- India

- /

- Consumer Services

- /

- NSEI:COMPUSOFT

Compucom Software (NSE:COMPUSOFT) Has Re-Affirmed Its Dividend Of ₹0.30

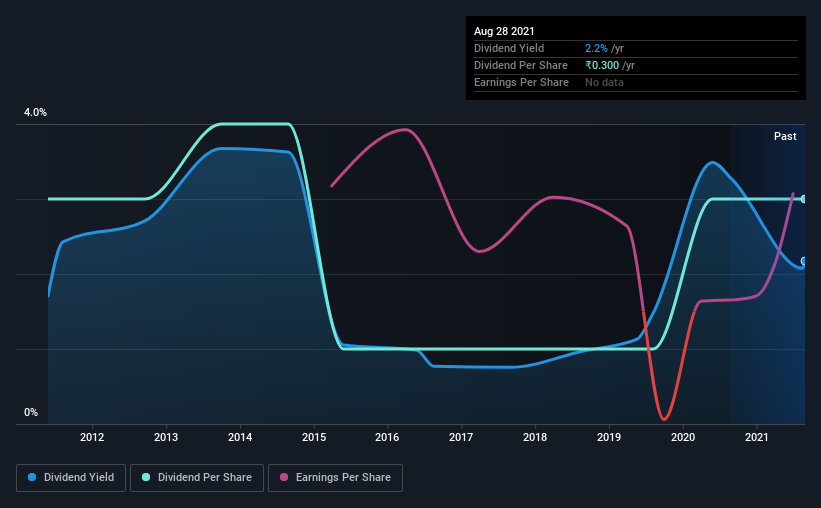

The board of Compucom Software Limited (NSE:COMPUSOFT) has announced that it will pay a dividend of ₹0.30 per share on the 15th of October. Based on this payment, the dividend yield on the company's stock will be 2.2%, which is an attractive boost to shareholder returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Compucom Software's stock price has increased by 34% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Compucom Software

Compucom Software's Earnings Easily Cover the Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Compucom Software was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

EPS is set to fall by 8.3% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 64%, which is definitely feasible to continue.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The payments haven't really changed that much since 10 years ago. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth Is Doubtful

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. In the last five years, Compucom Software's earnings per share has shrunk at approximately 8.3% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 5 warning signs for Compucom Software you should be aware of, and 1 of them shouldn't be ignored. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade Compucom Software, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:COMPUSOFT

Compucom Software

Together with its subsidiary, CSL Infomedia Private Limited, operates as a software and education company in India and the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Elanco Animal Health (ELAN) Unleashing the Pipeline: Can New Launches Lead the Pack?

BridgeBio Pharma (BBIO) From Biotech Blueprint to Commercial Powerhouse

Applied Digital Corp. (APLD) The AI Factory Architect: Infrastructure at the Speed of Light

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion