- India

- /

- Hospitality

- /

- NSEI:WESTLIFE

Recent 6.6% pullback isn't enough to hurt long-term Westlife Foodworld (NSE:WESTLIFE) shareholders, they're still up 64% over 5 years

It hasn't been the best quarter for Westlife Foodworld Limited (NSE:WESTLIFE) shareholders, since the share price has fallen 21% in that time. On the bright side the share price is up over the last half decade. In that time, it is up 63%, which isn't bad, but is below the market return of 173%. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 31% drop, in the last year.

Although Westlife Foodworld has shed ₹6.6b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

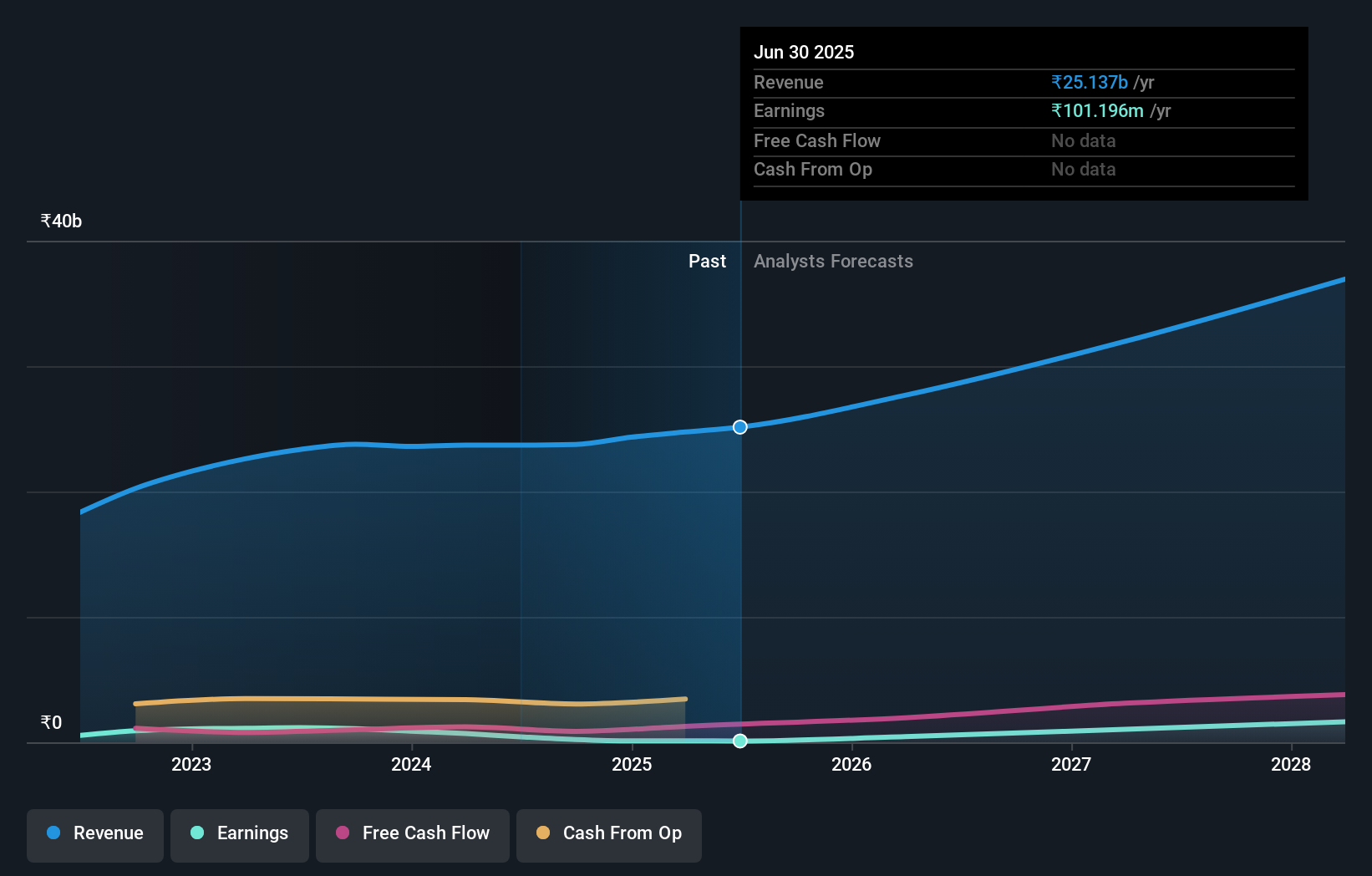

Given that Westlife Foodworld only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Westlife Foodworld can boast revenue growth at a rate of 18% per year. That's well above most pre-profit companies. It's nice to see shareholders have made a profit, but the gain of 10% over the period isn't that impressive compared to the overall market. You could argue the market is still pretty skeptical, given the growing revenues. It could be that the stock was previously over-priced - but if you're looking for underappreciated growth stocks, these numbers indicate that there might be an opportunity here.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Westlife Foodworld

A Different Perspective

We regret to report that Westlife Foodworld shareholders are down 31% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 1.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Westlife Foodworld better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Westlife Foodworld (including 1 which is potentially serious) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Westlife Foodworld might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WESTLIFE

Westlife Foodworld

Through its subsidiary, Hardcastle Restaurants Private Limited, owns and operates a chain of McDonald's restaurants in Western and Southern India.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives