- South Korea

- /

- Hospitality

- /

- KOSE:A032350

November 2024's Leading Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, investors are keenly observing how these factors impact stock performance across various indices. In this environment, growth companies with high insider ownership can offer a unique advantage, as strong insider stakes often align management's interests with those of shareholders, potentially fostering robust company performance even amid broader market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

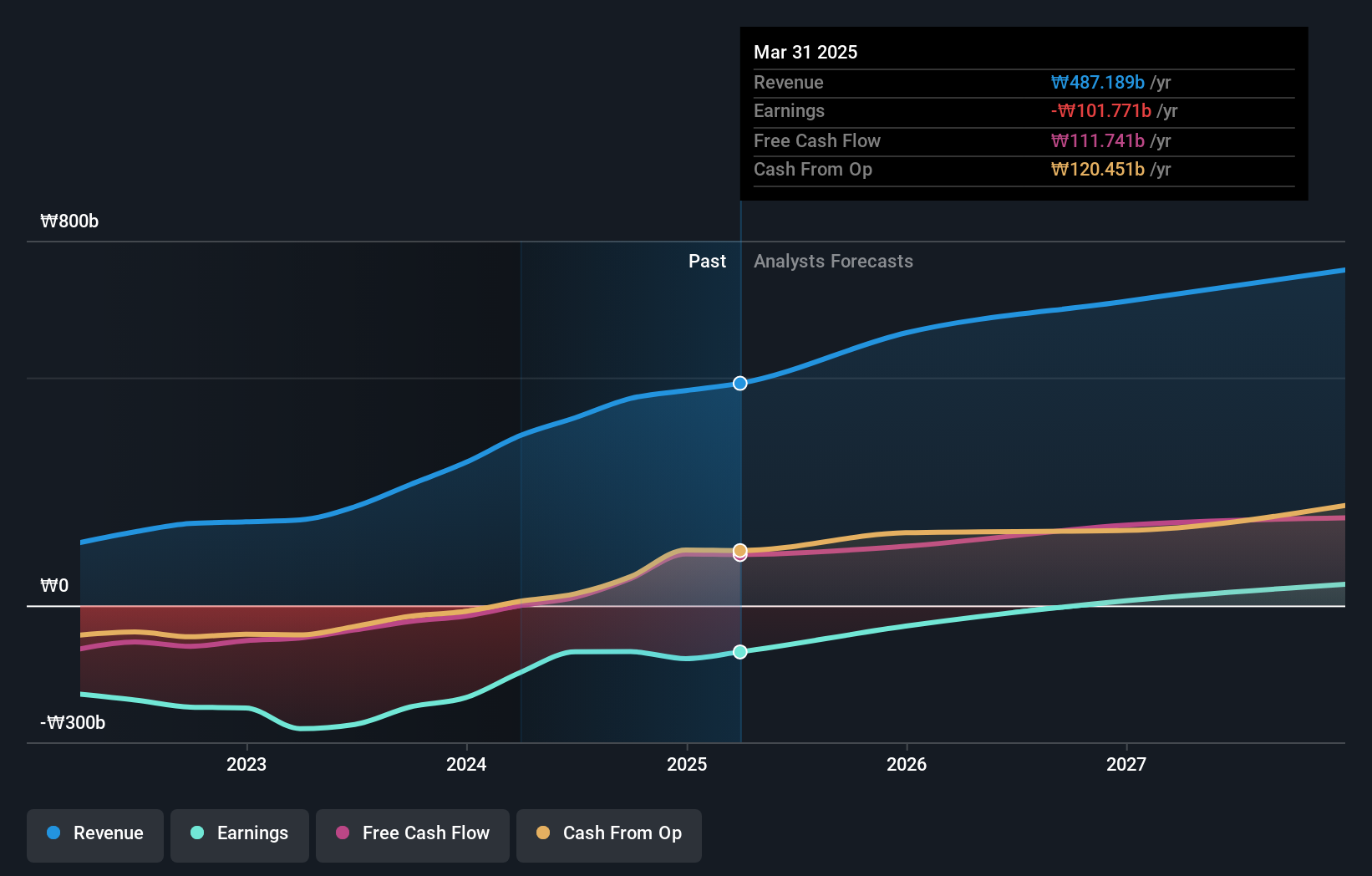

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Tour Development Co., Ltd., along with its subsidiaries, provides travel and tourism services in South Korea and has a market cap of approximately ₩731.48 billion.

Operations: The company's revenue is primarily derived from the Dream Tower Integrated Resort Division at ₩337.15 billion, followed by the Travel Related Service Sector (excluding Internet Journalism) at ₩72.47 billion, and the Internet Media Sector contributing ₩2.19 million.

Insider Ownership: 29.4%

Earnings Growth Forecast: 107.5% p.a.

Lotte Tour Development is positioned for growth with revenue forecasted to increase by 15% annually, outpacing the KR market. Despite a low future return on equity of 5.1%, its earnings are expected to grow significantly at 107.46% per year, becoming profitable within three years. Trading at over 80% below its estimated fair value suggests potential undervaluation. Recent results show improved sales and reduced net losses, indicating positive momentum despite ongoing challenges.

