- India

- /

- Food and Staples Retail

- /

- NSEI:UMAEXPORTS

Uma Exports Limited's (NSE:UMAEXPORTS) Share Price Boosted 32% But Its Business Prospects Need A Lift Too

Despite an already strong run, Uma Exports Limited (NSE:UMAEXPORTS) shares have been powering on, with a gain of 32% in the last thirty days. The last 30 days bring the annual gain to a very sharp 60%.

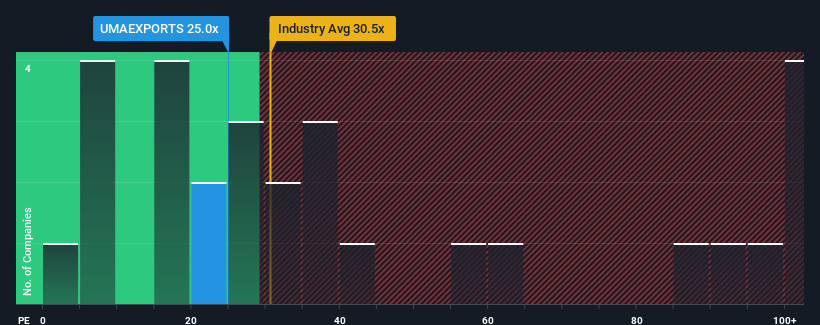

Although its price has surged higher, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Uma Exports as an attractive investment with its 25x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Uma Exports' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Uma Exports

What Are Growth Metrics Telling Us About The Low P/E?

Uma Exports' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. This means it has also seen a slide in earnings over the longer-term as EPS is down 40% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

In light of this, it's understandable that Uma Exports' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The latest share price surge wasn't enough to lift Uma Exports' P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Uma Exports maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Uma Exports (2 are potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Uma Exports' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UMAEXPORTS

Uma Exports

UMA Exports Limited engages in the trading and marketing of agricultural produce and commodities.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives