- India

- /

- Capital Markets

- /

- NSEI:CARERATING

Undiscovered Gems to Explore in November 2024

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and small-cap stocks outperforming their larger counterparts, investors are keenly observing the economic indicators that suggest a robust labor market and stabilizing mortgage rates. This environment presents an opportune moment to explore lesser-known stocks that may benefit from these broad-based gains, especially those with strong fundamentals and growth potential in sectors poised to thrive amidst current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

CARE Ratings (NSEI:CARERATING)

Simply Wall St Value Rating: ★★★★★★

Overview: CARE Ratings Limited is a credit rating agency that offers a range of rating and related services both in India and internationally, with a market capitalization of ₹41.44 billion.

Operations: CARE Ratings derives its revenue primarily from ratings and related services, amounting to ₹3.27 billion.

CARE Ratings, a financial services company in India, is debt-free and has shown consistent earnings growth of 1.9% annually over the past five years. The company's recent earnings report for the second quarter of 2024 revealed a net income increase to INR 460.9 million from INR 351.74 million the previous year, with basic earnings per share rising to INR 15.41 from INR 11.83. Despite its high-quality earnings and positive free cash flow, CARE's share price has been highly volatile recently, reflecting market uncertainties or investor sentiment shifts in this dynamic sector.

- Delve into the full analysis health report here for a deeper understanding of CARE Ratings.

Examine CARE Ratings' past performance report to understand how it has performed in the past.

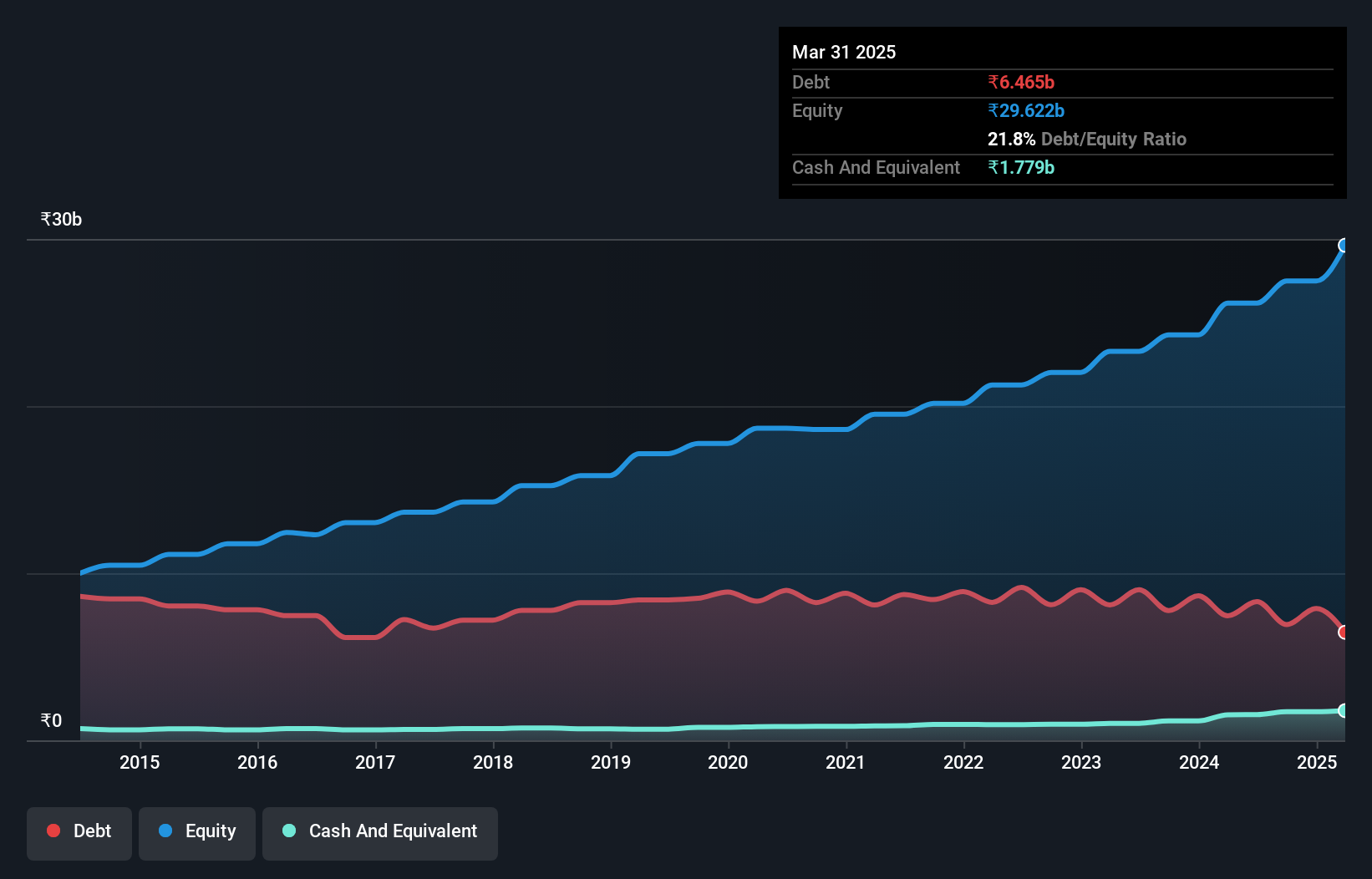

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited is involved in the manufacture and sale of polymer and composite products both in India and internationally, with a market capitalization of ₹88.74 billion.

Operations: Time Technoplast generates revenue primarily from its Polymer Products segment, contributing ₹34.43 billion, and the Composite Products segment, adding ₹18.77 billion.

