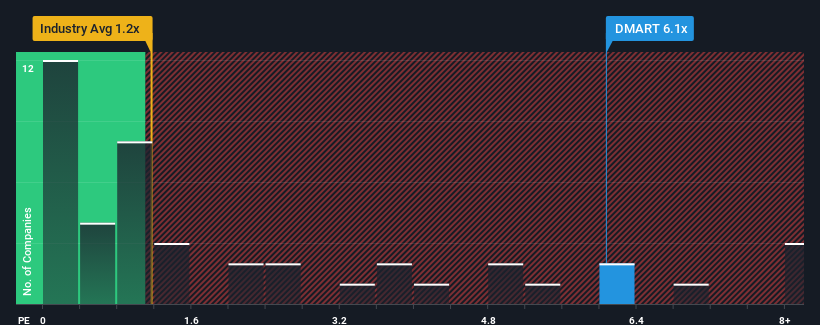

Avenue Supermarts Limited's (NSE:DMART) price-to-sales (or "P/S") ratio of 6.1x may look like a poor investment opportunity when you consider close to half the companies in the Consumer Retailing industry in India have P/S ratios below 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Avenue Supermarts

How Has Avenue Supermarts Performed Recently?

Recent times haven't been great for Avenue Supermarts as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Avenue Supermarts' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Avenue Supermarts would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Pleasingly, revenue has also lifted 108% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the analysts watching the company. With the industry only predicted to deliver 10% per year, the company is positioned for a stronger revenue result.

With this information, we can see why Avenue Supermarts is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Avenue Supermarts' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Avenue Supermarts' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Avenue Supermarts, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Avenue Supermarts, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DMART

Avenue Supermarts

Engages in the business of organized retail and operating supermarkets under the D-Mart brand name in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives