- India

- /

- Diversified Financial

- /

- NSEI:ABCAPITAL

Aditya Birla Capital's (NSE:ABCAPITAL) earnings growth rate lags the 11% CAGR delivered to shareholders

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. For example, the Aditya Birla Capital Limited (NSE:ABCAPITAL) share price return of 37% over three years lags the market return in the same period. Looking at more recent returns, the stock is up 19% in a year.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Aditya Birla Capital

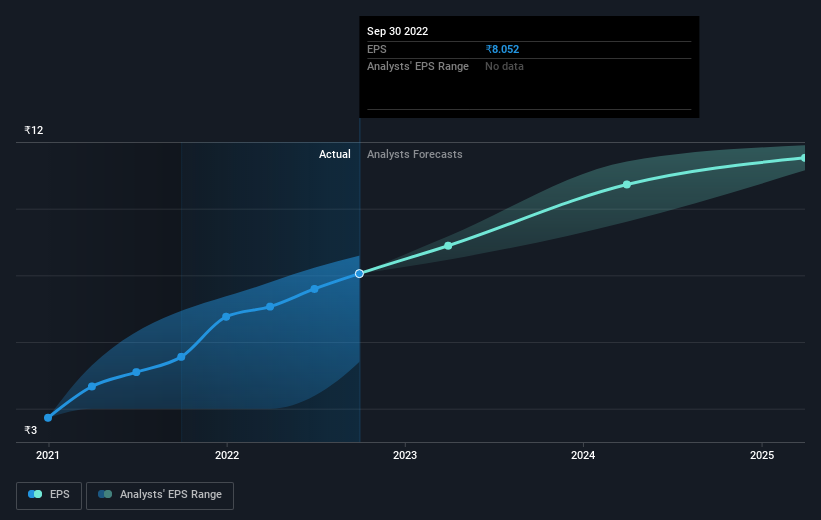

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Aditya Birla Capital was able to grow its EPS at 21% per year over three years, sending the share price higher. This EPS growth is higher than the 11% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Aditya Birla Capital's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Aditya Birla Capital has rewarded shareholders with a total shareholder return of 19% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 3% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Aditya Birla Capital better, we need to consider many other factors. For instance, we've identified 2 warning signs for Aditya Birla Capital that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ABCAPITAL

Aditya Birla Capital

Through its subsidiaries, provides various financial products and services in India and internationally.

Solid track record and fair value.

Market Insights

Community Narratives