Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Kaya Limited (NSE:KAYA) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Kaya

What Is Kaya's Debt?

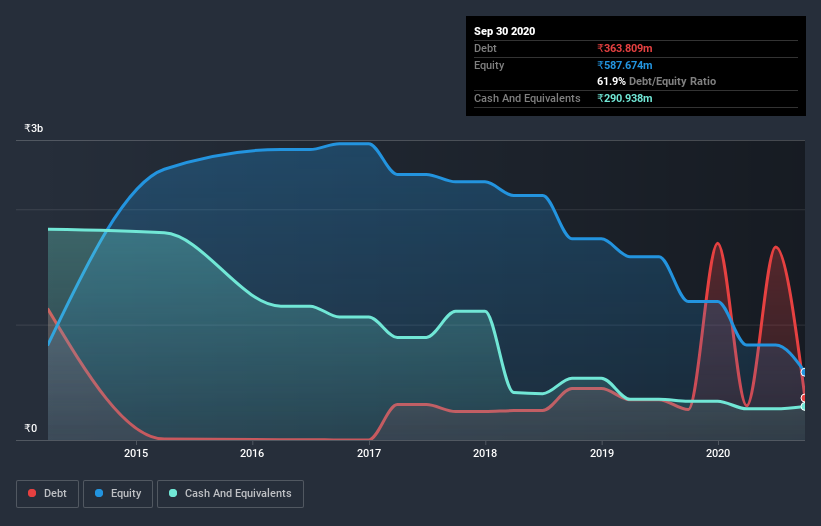

As you can see below, at the end of September 2020, Kaya had ₹363.8m of debt, up from ₹263.4m a year ago. Click the image for more detail. However, it does have ₹290.9m in cash offsetting this, leading to net debt of about ₹72.9m.

A Look At Kaya's Liabilities

We can see from the most recent balance sheet that Kaya had liabilities of ₹1.94b falling due within a year, and liabilities of ₹1.34b due beyond that. Offsetting this, it had ₹290.9m in cash and ₹125.8m in receivables that were due within 12 months. So its liabilities total ₹2.87b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of ₹4.27b, so it does suggest shareholders should keep an eye on Kaya's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. There's no doubt that we learn most about debt from the balance sheet. But it is Kaya's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Kaya had a loss before interest and tax, and actually shrunk its revenue by 30%, to ₹2.9b. That makes us nervous, to say the least.

Caveat Emptor

While Kaya's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost ₹425m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of ₹711m into a profit. So we do think this stock is quite risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Kaya is showing 3 warning signs in our investment analysis , and 1 of those is significant...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Kaya, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KAYA

Kaya

Owns and operates skin and hair care clinics in India and the Middle East.

Low and slightly overvalued.

Market Insights

Community Narratives