- India

- /

- Hospitality

- /

- NSEI:BYKE

If EPS Growth Is Important To You, Byke Hospitality (NSE:BYKE) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Byke Hospitality (NSE:BYKE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Byke Hospitality with the means to add long-term value to shareholders.

See our latest analysis for Byke Hospitality

How Fast Is Byke Hospitality Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Byke Hospitality to have grown EPS from ₹0.23 to ₹1.18 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

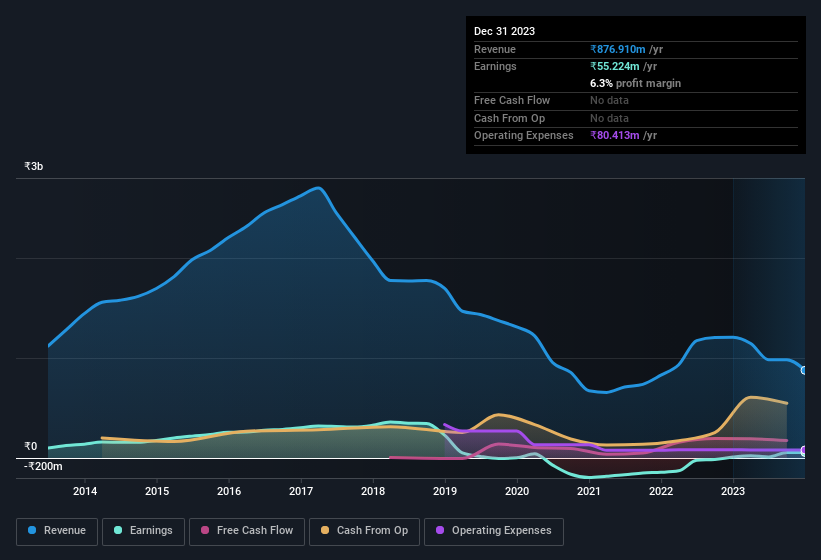

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, Byke Hospitality's revenue dropped 27% last year, but the silver lining is that EBIT margins improved from 6.7% to 13%. While not disastrous, these figures could be better.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Byke Hospitality isn't a huge company, given its market capitalisation of ₹3.5b. That makes it extra important to check on its balance sheet strength.

Are Byke Hospitality Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Byke Hospitality insiders walking the walk, by spending ₹58m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. Zooming in, we can see that the biggest insider purchase was by company insider Aayush Patodia for ₹22m worth of shares, at about ₹45.00 per share.

Does Byke Hospitality Deserve A Spot On Your Watchlist?

Byke Hospitality's earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this these factors intrigue you, then an addition of Byke Hospitality to your watchlist won't go amiss. We don't want to rain on the parade too much, but we did also find 4 warning signs for Byke Hospitality (2 are a bit unpleasant!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Byke Hospitality, you'll probably love this curated collection of companies in IN that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Byke Hospitality might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BYKE

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives