Capital Allocation Trends At Sutlej Textiles and Industries (NSE:SUTLEJTEX) Aren't Ideal

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after briefly looking over the numbers, we don't think Sutlej Textiles and Industries (NSE:SUTLEJTEX) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Sutlej Textiles and Industries, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.027 = ₹399m ÷ (₹21b - ₹6.7b) (Based on the trailing twelve months to March 2021).

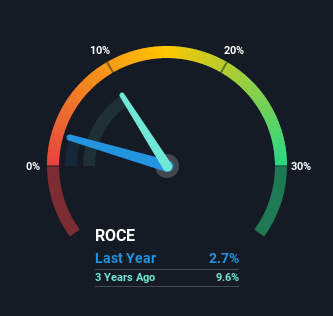

Therefore, Sutlej Textiles and Industries has an ROCE of 2.7%. In absolute terms, that's a low return and it also under-performs the Luxury industry average of 9.6%.

View our latest analysis for Sutlej Textiles and Industries

Historical performance is a great place to start when researching a stock so above you can see the gauge for Sutlej Textiles and Industries' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Sutlej Textiles and Industries, check out these free graphs here.

What Does the ROCE Trend For Sutlej Textiles and Industries Tell Us?

On the surface, the trend of ROCE at Sutlej Textiles and Industries doesn't inspire confidence. Around five years ago the returns on capital were 17%, but since then they've fallen to 2.7%. Given the business is employing more capital while revenue has slipped, this is a bit concerning. This could mean that the business is losing its competitive advantage or market share, because while more money is being put into ventures, it's actually producing a lower return - "less bang for their buck" per se.

In Conclusion...

In summary, we're somewhat concerned by Sutlej Textiles and Industries' diminishing returns on increasing amounts of capital. And, the stock has remained flat over the last five years, so investors don't seem too impressed either. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

If you want to know some of the risks facing Sutlej Textiles and Industries we've found 3 warning signs (2 are potentially serious!) that you should be aware of before investing here.

While Sutlej Textiles and Industries may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Sutlej Textiles and Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SUTLEJTEX

Sutlej Textiles and Industries

Designs, manufactures, and distributes textiles to wholesalers, manufacturers, and retailers for the home furnishing industry in India, Bangladesh, Turkey, the United States of America, Hong Kong, Singapore, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026