- India

- /

- Hospitality

- /

- NSEI:CHALET

Chalet Hotels' (NSE:CHALET) Stock Price Has Reduced 30% In The Past Year

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Chalet Hotels Limited (NSE:CHALET) shareholders over the last year, as the share price declined 30%. That contrasts poorly with the market return of 69%. Because Chalet Hotels hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 16% in the last three months.

View our latest analysis for Chalet Hotels

Chalet Hotels isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Chalet Hotels' revenue didn't grow at all in the last year. In fact, it fell 57%. That looks like a train-wreck result to investors far and wide. Meanwhile, the share price dropped by 30%. We would want to see improvements in the core business, and diminishing losses, before getting too excited about this one.

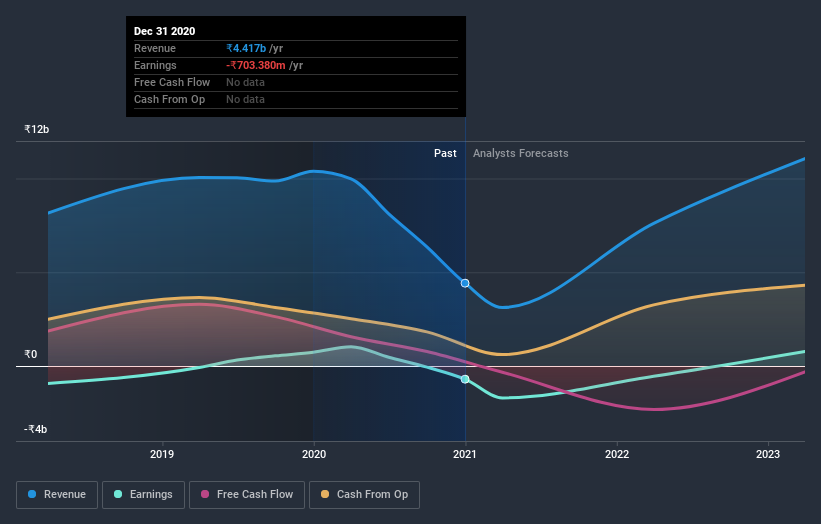

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Chalet Hotels' financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 69% in the last year, Chalet Hotels shareholders might be miffed that they lost 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 16% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You could get a better understanding of Chalet Hotels' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Chalet Hotels, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CHALET

Chalet Hotels

Owns, develops, manages, and operates hotels and resorts in India.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives