- India

- /

- Hospitality

- /

- NSEI:PARKHOTELS

Exploring Undiscovered Stocks with Potential in July 2024

Reviewed by Simply Wall St

The Indian stock market has experienced a notable fluctuation recently, with a 1.3% drop over the last week, yet it shows a robust annual growth of 43%. In this dynamic environment, identifying stocks with potential involves looking for companies that are poised to leverage such earnings growth forecasts and capitalize on broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Voith Paper Fabrics India | NA | 10.79% | 9.57% | ★★★★★★ |

| Yuken India | 27.52% | 9.91% | -52.98% | ★★★★★★ |

| Bengal & Assam | 4.48% | 3.82% | 47.41% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Master Trust | 37.05% | 26.63% | 41.10% | ★★★★☆☆ |

| Apollo Micro Systems | 38.17% | 7.94% | 2.46% | ★★★★☆☆ |

| SG Mart | 16.73% | 99.32% | 94.08% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Anand Rathi Wealth (NSEI:ANANDRATHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anand Rathi Wealth Limited operates in India, offering a range of financial and insurance services, with a market capitalization of ₹158.17 billion.

Operations: The company generates its revenue primarily through the sale and distribution of financial products, achieving a revenue of ₹8.19 billion as of the latest reporting period. It has demonstrated a consistent increase in gross profit margin over recent years, reaching 57.01% by mid-2024, reflecting efficient cost management relative to its sales growth.

Anand Rathi Wealth, a notable player in the financial sector, has demonstrated robust performance with earnings growth of 31% annually over the past five years. Recently, it reported a significant revenue increase to INR 2.45 billion in Q1 2024, up from INR 1.78 billion year-over-year. The company's strategic share repurchases further reflect its strong financial health and commitment to shareholder value, having recently completed a buyback of 370,000 shares for INR 1.65 billion.

CARE Ratings (NSEI:CARERATING)

Simply Wall St Value Rating: ★★★★★★

Overview: CARE Ratings Limited operates as a credit rating agency, offering a range of rating and related services both in India and globally, with a market capitalization of ₹29.93 billion.

Operations: The company primarily generates its revenue from ratings and related services, contributing ₹2983.77 million, with a minor segment labeled 'Others' adding ₹339.01 million. It operates with a gross profit margin recently reported at 50.38%, reflecting the cost efficiency of its service-based model despite fluctuations in operating and non-operating expenses over different periods.

CARE Ratings, a standout in the Indian market, offers robust financial health with a debt-free status and a price-to-earnings ratio of 29.8, below the market average of 33.4. The company's earnings have grown by 20.3% over the past year, although trailing the industry's rapid expansion at 54.6%. Looking ahead, earnings are expected to increase by approximately 15.68% annually. Recent developments include appointing Mr. Manoj Chugh as Non-Executive Independent Director and approving an INR 11 per share dividend at their latest AGM.

- Dive into the specifics of CARE Ratings here with our thorough health report.

Gain insights into CARE Ratings' past trends and performance with our Past report.

Apeejay Surrendra Park Hotels (NSEI:PARKHOTELS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Apeejay Surrendra Park Hotels Limited is an Indian hospitality company that owns and operates a chain of upscale hotels, with a market capitalization of ₹39.64 billion.

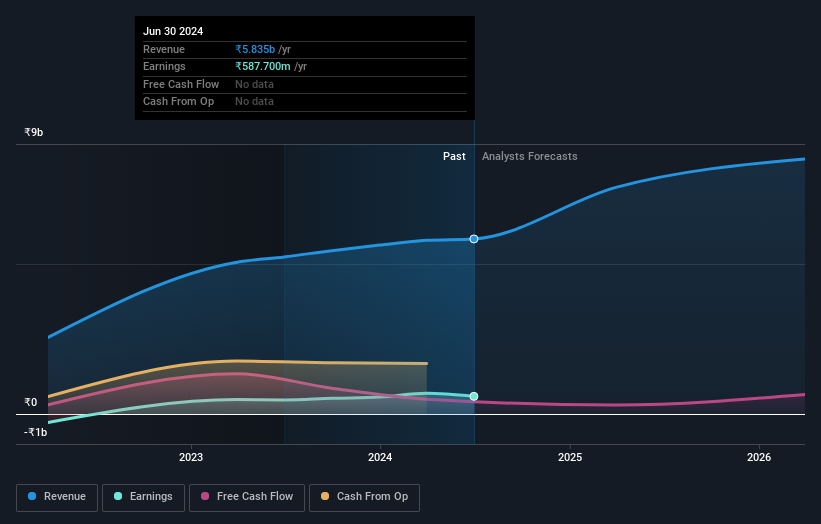

Operations: The company primarily operates in the hospitality sector, generating ₹5780.4 million from this segment. It has demonstrated a significant increase in gross profit margin over recent years, reaching 66.98% by mid-2024, reflecting an efficient control over costs relative to its revenue growth.

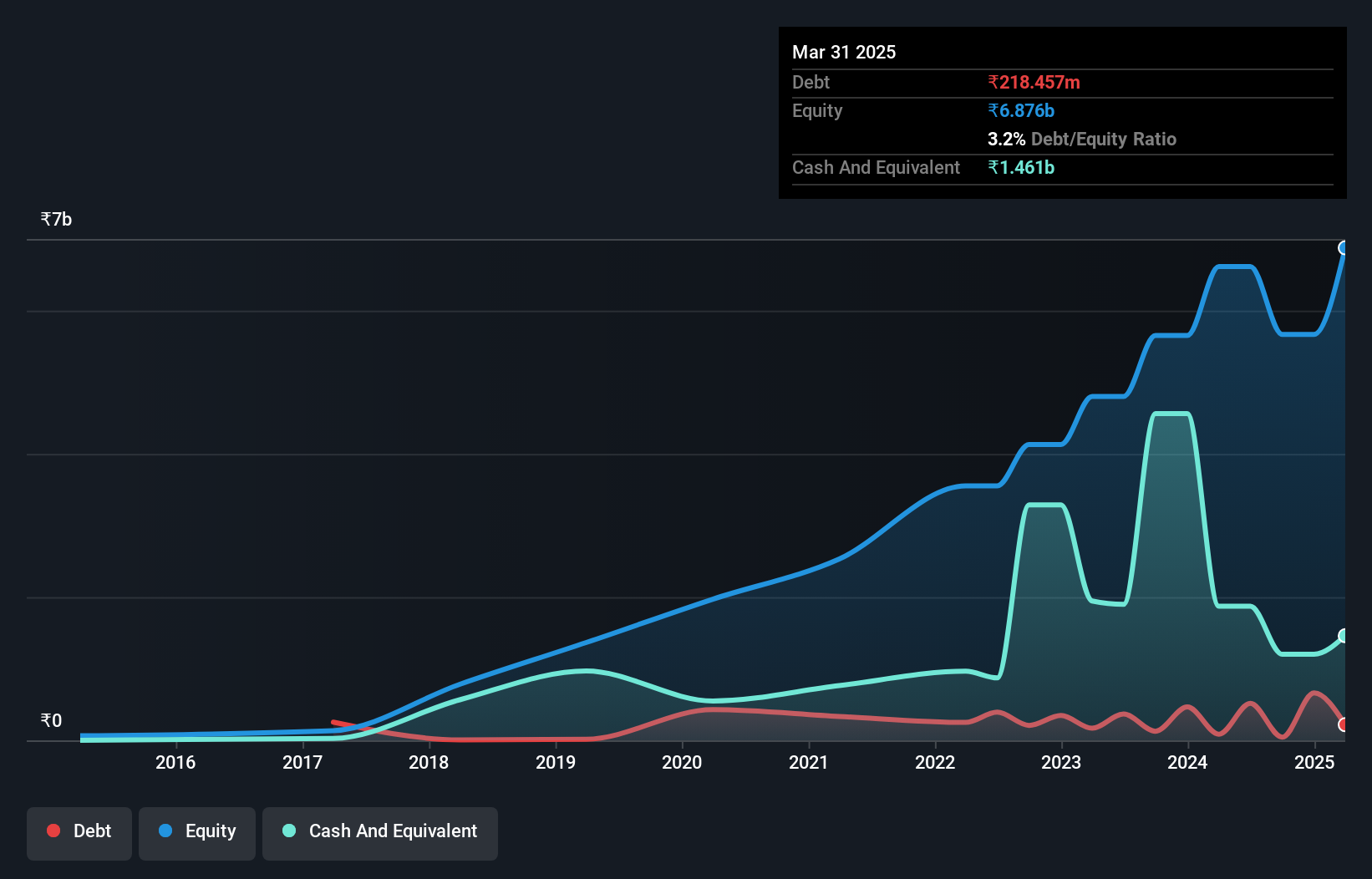

Apeejay Surrendra Park Hotels, a lesser-known yet promising player in India's hospitality sector, has announced robust growth with earnings up by 43% this past year, outpacing the industry's 12.8%. With an impressive reduction in its debt-to-equity ratio from 82.7% to just 2.7% over five years and a forecasted revenue increase of 18.64% per annum, the company is on a solid footing. Recent expansions include launching a new hotel near Jim Corbett National Park, enhancing its luxury offerings and geographical footprint.

Taking Advantage

- Investigate our full lineup of 448 Indian Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PARKHOTELS

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives