, Singapore, and internationally.

Proven track record with adequate balance sheet.