Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Vardhman Textiles Limited (NSE:VTL) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Vardhman Textiles

What Is Vardhman Textiles's Debt?

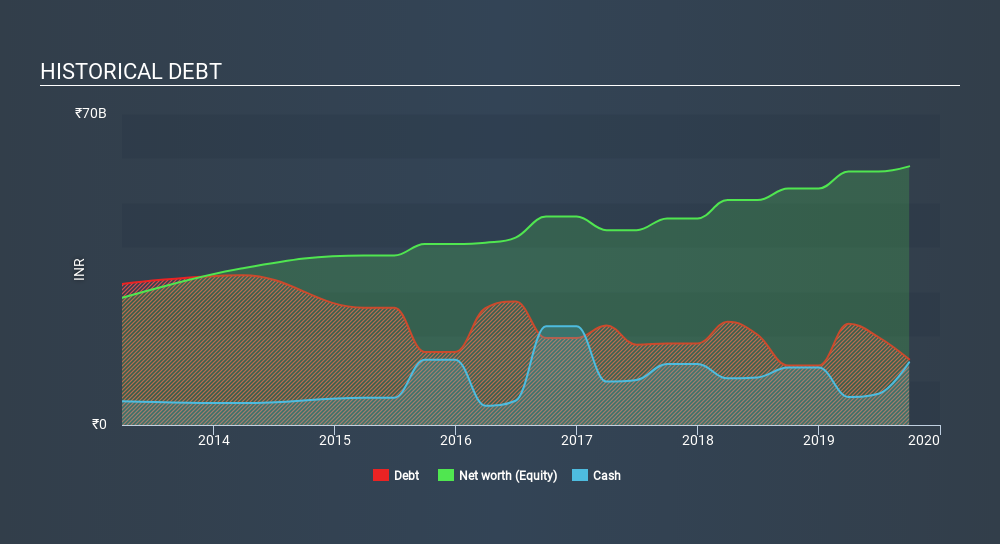

The image below, which you can click on for greater detail, shows that at September 2019 Vardhman Textiles had debt of ₹14.8b, up from ₹13.4b in one year. However, because it has a cash reserve of ₹14.1b, its net debt is less, at about ₹655.3m.

How Healthy Is Vardhman Textiles's Balance Sheet?

We can see from the most recent balance sheet that Vardhman Textiles had liabilities of ₹14.5b falling due within a year, and liabilities of ₹15.2b due beyond that. On the other hand, it had cash of ₹14.1b and ₹9.18b worth of receivables due within a year. So its liabilities total ₹6.43b more than the combination of its cash and short-term receivables.

Of course, Vardhman Textiles has a market capitalization of ₹51.9b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. But either way, Vardhman Textiles has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Vardhman Textiles's debt of just 0.06 times EBITDA is really very modest. And EBIT easily covered the interest expense 9.0 times over, lending force to that view. On the other hand, Vardhman Textiles saw its EBIT drop by 7.9% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Vardhman Textiles recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for and improvement.

Our View

When it comes to the balance sheet, the standout positive for Vardhman Textiles was the fact that it seems able handle its debt, based on its EBITDA, confidently. But the other factors we noted above weren't so encouraging. To be specific, it seems about as good at converting EBIT to free cash flow as wet socks are at keeping your feet warm. When we consider all the factors mentioned above, we do feel a bit cautious about Vardhman Textiles's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Over time, share prices tend to follow earnings per share, so if you're interested in Vardhman Textiles, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:VTL

Vardhman Textiles

Manufactures, purchases, and sells textiles and fibres in India and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives