- India

- /

- Capital Markets

- /

- NSEI:ALMONDZ

Almondz Global Securities Limited (NSE:ALMONDZ) Stock Rockets 28% But Many Are Still Ignoring The Company

Despite an already strong run, Almondz Global Securities Limited (NSE:ALMONDZ) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 63%.

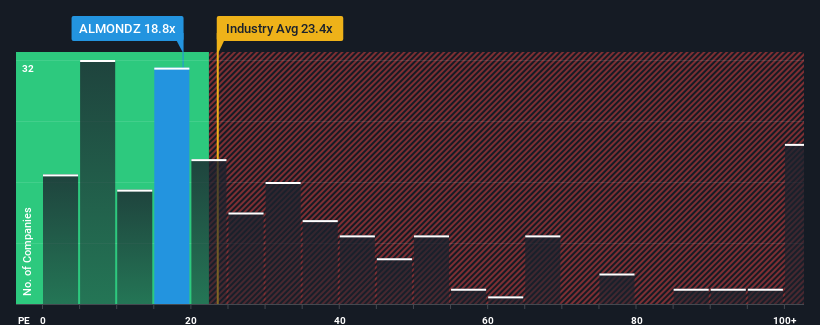

Even after such a large jump in price, Almondz Global Securities may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.8x, since almost half of all companies in India have P/E ratios greater than 31x and even P/E's higher than 56x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Almondz Global Securities has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Almondz Global Securities

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Almondz Global Securities would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 26% gain to the company's bottom line. The latest three year period has also seen an excellent 91% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Almondz Global Securities' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Almondz Global Securities' P/E?

Almondz Global Securities' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Almondz Global Securities currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Almondz Global Securities (1 is potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Almondz Global Securities' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ALMONDZ

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives