Increases to CEO Compensation Might Be Put On Hold For Now at VIP Clothing Limited (NSE:VIPCLOTHNG)

Key Insights

- VIP Clothing's Annual General Meeting to take place on 14th of September

- Total pay for CEO Sunil Pathare includes ₹8.87m salary

- Total compensation is 127% above industry average

- VIP Clothing's total shareholder return over the past three years was 297% while its EPS grew by 128% over the past three years

CEO Sunil Pathare has done a decent job of delivering relatively good performance at VIP Clothing Limited (NSE:VIPCLOTHNG) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 14th of September. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for VIP Clothing

Comparing VIP Clothing Limited's CEO Compensation With The Industry

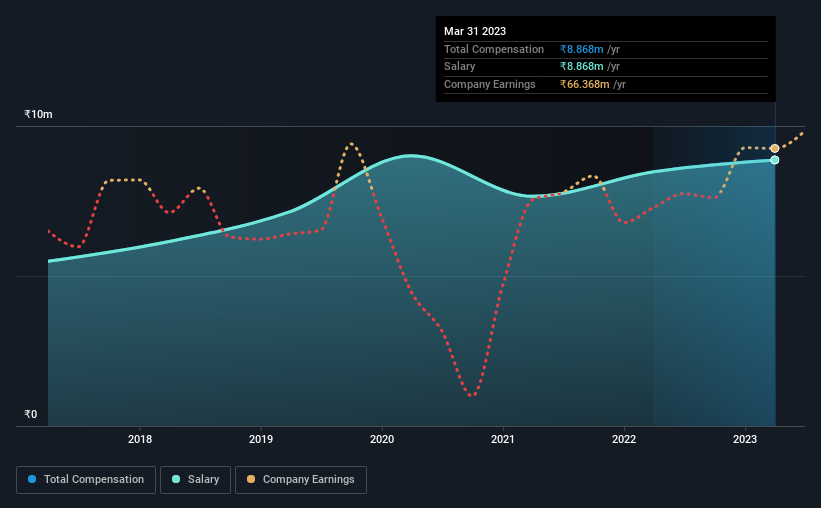

At the time of writing, our data shows that VIP Clothing Limited has a market capitalization of ₹3.9b, and reported total annual CEO compensation of ₹8.9m for the year to March 2023. That's a modest increase of 4.7% on the prior year. Notably, the salary of ₹8.9m is the entirety of the CEO compensation.

On comparing similar-sized companies in the Indian Luxury industry with market capitalizations below ₹17b, we found that the median total CEO compensation was ₹3.9m. Hence, we can conclude that Sunil Pathare is remunerated higher than the industry median. What's more, Sunil Pathare holds ₹812m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹8.9m | ₹8.5m | 100% |

| Other | - | - | - |

| Total Compensation | ₹8.9m | ₹8.5m | 100% |

Talking in terms of the industry, salary represented approximately 100% of total compensation out of all the companies we analyzed, while other remuneration made up 0.0015% of the pie. On a company level, VIP Clothing prefers to reward its CEO through a salary, opting not to pay Sunil Pathare through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at VIP Clothing Limited's Growth Numbers

Over the past three years, VIP Clothing Limited has seen its earnings per share (EPS) grow by 128% per year. In the last year, its revenue is down 3.1%.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has VIP Clothing Limited Been A Good Investment?

Most shareholders would probably be pleased with VIP Clothing Limited for providing a total return of 297% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

VIP Clothing rewards its CEO solely through a salary, ignoring non-salary benefits completely. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for VIP Clothing (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade VIP Clothing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VIPCLOTHNG

VIP Clothing

Engages in the manufacture, marketing, and distribution of garments in India.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives