The harsh reality for Zee Learn Limited (NSE:ZEELEARN) shareholders is that its auditors, Ford Rhodes Parks & Co, expressed doubts about its ability to continue as a going concern, in its reported results to June 2022. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares. Worse still, the auditor has given a qualified opinion, which is a red flag for many investors, and lenders.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

View our latest analysis for Zee Learn

What Is Zee Learn's Debt?

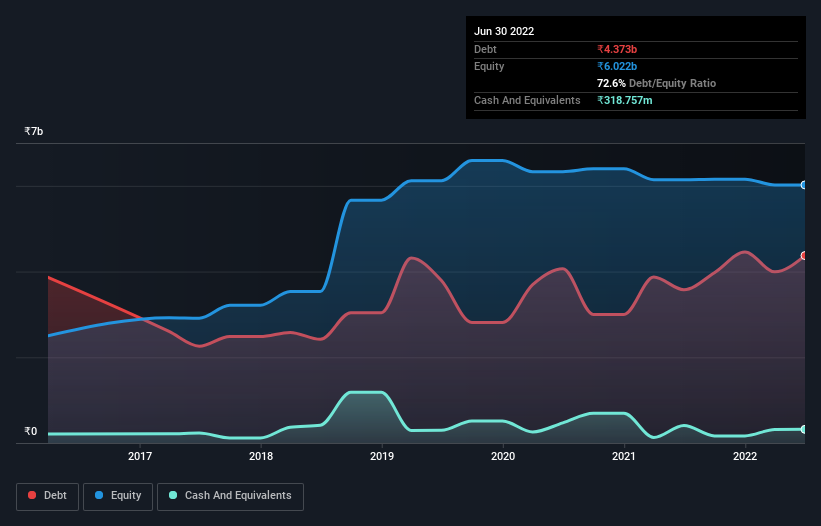

As you can see below, at the end of March 2022, Zee Learn had ₹4.37b of debt, up from ₹3.58b a year ago. Click the image for more detail. However, because it has a cash reserve of ₹318.8m, its net debt is less, at about ₹4.05b.

How Strong Is Zee Learn's Balance Sheet?

The latest balance sheet data shows that Zee Learn had liabilities of ₹4.10b due within a year, and liabilities of ₹4.35b falling due after that. Offsetting this, it had ₹318.8m in cash and ₹1.49b in receivables that were due within 12 months. So its liabilities total ₹6.65b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₹2.73b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Zee Learn would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 0.31 times and a disturbingly high net debt to EBITDA ratio of 7.7 hit our confidence in Zee Learn like a one-two punch to the gut. The debt burden here is substantial. However, the silver lining was that Zee Learn achieved a positive EBIT of ₹134m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But it is Zee Learn's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Zee Learn actually produced more free cash flow than EBIT over the last year. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On the face of it, Zee Learn's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. We're quite clear that we consider Zee Learn to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. While some investors may specialize in these sort of situations, it's simply too risky and complicated for us to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Zee Learn is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Zee Learn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZEELEARN

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026