- India

- /

- Hospitality

- /

- NSEI:THOMASCOOK

Slammed 26% Thomas Cook (India) Limited (NSE:THOMASCOOK) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Thomas Cook (India) Limited (NSE:THOMASCOOK) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

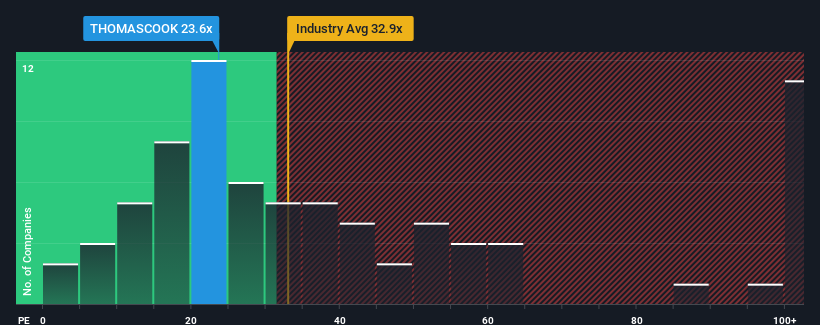

Although its price has dipped substantially, it's still not a stretch to say that Thomas Cook (India)'s price-to-earnings (or "P/E") ratio of 23.6x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 25x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Thomas Cook (India) has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Thomas Cook (India)

How Is Thomas Cook (India)'s Growth Trending?

In order to justify its P/E ratio, Thomas Cook (India) would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 29% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 25%, which is noticeably less attractive.

With this information, we find it interesting that Thomas Cook (India) is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Thomas Cook (India)'s plummeting stock price has brought its P/E right back to the rest of the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Thomas Cook (India) currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about this 1 warning sign we've spotted with Thomas Cook (India).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Thomas Cook (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:THOMASCOOK

Thomas Cook (India)

Offers integrated travel services in India and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives