Market Might Still Lack Some Conviction On Shekhawati Poly-Yarn Limited (NSE:SPYL) Even After 38% Share Price Boost

Shekhawati Poly-Yarn Limited (NSE:SPYL) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

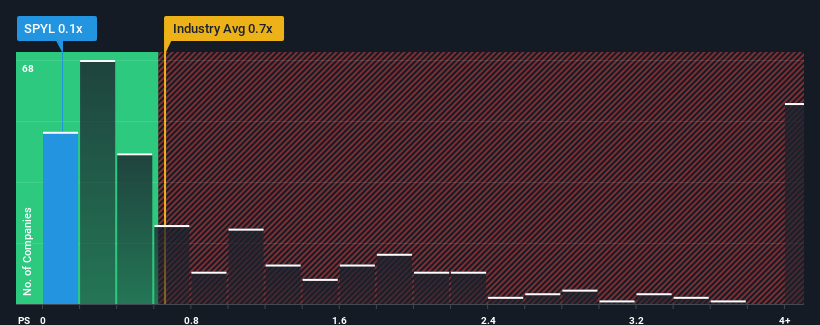

In spite of the firm bounce in price, given about half the companies operating in India's Luxury industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider Shekhawati Poly-Yarn as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shekhawati Poly-Yarn

What Does Shekhawati Poly-Yarn's Recent Performance Look Like?

For instance, Shekhawati Poly-Yarn's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shekhawati Poly-Yarn's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Shekhawati Poly-Yarn?

In order to justify its P/S ratio, Shekhawati Poly-Yarn would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 62% decrease to the company's top line. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 12% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Shekhawati Poly-Yarn's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Despite Shekhawati Poly-Yarn's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shekhawati Poly-Yarn revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Shekhawati Poly-Yarn that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHEKHAWATI

Shekhawati Industries

Manufactures polyester and nylon draw textured yarn, twisted yarn, and knitted fabrics in India.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives