- India

- /

- Consumer Services

- /

- NSEI:ZEELEARN

A Rising Share Price Has Us Looking Closely At Zee Learn Limited's (NSE:ZEELEARN) P/E Ratio

Zee Learn (NSE:ZEELEARN) shareholders are no doubt pleased to see that the share price has had a great month, posting a 33% gain, recovering from prior weakness. But shareholders may not all be feeling jubilant, since the share price is still down 31% in the last year.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

See our latest analysis for Zee Learn

How Does Zee Learn's P/E Ratio Compare To Its Peers?

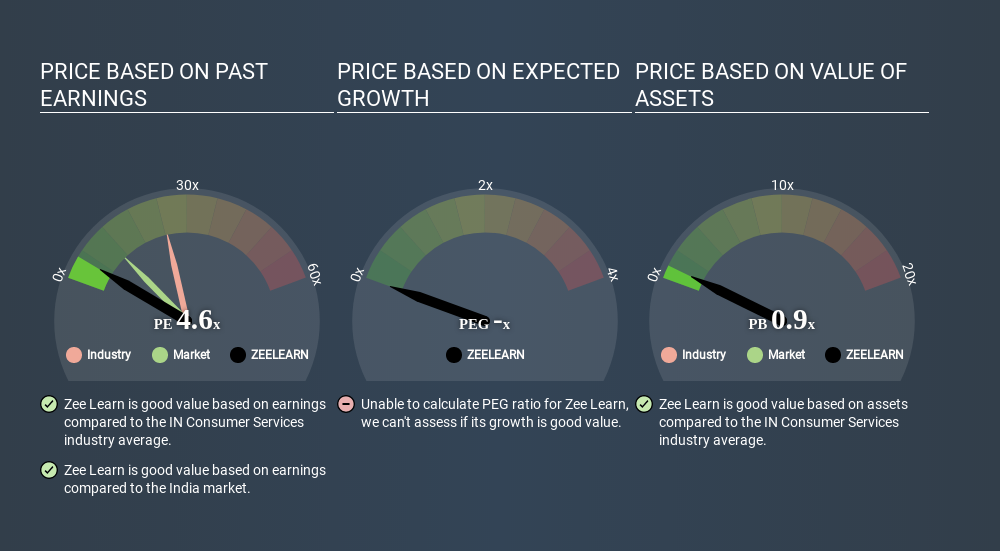

We can tell from its P/E ratio of 5.73 that sentiment around Zee Learn isn't particularly high. If you look at the image below, you can see Zee Learn has a lower P/E than the average (24.1) in the consumer services industry classification.

This suggests that market participants think Zee Learn will underperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. And in that case, the P/E ratio itself will drop rather quickly. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

It's nice to see that Zee Learn grew EPS by a stonking 40% in the last year. And its annual EPS growth rate over 5 years is 55%. So we'd generally expect it to have a relatively high P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. So it won't reflect the advantage of cash, or disadvantage of debt. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Zee Learn's Balance Sheet

Zee Learn's net debt equates to 44% of its market capitalization. While it's worth keeping this in mind, it isn't a worry.

The Bottom Line On Zee Learn's P/E Ratio

Zee Learn trades on a P/E ratio of 5.7, which is below the IN market average of 11.2. The company hasn't stretched its balance sheet, and earnings growth was good last year. If the company can continue to grow earnings, then the current P/E may be unjustifiably low. What we know for sure is that investors are becoming less uncomfortable about Zee Learn's prospects, since they have pushed its P/E ratio from 4.3 to 5.7 over the last month. If you like to buy stocks that could be turnaround opportunities, then this one might be a candidate; but if you're more sensitive to price, then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

But note: Zee Learn may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:ZEELEARN

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026