Time Technoplast, a notable player in the packaging sector, has shown impressive financial performance. Its earnings growth of 43.9% over the past year outpaced the industry's 4.2%, signaling robust expansion. The company's net income for Q2 2024 was INR 983.6 million, up from INR 704 million a year earlier, with basic earnings per share rising to INR 4.33 from INR 3.11. Moreover, Time Technoplast has effectively reduced its debt to equity ratio from 47.9% to a satisfactory level of 25.2% over five years and trades at an attractive valuation below its estimated fair value by about 3%.

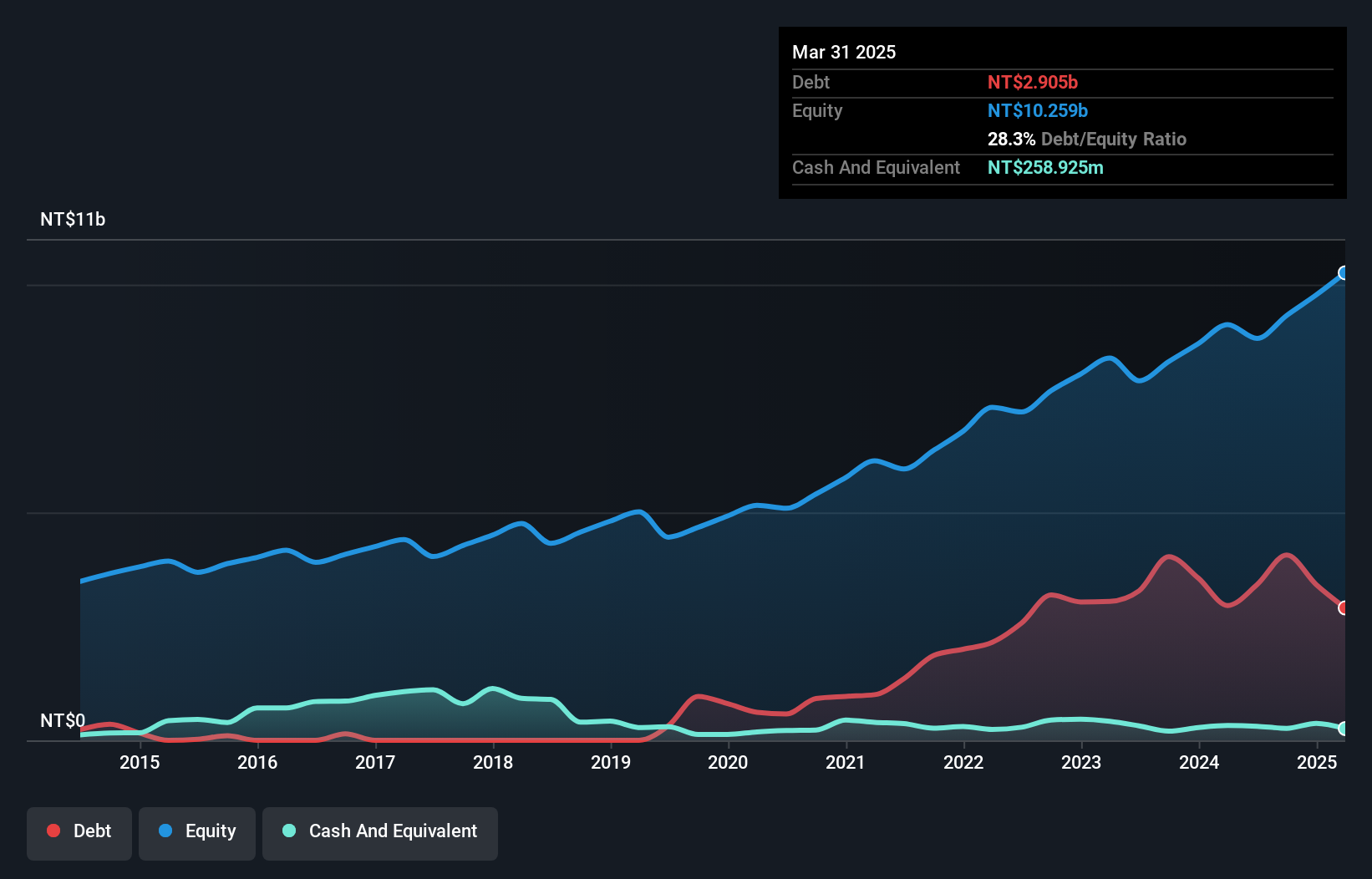

Shiny Chemical Industrial (TWSE:1773)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shiny Chemical Industrial Co., Ltd. is involved in the manufacturing, processing, and trading of chemical solvents in Taiwan with a market capitalization of NT$41.38 billion.

Operations: Shiny Chemical Industrial generates revenue primarily from its Yongan Factory and Zhangbin Plant, with the Yongan Factory contributing NT$9.90 billion and the Zhangbin Plant NT$1.54 billion. Adjustments and eliminations reduce total revenue by NT$722.96 million.

Shiny Chemical Industrial, a standout in the chemical sector, has seen its earnings grow 11.9% annually over the past five years. The company's recent third-quarter results show sales of TWD 2.88 billion, up from TWD 2.52 billion last year, with net income rising to TWD 477.91 million from TWD 387.54 million previously. Despite its robust earnings growth and positive free cash flow, Shiny faces a high debt-to-equity ratio at 43.6%, indicating increased leverage over time; however, interest payments are well-covered by EBIT at a substantial multiple of 45x, reflecting solid operational performance amidst industry challenges.

Key Takeaways

- Discover the full array of 4632 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CARERATING

CARE Ratings

A credit rating agency, provides various rating and related services in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026