- Click here to discover the nuances of Lotte Tour Development with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Lotte Tour Development is priced lower than what may be justified by its financials.

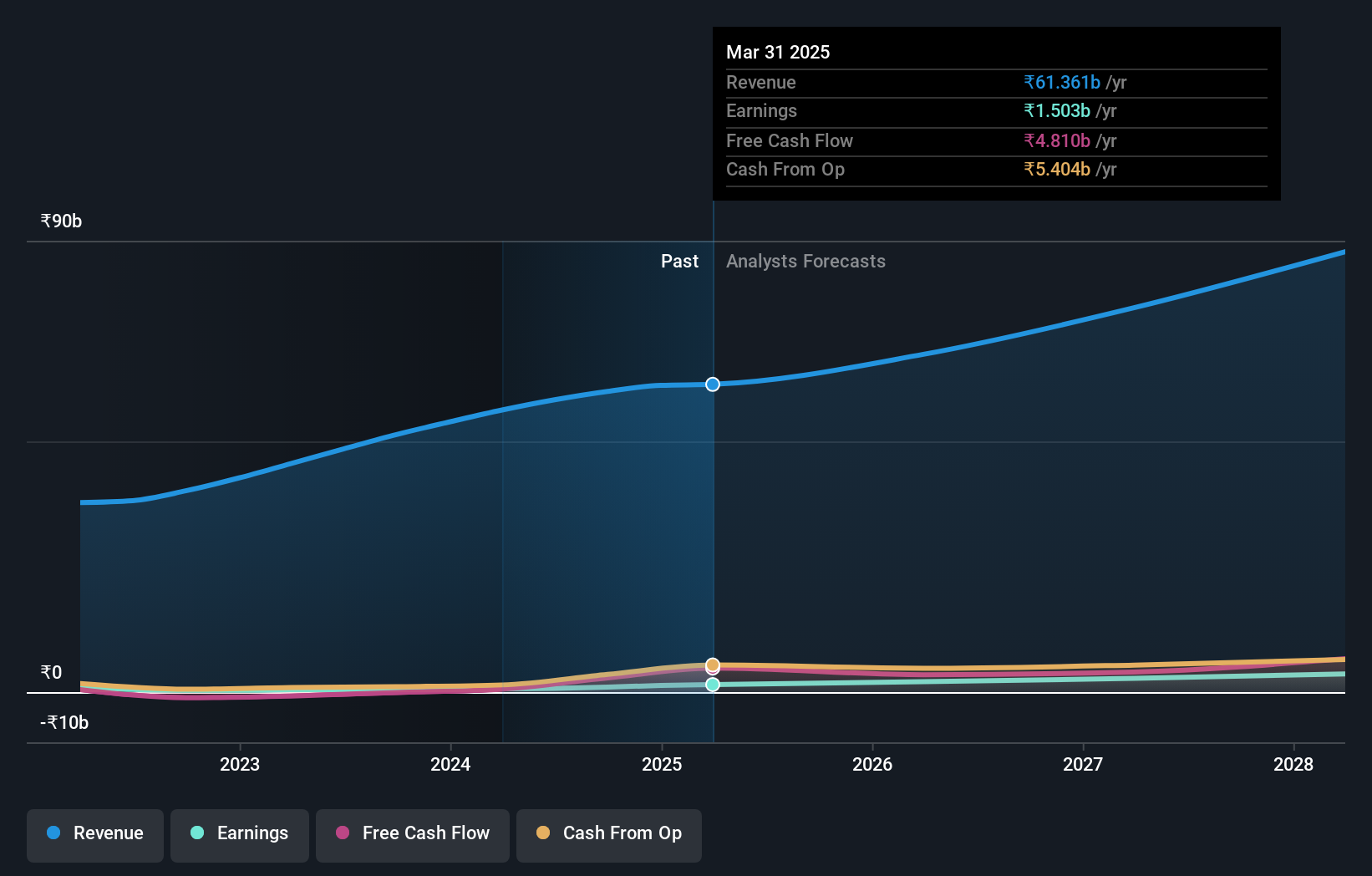

MedPlus Health Services (NSEI:MEDPLUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MedPlus Health Services Limited operates in India as a retailer of medicines and general items, with a market cap of ₹76.36 billion.

Operations: The company's revenue primarily comes from its retail segment, which generated ₹57.43 billion, complemented by its diagnostics segment with ₹852.29 million.

Insider Ownership: 13.5%

Earnings Growth Forecast: 41.8% p.a.

MedPlus Health Services is poised for significant earnings growth at 41.8% annually, surpassing the Indian market's average. Despite this, its return on equity is forecasted to remain low at 11%. Revenue growth of 16.7% also exceeds market expectations but remains below a high-growth threshold. Recent regulatory challenges could impact operations slightly, with potential revenue losses totaling INR 1.334 million from temporary store suspensions in Maharashtra and Andhra Pradesh.

- Get an in-depth perspective on MedPlus Health Services' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report MedPlus Health Services implies its share price may be too high.

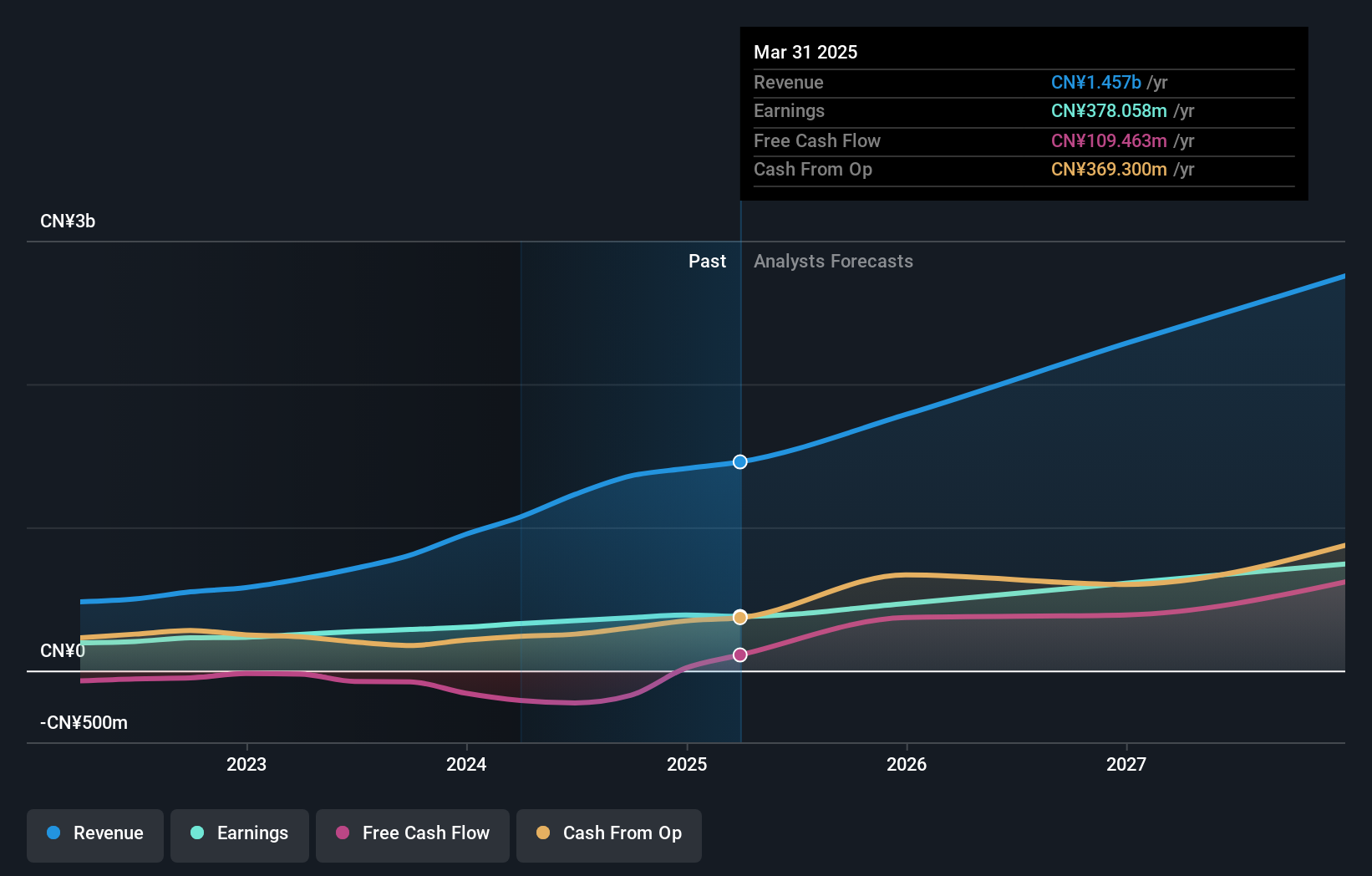

Eyebright Medical Technology (Beijing) (SHSE:688050)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector, focusing on developing and manufacturing ophthalmic medical devices, with a market cap of CN¥19.18 billion.

Operations: The company's revenue is primarily derived from its medical products segment, amounting to CN¥1.51 billion.

Insider Ownership: 21.5%

Earnings Growth Forecast: 28.1% p.a.

Eyebright Medical Technology (Beijing) demonstrates robust growth potential, with earnings and revenue forecasted to grow significantly at 28.1% and 27.7% annually, outpacing the Chinese market averages. Recent half-year results showed a substantial rise in sales to CNY 680.74 million from CNY 405.35 million year-on-year, with net income increasing to CNY 208.04 million. The stock trades at a discount of over 30% below its estimated fair value, suggesting possible investment appeal despite low future return on equity projections of 18%.

- Delve into the full analysis future growth report here for a deeper understanding of Eyebright Medical Technology (Beijing).

- In light of our recent valuation report, it seems possible that Eyebright Medical Technology (Beijing) is trading beyond its estimated value.

Key Takeaways

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1527 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A032350

Lotte Tour Development

Engages in the provision of travel and tourism services in South Korea.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives